Market Overview: S&P 500 Emini Futures

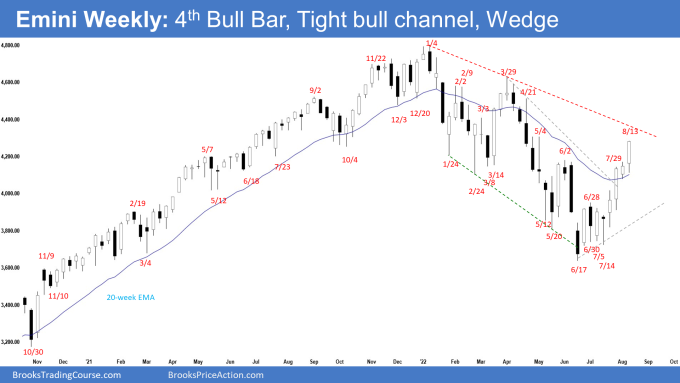

S&P 500 Emini futures continues the strong rally up, with 4th consecutive bull bar, and likely to test the May 4 high and bear trend line. The move up is strong enough for traders to expect at least a second leg sideways to up after a pullback. The bears want a reversal lower from a wedge bear flag (June 28, July 29 and Aug 13), but because of the strong leg up, the bears will need at least a micro double top or a strong reversal bar before they would be willing to sell aggressively.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bull bar closing near the high with a long tail below.

- Last week, we said that odds slightly favor at least a small second leg sideways to up after a small pullback.

- This week traded higher towards the May 4 high and the major bear trend line. This is the 4th consecutive bull bar now, the first time in 2022.

- The bulls got a reversal higher from a trend channel line overshoot, and a wedge bottom (Feb 24, May 20 and June 17). They want a second leg sideways to up after a pullback.

- This is the first series of consecutive bull bars (follow-through buying) since March. There is a 5-bar bull micro channel, and the move up from June 17 low is in a tight channel. That means persistent buying.

- The next targets for the bulls are the May 4 high and the major bear trend line.

- The bulls will need to close far above the bear trend line to increase the odds of a re-test of the all-time high.

- The consecutive bull bars closing near their highs are increasing the odds that the bear trend has ended, and the Emini may be turning into a trading range.

- The bears want the Emini to stall around the May 4 high, or the major bear trend line. They want a reversal lower from a lower high followed by a re-test of the June low.

- They see the current rally as a deep pullback in a broad bear channel. The bears see a wedge bear flag (June 28, July 29 and Aug 13), but the move up is in a tight bull channel.

- Because of the strong move up, the bears will need at least a micro double top or a strong reversal bar before they would be willing to sell aggressively.

- Since this week was a strong bull bar, it is a weak sell signal bar for next week. It is a good buy signal bar for next week.

- Next week may gap up at the open, however, small gaps usually close early.

- The May 4 high and the major bear trend line is close enough that it may act as a magnet. The Emini may need to test it first before we see some profit taking (pullback).

- The move up is strong enough for traders to expect at least a small second leg sideways to up move after a pullback.

The Daily S&P 500 Emini chart

- The Emini pulled back slightly earlier in the week but gapped up to close above June 2 high on Wednesday. Thursday was a bear reversal bar, but Friday reversed to close near May 4 high.

- Last week, we said that the move up is strong enough for traders to expect at least a small second leg sideways to up after a pullback. The move up since July 14 is climactic. We may start to see some pullback within the next 1-3 weeks.

- So far, the bulls continue to have good buying pressure, while the bear bars are becoming smaller with poor follow-through since July 14.

- The bulls got a reversal higher from a trend channel line overshoot and a wedge bottom (Feb 24, May 20 and June 17).

- They want a test of the May 4 lower high, followed by a strong break of the major bear trend line.

- The bulls then want a continuation higher from a higher low major trend reversal after a pullback.

- Friday was a bull bar closing near the high. The Emini may gap up on Monday. Small gaps usually close early.

- If the gap remains open but gaps down after a few days, it may then form an island top following a wedge pattern at resistance (bear trend line). However, an island top is a minor reversal pattern.

- The bears want a reversal lower from around the May 4 high or around the bear trend line. They then want to re-test the June low, followed by a breakout and measured move down.

- There is a wedge pattern (July 22, Aug 3 and Aug 12) since the rally on July 14. However, the move up is in a tight bull channel.

- That means strong bulls. The bears will need at least a micro double top or a strong reversal bar before they would be willing to sell aggressively.

- We have said that the move up is climactic. We may start to see some pullback within the next couple of weeks. This remains true.

- However, the move up since July 14 is in a tight bull channel. It increases the odds of at least a small second leg sideways to up after a pullback.

- For now, odds slightly favor a test of the May 4 high and the bear trend line.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

The next points to me are the 6/2 & 6/17 H & L. That would take the market back up to the area of the 3/29 H.

Thanks Andrew..

Thanks for great analysis Andrew. Question re bulls MM scenario on the weekly chart: this week close (4280) was a bull MM from the June 17th low to the June 28th high. In addition to the May high and bear trend line (~4350 area) as potential resistance levels, what shall be next bulls MM target and based on what to calculate this? Does the low of August 2nd shall be considered as a measuring gap with the high July 22?

Dear Eli,

A good day to you. Hope all is well there.

Truth is I don’t use MM as much as I should be.. I just use regular leg 1 = leg 2, and other more regular ones for trading..

Let’s wait for others to answer your question and see if they have some insight..

Take care and have a blessed week ahead!

Best Regards,

AA