Market Overview: DAX 40 Futures

DAX futures moved lower last week with a bear bar in the middle of the prior week’s strong bull bar. Its alternating bars, a Dax 40 tight trading range and a place of agreement for traders. This will form a magnet when we move away from here. The bulls see a final flag and want one more push-up. The bears a failed breakout above the trading range below. We might need to go sideways to down to the moving average to find more buyers.

DAX 40 Futures

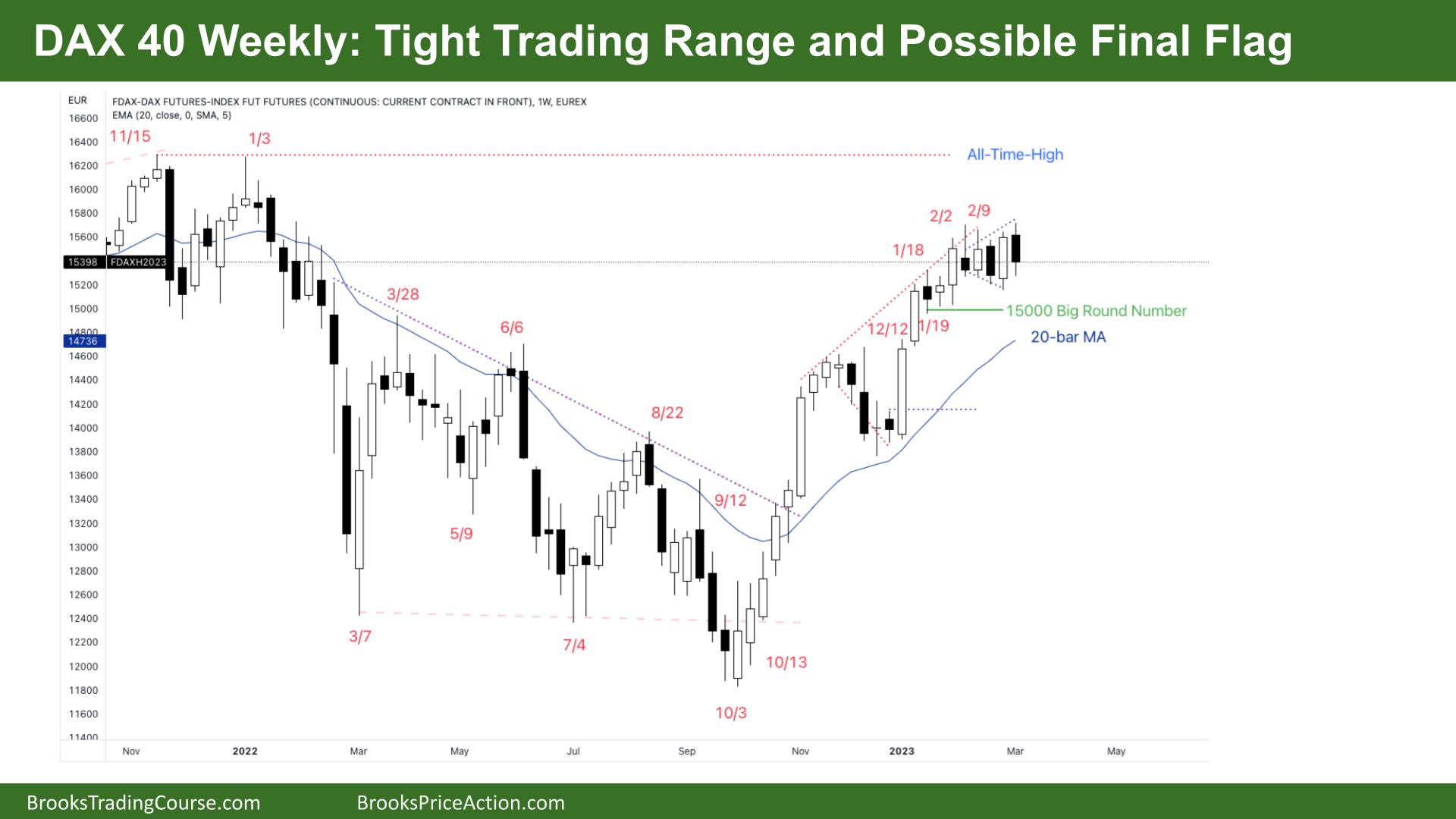

The Weekly DAX chart

- The DAX 40 futures was a bear bar closing below its midpoint last week.

- We have been going sideways in a tight trading range for the past 9 weeks.

- The bulls see a tight bull channel; we have had two large pushes up. It might get a third.

- The bears see a breakout down of the prior trading range and a pullback to test the breakout, and we are stalling.

- The bears want a break back down into the range below, the 15000 Big Round Number and towards the moving average. All reasonable.

- The bulls have been very strong for a number of months and have open gaps below.

- Neither limit bears nor stop bears on this timeframe have made much money. So the best the bears can get is a scalp. But after a big bull bar is not a great sell setup.

- The bears need consecutive bars breaking out of this expanding triangle and moving lower.

- The bulls are happy to buy lower, and at the swing low, betting we will stay always in. They might stop buying high and wait for two legs sideways to down before buying again as the trend is starting to go more sideways.

- Some bulls might wait for a 50% pullback from the start of the last leg – just below the moving average to start buying again. They will wait to see the tight trading range breakout strongly before committing.

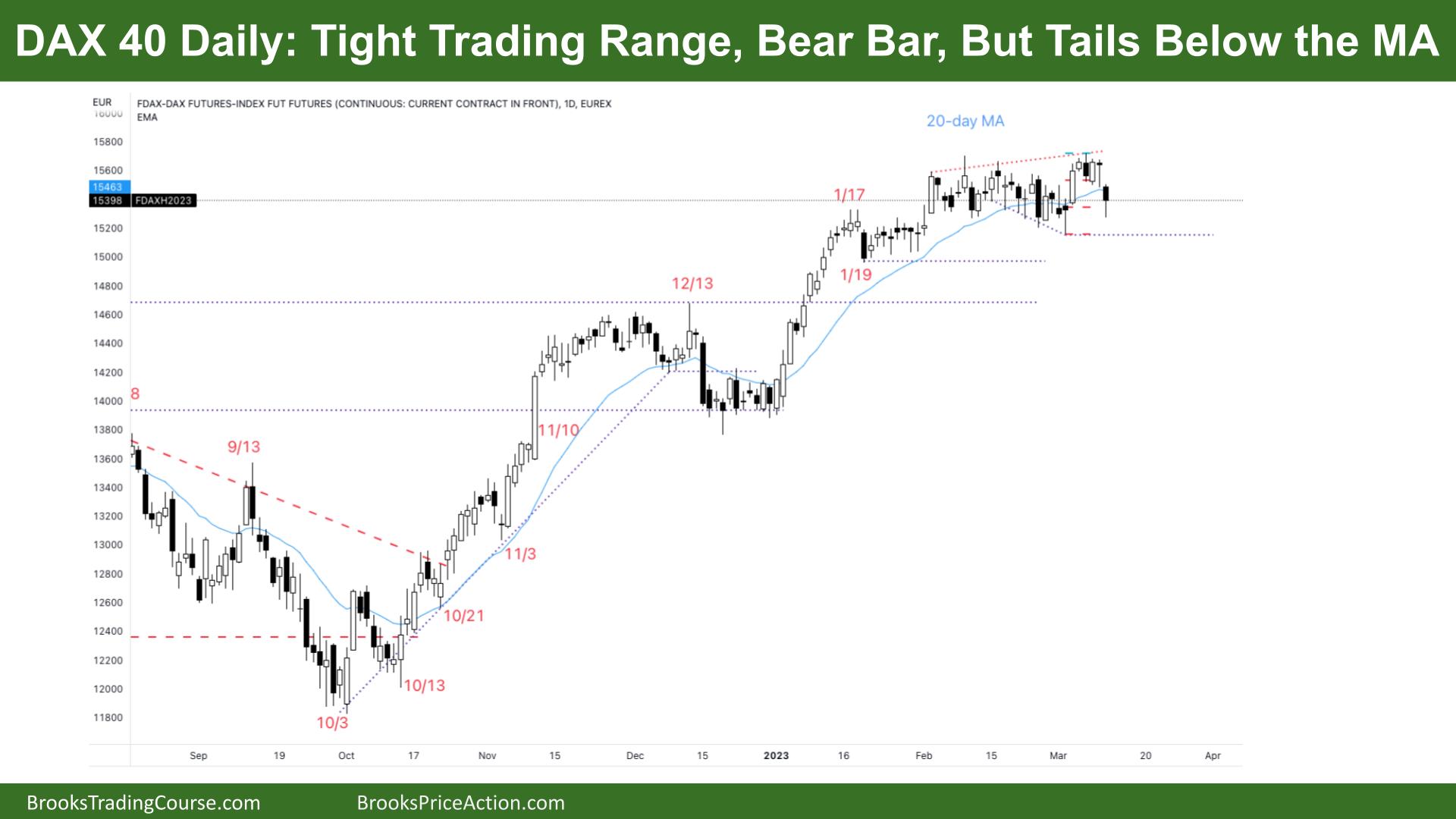

The Daily DAX chart

- The DAX 40 futures was a bear bar with a tail below on Friday. The bar was nearly completely below the moving average.

- The bulls see a tight channel levelling off in a trading range.

- The bears see a possible wedge top but bad follow-through selling below.

- You can draw many lines, so best to say it is a tight trading range and traders are deciding where to go next.

- The bulls want a final flag and one more push-up – they might get it because the trend has been so strong.

- The bears want a break below the trading range and a two-legged move down to the prior breakout points, the gaps below and swing lows.

- You can see on the chart the lack of consecutive bear bars closing on their lows. That means bears are unwilling to swing short. So swing bulls are happy to buy and buy now or lower, betting the best the bears can get is a trading range.

- Better to be long or flat. The bulls need a good buy signal next week to get long. But we will likely go sideways to down next week with a bear bar on Friday.

- It is a bear micro channel, so expect the first-time price travels above a prior day’s bar to get sold off, if briefly.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.