Market Overview: DAX 40 Futures

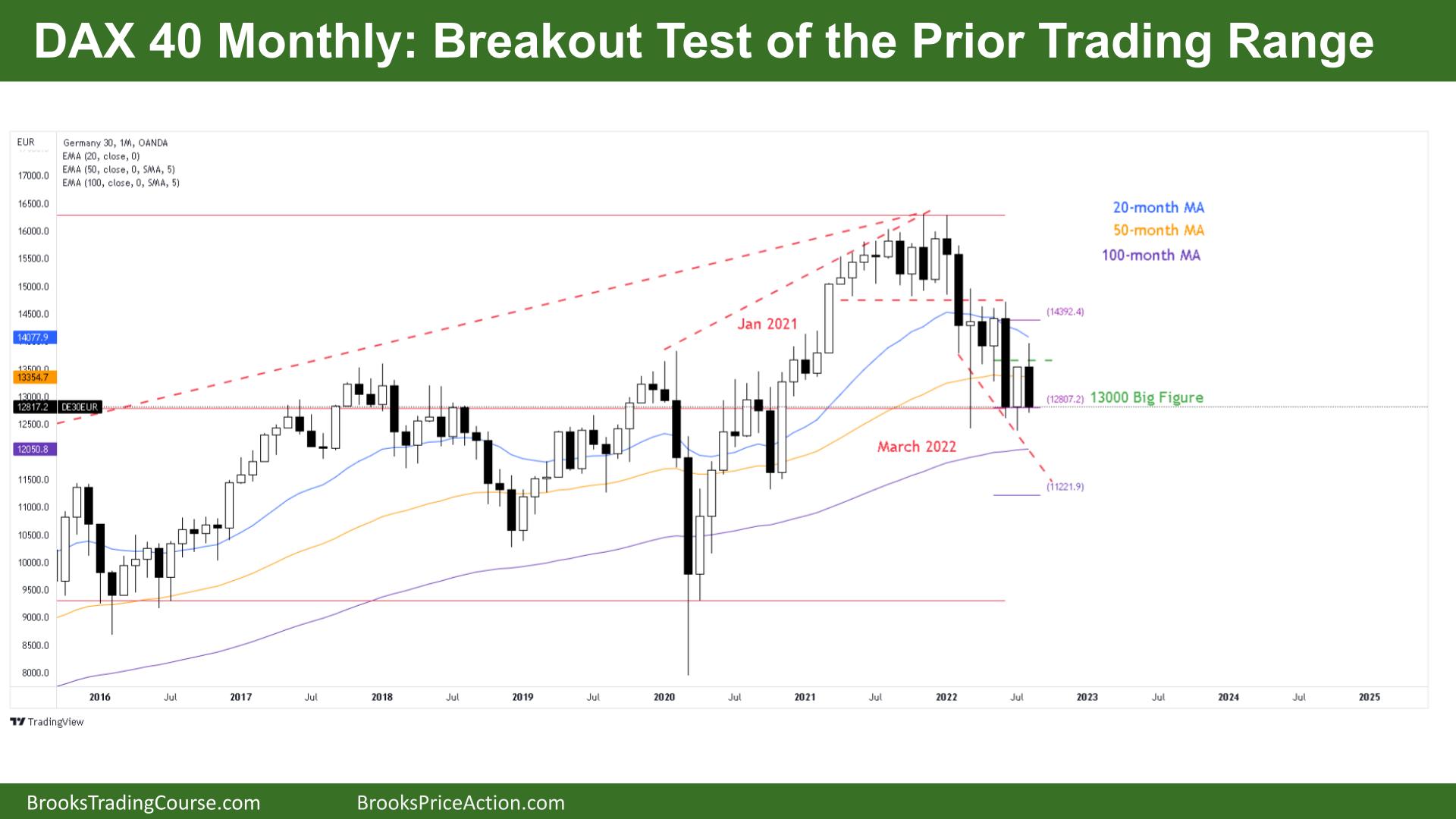

DAX futures reversed strongly closing on the lows so it’s a sell signal on the monthly chart. It’s a DAX 40 breakout test of the prior trading range of January 2021. The bears want a move back into that range, a failed wedge bottom. The bulls see support at the moving averages and the range lows and will continue to buy below bars. If the bears can get a consecutive monthly bear bar we could test the 11000 area.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures was a bear bar closing on its lows. A very small tail below.

- It’s a sell signal in a bear trend but has lacked consecutive strong bear bars.

- The bulls see a DAX 40 breakout test of the prior trading range. Micro double bottom – Micro DB, a breakout pullback to the high of the prior trading range around January 2021.

- The bulls see support as 3 months – March, June and July – with tails down here so we can expect them to scale in below.

- The bulls see a wedge, three pushes down – February, June and July and bought the July high for a low-probability swing.

- The bulls see July as a reasonable buy signal, the second entry long in a two-legged pullback after a bull trend. It made sense that we traded above the midpoint of those two entries to let longs out.

- The bears see a bear trend, a tight bear channel and want a failed breakout below the wedge. They want a consecutive bear bar for a measured move down.

- The trend lacks good stop entries. When both sides are making money the trend is not strong and may turn into a trading range. That is why it looks like a DAX 40 breakout test rather than a bear trend on the higher time frames.

- It’s better to be short or flat – if you’re short, stop above August. If you’re long you can get out below July, or buy more on the breakout bar betting we will get back to the midpoint to get out breakeven.

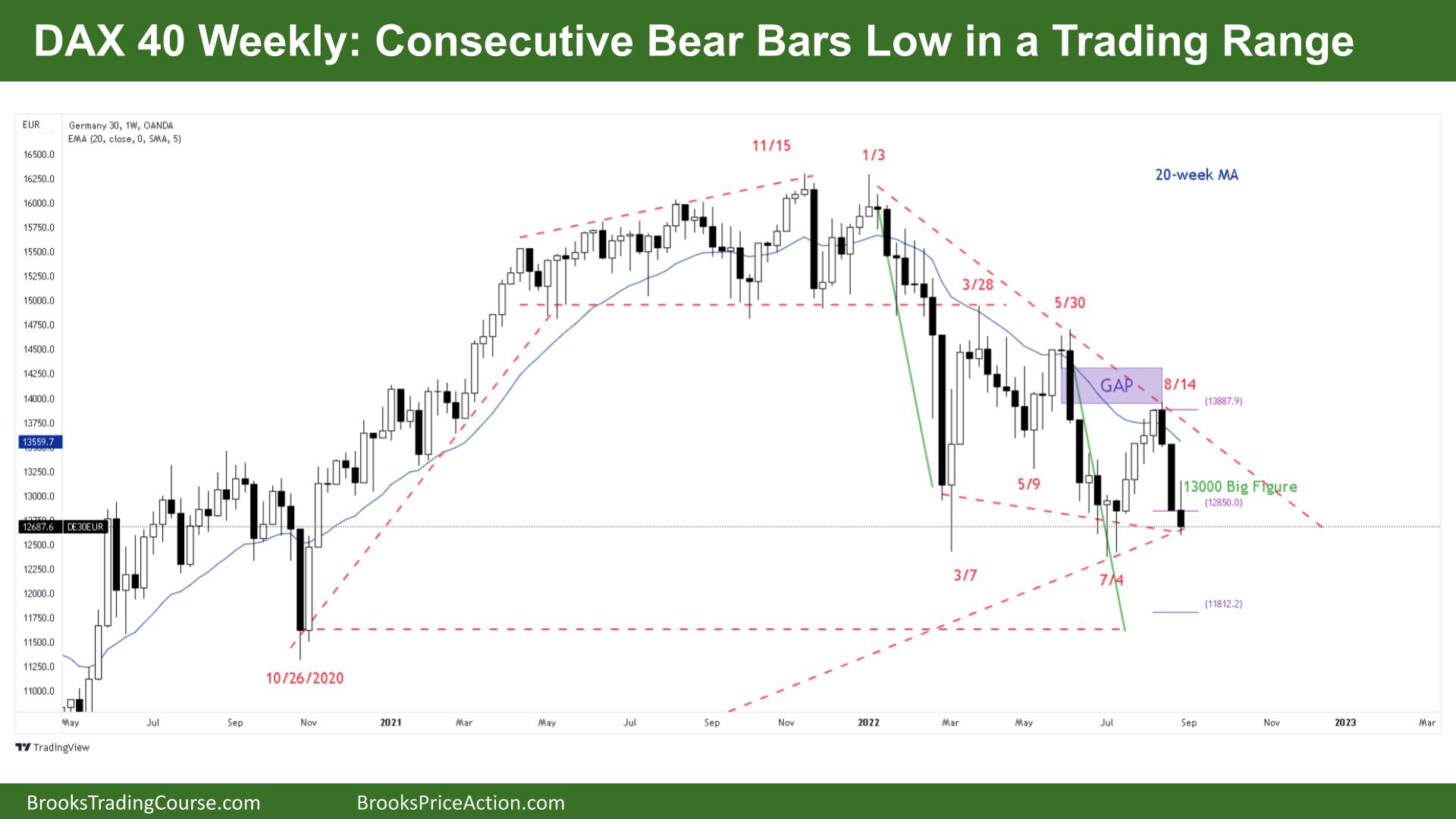

The Weekly DAX chart

- The DAX 40 futures was a bear bar with a tail above and small tail below. It is 3 consecutive bear bars so we are always in short.

- The bulls see a wedge bottom and a higher low major trend reversal. But it’s not a good buy signal. They see the move as a pullback to the trend channel line to continue higher.

- The bears see a bear trend and lower highs and lower lows. They want a break below July for a measured move down or at least another leg. There is also a gap between May and August.

- The bears know there is a harmonic move down around 11800, which is also the measured move target so 50% chance we get down there. The breakout of the prior range is around this area.

- The bulls want a fortnight like in July, big tails below and set up another buy signal. It would be the second decent buy signal at the bottom of the range, a second entry so a higher probability swing up.

- But it’s a trading range so we can expect disappointment next week. Big bear bar with a big tail below. Big Bull bar with big tail above.

- Probably sellers above last week expecting a second leg after 3 consecutive bear bars.

- Bulls were able to get 4 consecutive bull bars so the trend is not that strong yet. Bulls want a pair of consecutive bull bars here to move back up.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.