Market Overview: DAX 40 Futures

DAX futures went higher last month with a big bull breakout and follow-through near 19000. We went past 18000 and one MM target and I think we will pullback before hitting the next one. The pain trade for bears would be to keep racing up. But it wasn’t a very good short. Strong bull Microchannel so probability is high for more up.

DAX 40 Futures

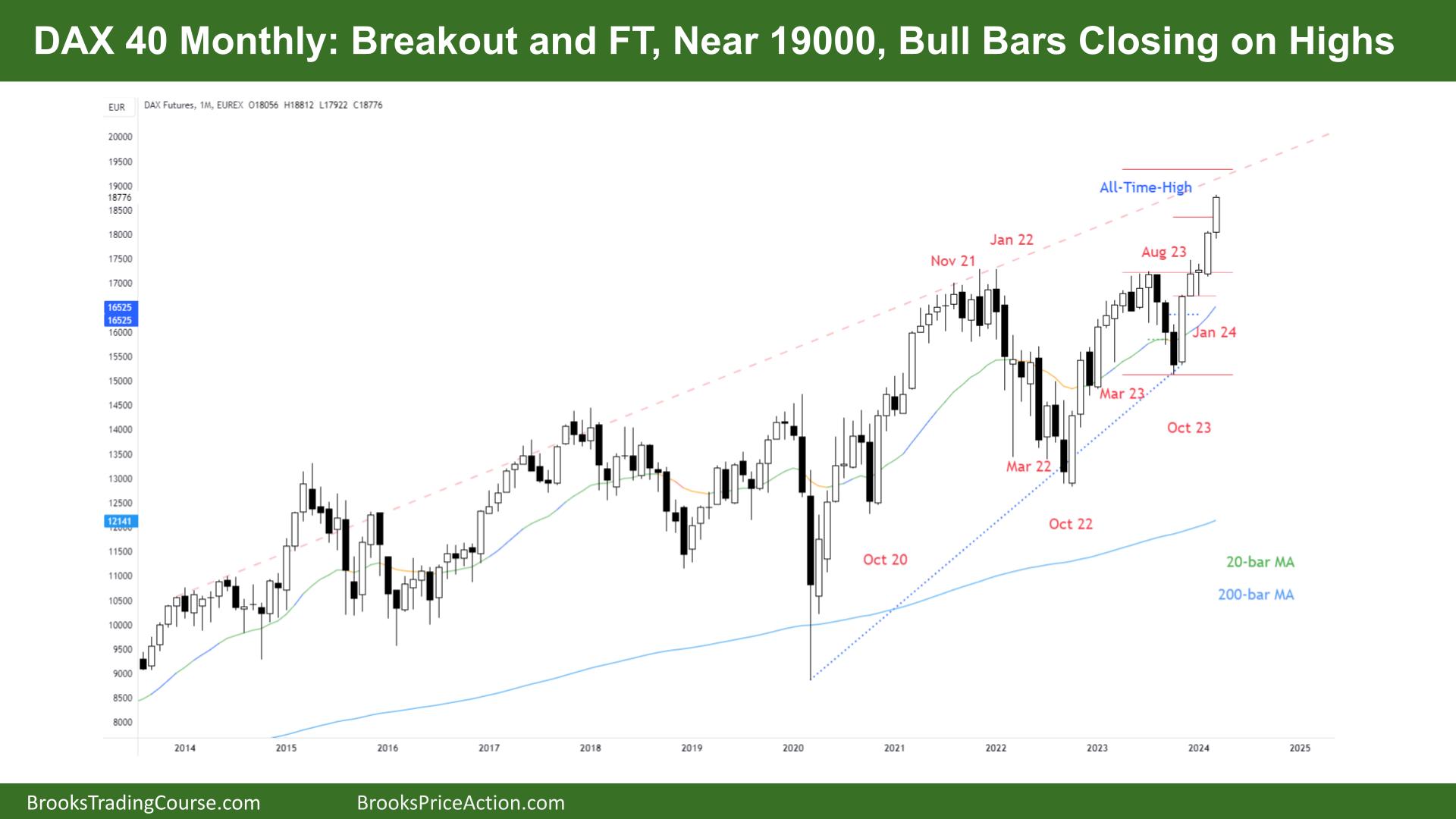

The Monthly DAX chart

- The DAX 40 futures rocketed higher last month with another big bull bar closing on its high, a bull breakout and follow-through.

- We went right past the 1:1 target from October buy the close bulls and we might pullback to it to test before going higher to the larger 1:1 around 19000.

- When the measured move targets are very clear and the market fails to reach them you often have traders scaling in betting we will get back there.

- Here a bull breakout, pullback and then resumption.

- Sometimes the market moves halfway to the MM target and then retraces before going all the way there.

- So many bulls will take some profits at new highs from the positions they take on the pullbacks. It is important to get the risk reward right.

- So why would anyone short here? Well, risk is small right now the reward is good.

- A 5 bar bull Microchannel is around the typical MC before a pullback. And the pullback could be deep. Because a bull taking a position here on this chart needs a wide stop.

- 19000 big round number above which is another magnet. Although I think 18000 is more important and we never spent much time there.

- Another buy signal so nothing to sell here for bears.

- Always in long so better to be long or flat.

- Expect sideways to up.

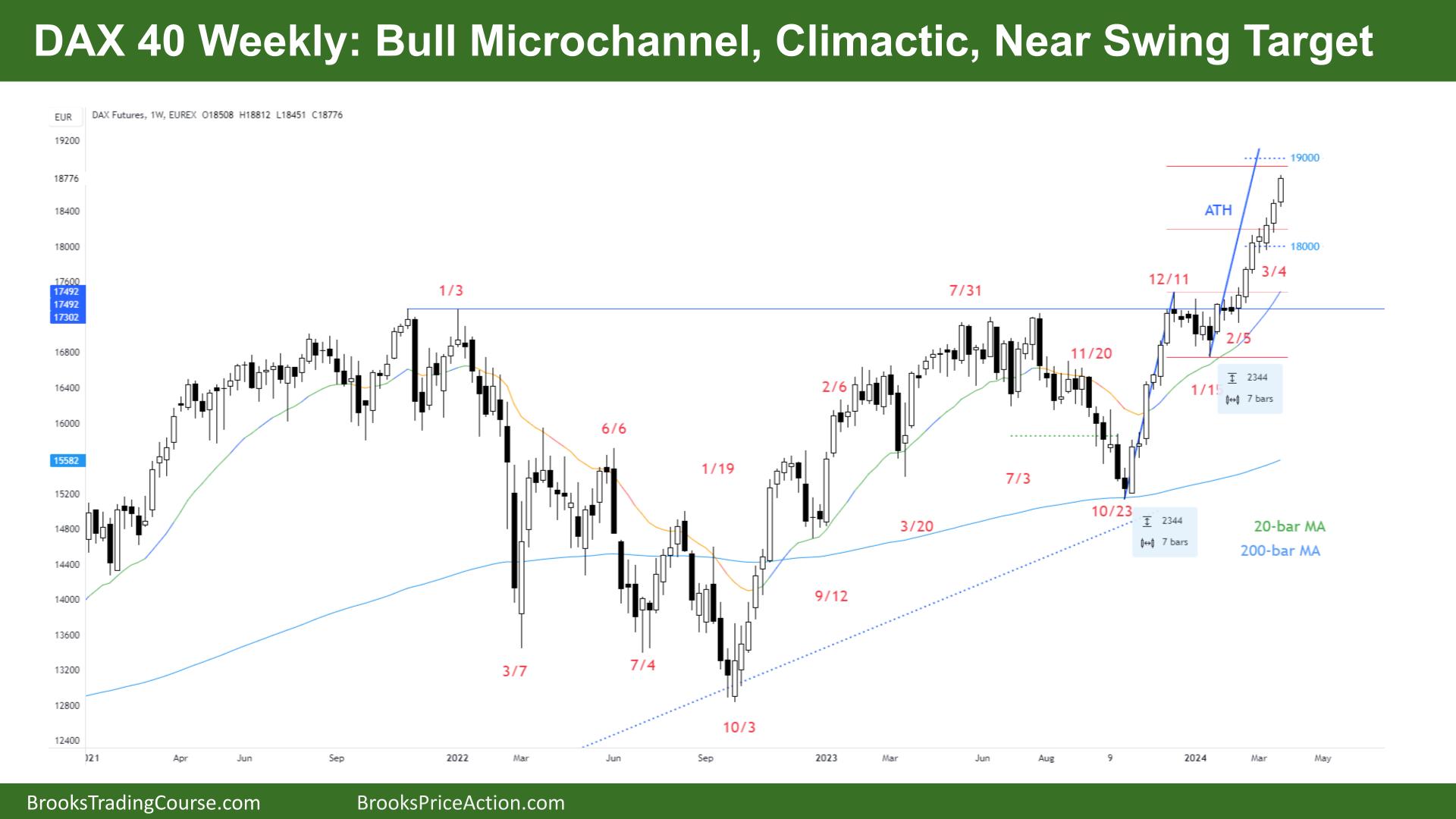

The Weekly DAX chart

- The DAX 40 futures printed another buy signal last week in a strong bull Microchannel on the weekly chart.

- A 7-bar bull Microchannel so the first reversal should be minor. There should be buyers below the low of a prior strong bar. And there are a few of those!

- But because it is climactic the pullback can be deeper than traders expect.

- Measured move targets above and 19000 big round number so what should a trader do?

- If you buy you need a wide stop and your risk reward isn’t so good. But proability is high.

- There is nothing to short here so has to be low probability. Could bears argue 7-bars so likely a pullback? Perhaps. But where is your stop?

- Usually the distance of the leg up would make sense to improve your chances. But I still think too big here to short.

- Strong bull spikes on the 5min chart on most days recently.

- Bears could argue parabolic wedge top, 3 pushes up but where is the pause bar?

- So still strong breakout and more likely to go higher.

- The one case for bears here is the sudden acceleration on the chart. When the bars move quickly away from the moving average it creates these air pockets.

- Now this creates a good pullback trade for bulls. But also limits the upside for new bulls and hence can be a good short trade.

- The best way to trade it is with limit orders and waiting for front running bears to start shorting. Which we can see with upper tails. Until they appear better to be long or flat.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.