Market Overview: DAX 40 Futures

DAX futures went sideways last month with a small bull inside bar high at the top of a bull channel. The bears got 3 good bear bars and tried to create a double top. But they weren’t able to get a follow-through barb under the MA. Strong bull bars above the MA again so more likely we will go higher. Nothing to sell here so better to be long or flat.

DAX 40 Futures

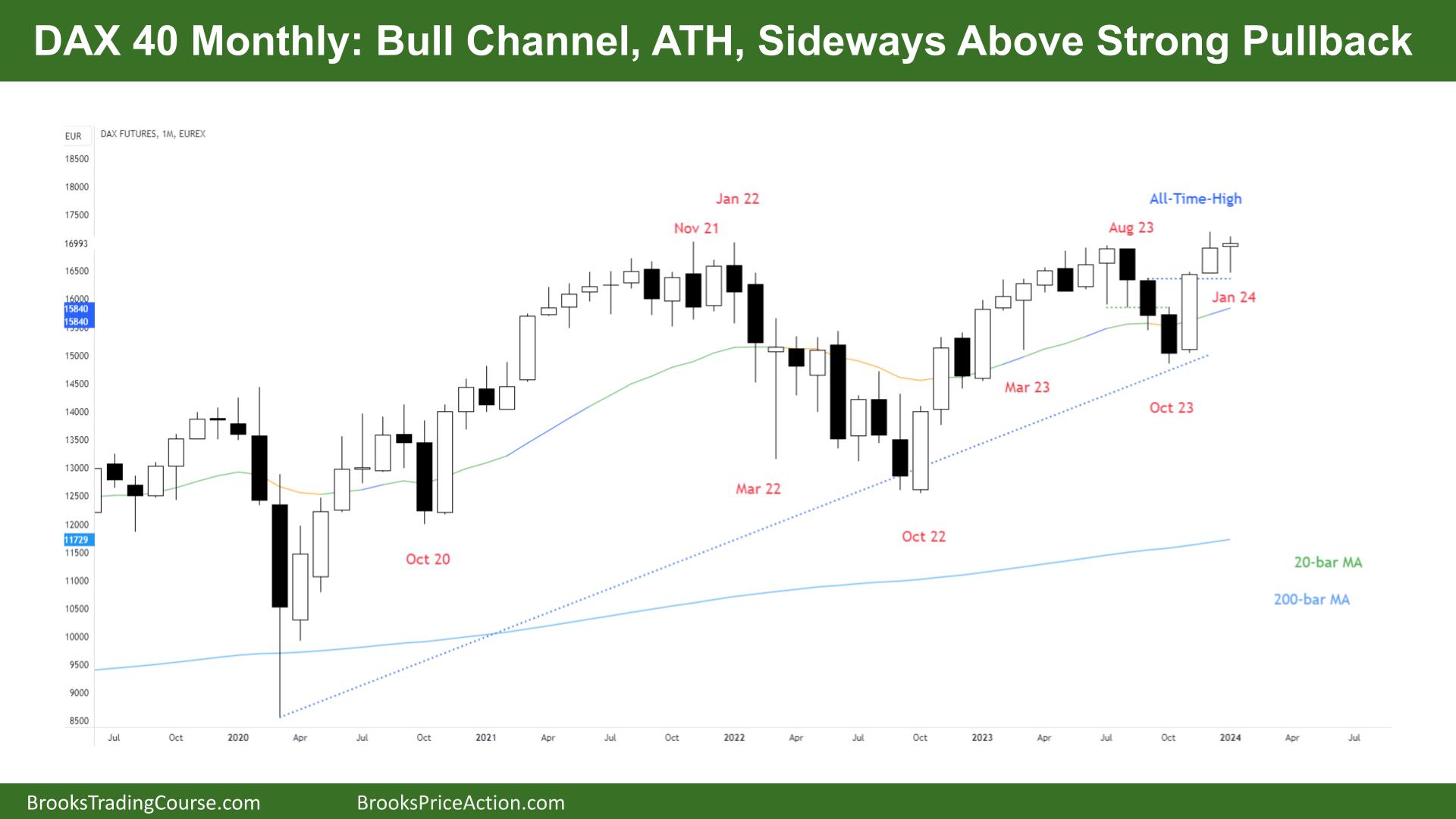

The Monthly DAX chart

- The DAX 40 futures went sideways last month with a bull inside bar, a doji, high in a bull channel.

- The bulls see a HTF bull channel, several legs up, and they got a new high. The bears were unable to break a trendline, so bulls will continue to buy until they cannot do so.

- The bears see a possible double top – 3 strong bear bars and are looking to sell above, to get a failed breakout above a prior high.

- But the HTF trend is up, and the trendlines are intact. So, the best the bears can get is likely a trading range.

- The bears got a surprise breakout and follow-through, so they might get one more bar next month to complete it.

- But then the bulls got a breakout and follow-through. So that might be the second leg that takes us above the ATH again.

- Always in long, so better to be long or flat.

- Always in bulls bought the November and / or December bull bars and will hold until they have a reason to exit.

- The bears needed one more bar under the MA to prevent the channel from breakout out higher but didn’t get it.

- Nothing to sell here. If bears got a strong second entry sell signal, some bulls might exit and buy near the MA again.

- Some bears see the microchannel and sold above the high of the prior two bear bars and are stuck. They want to scale in and get back to test those prices. But right now they are probably stressed.

- If there is another bull bar, they will likely give up.

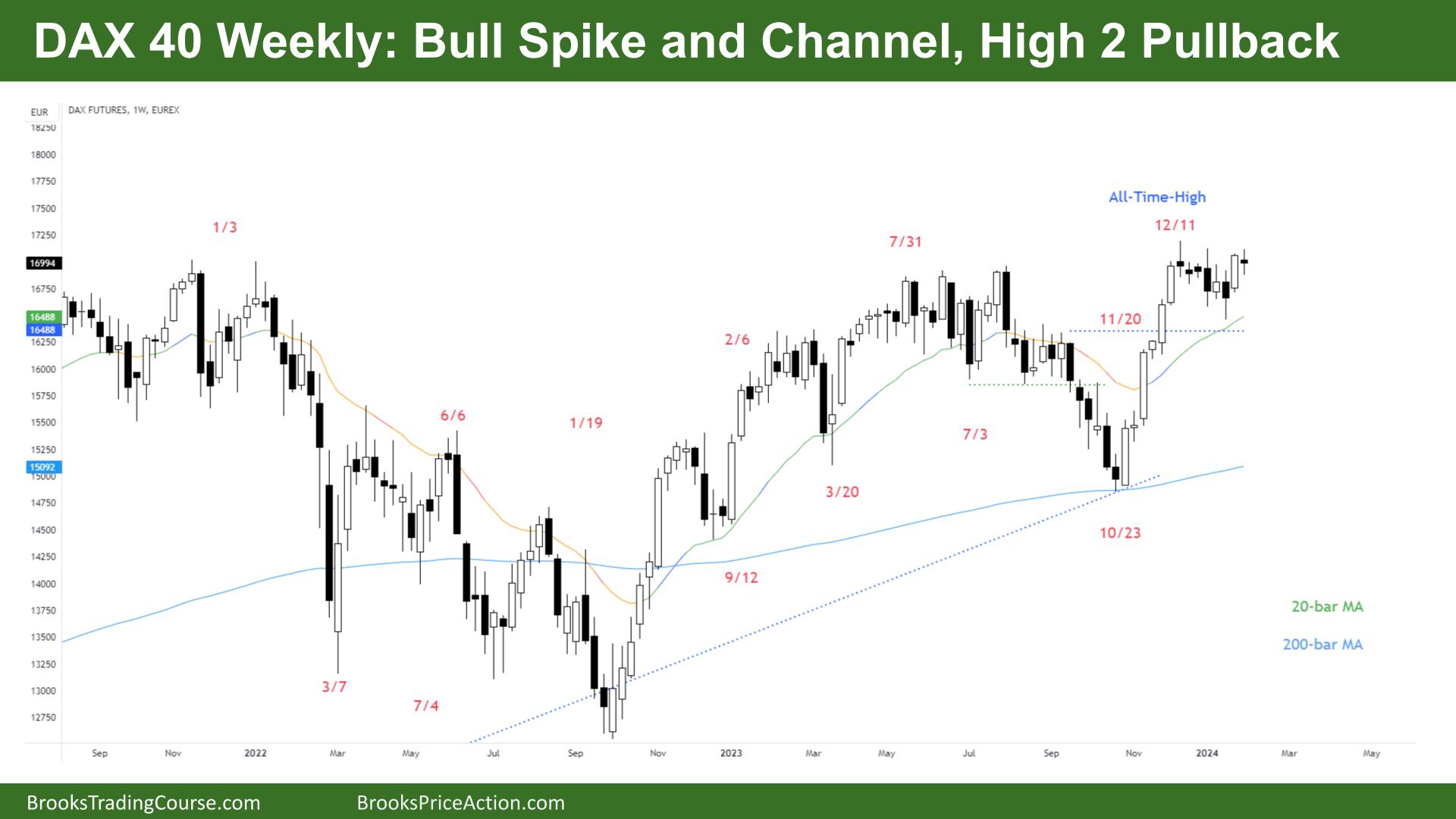

The Weekly DAX chart

- The DAX 40 futures went sideways last week with a High 2 getting triggered and now a pullback.

- The bulls see a tight channel and expect a second leg, and it looks like we are starting it now.

- The bears see a trading range, an expanding triangle and disappointing follow-through after a new ATH.

- The bulls want strong follow-through and a close above the bear dojis to the left. That would pressure all the bear limit order traders and force them to cover above.

- The bears have not yet had a chance to sell above a prior bars high and make money easily. They will get a chance next week to see if they can.

- We are always in long so most traders should be long or flat.

- Most traders should be trading with stop entries, and buying above the prior bar was a reasonable entry for a second leg.

- If the bears get a follow-through bear bar, they can exit below it.

- Most bulls here are buying believing they can make money even if it goes down.

- The bulls want measured move of this small trading range above. The bears might see it as a final flag after a parabolic wedge top.

- But most parabolic wedges are strong first legs so traders expect followthrough of some kind.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.