Market Overview: DAX 40 Futures

DAX futures moved higher last month, testing above the bear microchannel and creating a new ATH. It did not close strongly above the prior highs, leaving a small tail above. The bears didn’t get a sell signal, so we will likely continue higher to see what is above the highs. There is room to the top of the bull channel, and we could get there quickly if the bulls get follow-through. The bears need a successful fade above here to get deeper into the bear microchannel to convince other bears a top is in.

DAX 40 Futures

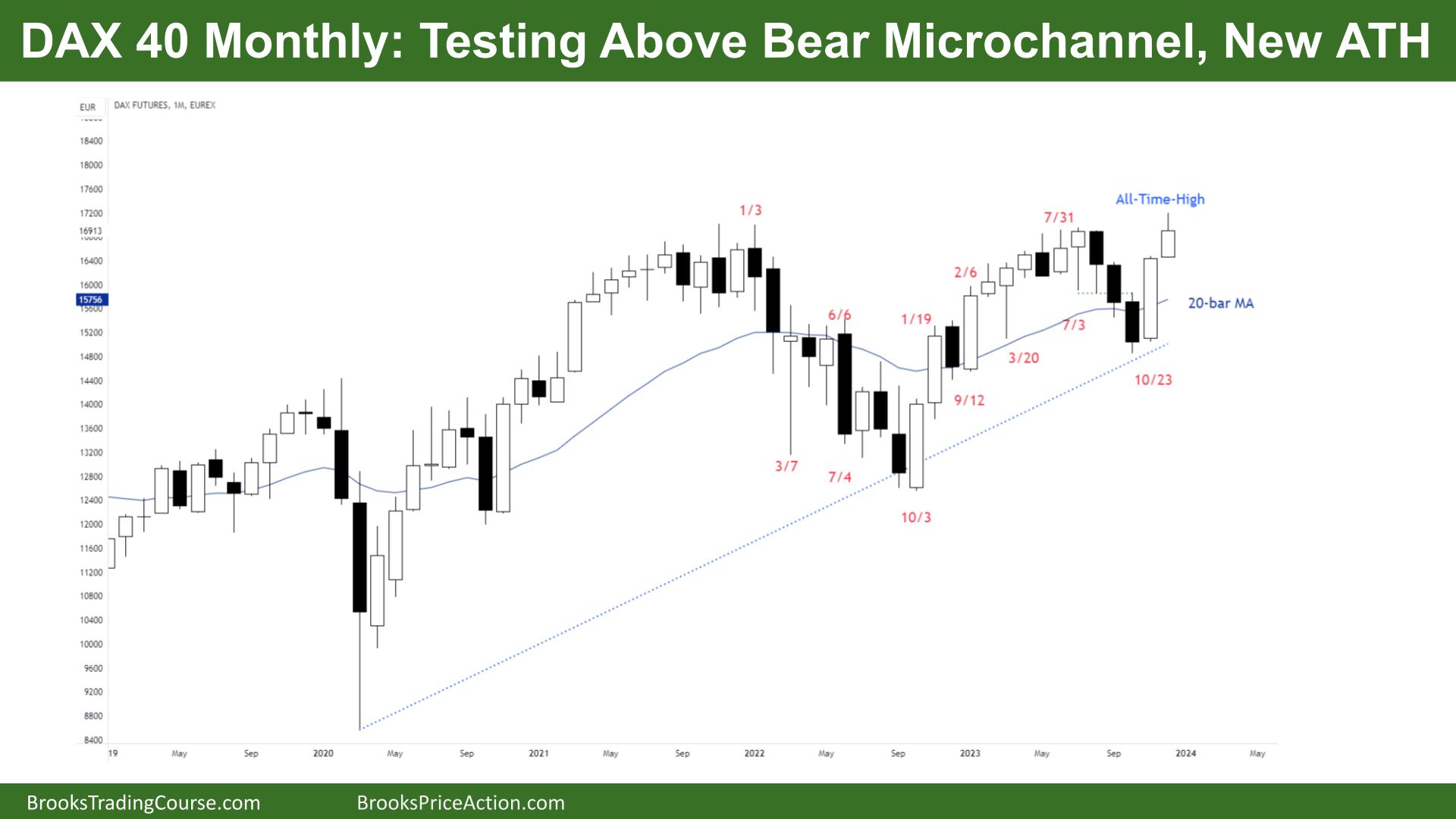

The Monthly DAX chart

- The DAX 40 futures went higher last month, testing above the high of a bear microchannel.

- The bar did not close above the prior highs on this chart, so it is not as bullish as possible.

- The bulls see a bull channel and a strong reversal up from the moving average.

- We created a new high. Some bulls took profits at the new high and will look to add on lower.

- Bulls want a follow-through bar to close above the high, so any pullback will be minor.

- The bears see a possible HH DT, and some bears will sell above the bear microchannel and look to sell higher. Most beginners should not do that in a bull environment.

- The bears want a good reversal bar, an outside down bar closing on its low, or another weak bull bar to make the bulls hesitate.

- Consecutive bull bars, so likely buyers below December and into the November candle.

- Some limit order bears sold above the last and second last bear bars and are now stuck. It will be important to see if they can make money fading the moves or have to panic out.

- The bulls didn’t get a great entry bar; it was too big. so some bulls are waiting for a pullback, a High 2.

- We are likely always long, so it is better to be long or flat.

- Expect sideways to up next week.

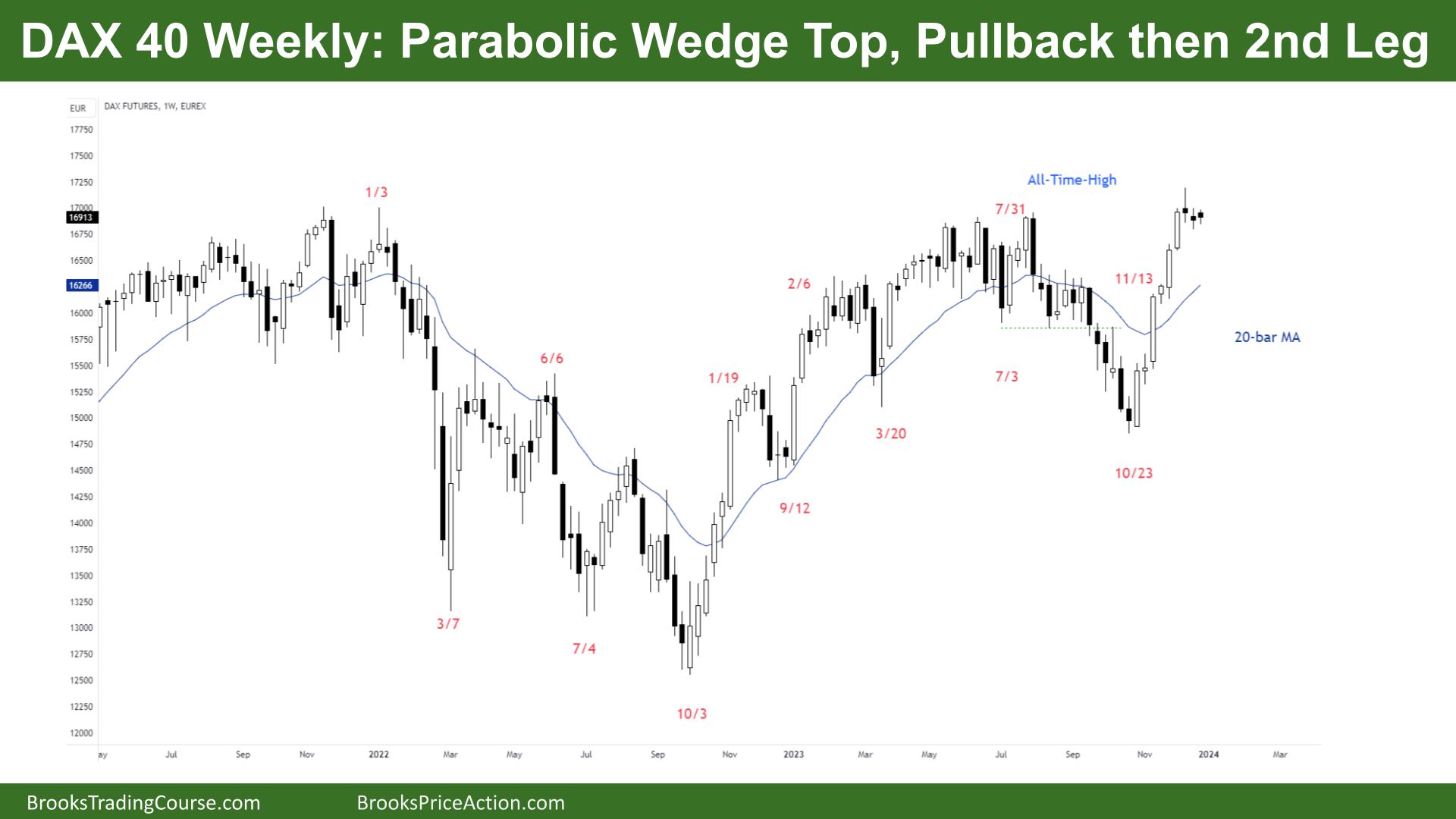

The Weekly DAX chart

- The DAX 40 futures went sideways last week with the third consecutive bear doji.

- Most traders expected to see some profit-taking but were waiting for the right bars to do so.

- We tested the ATH, and it is still sideways.

- It was the first chance for bulls to buy below a bar. But it was a bear doji, and the entry and follow-through bars were disappointing.

- Some might exit a scalp size below and wait for a better buy signal.

- Other traders saw the weak reversal bars and are looking to buy, betting it is not strong enough to attract many bears.

- The bulls see a parabolic wedge – three pushes up – and expect 2 legs sideways to down before a larger second leg.

- The bears see an expanding triangle and a credible double top. But they don’t have a sell signal yet to do anything.

- Look left. The tight channel up from January went sideways for many months, but the retracements were not enough to reverse it. We might do similar here.

- Bulls want a bear reversal bar to fail properly. They want both attempts to fail so they can resume up. This inside bar is probably not enough.

- Consecutive dojis late in a move can be the final flag. That means the next leg can by symmetrical or just one more bar.

- Always in long, so traders should be long or flat. Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi Timothy, great and many thanks for your analysis. Think about adding a daily in future posts – if you have time. This is the 2nd attempt at 16000 and it will either succeed or fail – it can do either. On cash monthly looks like a close above and on Weekly 3 weeks SW but not down. So assuming the move continues up, I think we may see a small pullback and then progress circa 830 points to conclude this move.