Weekend report co-author Andrew A.

Market Overview: Weekend Market Analysis

The SP500 Emini futures market has a 7 consecutive bull bars streak on the monthly chart. Since there has never been a streak of 8 bars in the 25-year history of the Emini, September should be a bear bar. Even though it is at the top of the daily bull channel, there is room to the top of the weekly channel and a measured move target based on the pandemic crash. It should rally more in early September, but there is an increased risk of a selloff late in the month.

The EURUSD Forex market’s weekly chart is turning up from a 2-bar reversal, a micro double bottom, a wedge bottom, and a failed breakout below the March low. It should work higher for several weeks.

EURUSD Forex market

The EURUSD weekly chart

- This week’s candlestick on the EURUSD Forex weekly chart was a bull bar closing near its high.

- It broke slightly above last week’s high. This week is now the 2nd bar of a 2-bar reversal buy signal.

- The bulls also have a micro double bottom (the bull reversal bar of 3 week’s ago was the 1st bottom), a wedge bottom, and a failed breakout below the March low.

- The context is good for price to work higher for several weeks.

- Traders need to see consecutive big bull bars closing on their highs before they conclude that a reversal up will be more than a pullback in the bear channel.

- EURUSD is in a tight bear channel that started on Jun 18 but with overlapping bars and reversals every week or two.

- While not a strong bear trend since June 25 high, the November low is a magnet.

- Bears want a strong breakout below the yearlong trading range and 700-pip measured move down, but there will probably be buyers below the November low since most breakouts from trading ranges fail. Markets have inertia and tend to continue what they have been doing.

- Therefore, the yearlong trading range is likely to continue. That means there should be a rally for a couple of months beginning around the current level or from just below the November low.

- The monthly bar will close on Tuesday. Bulls want the month to close above the 1.7818 middle of its monthly range, which would increase the chance of higher prices in September.

S&P500 Emini futures

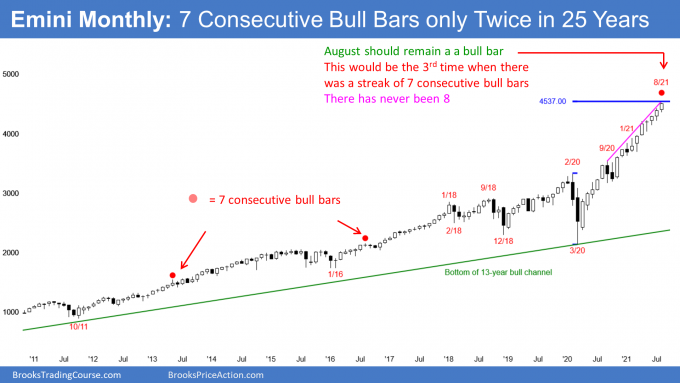

The Monthly Emini chart

- So far, August is a bull bar closing above 4500 and near its high. If it closes near the high of the month, September could gap up forming a monthly gap.

- Two trading days left in August, and the Emini is far above the open of the month. August will probably have a bull body with a 7 consecutive bull bars streak on the monthly chart.

- There has never been an 8 consecutive bull bars streak on the monthly chart in the 25-year history of the Emini. Therefore, September will probably have a bear body.

- If it does, that should lead to a 2- to 3-month month correction of 15 to 20%.

- If September is a bear bar, September could rally in the 1st half of the month and then sell off late in the month. The September 22 FOMC meeting is a potential catalyst.

- Bars often change their appearance just before they close. There is therefore an increased risk of a 50-point selloff over the next two days. It would take about 50 points of selling to add a noticeable tail on the top of the monthly candlestick.

- The bulls want the month to close on its high, which would increase the chance of higher prices in September.

- The bears want at least a prominent tail on top of the bar to reduce the bullishness.

- The bears have not yet been able to create a bear bar or even a bull bar with a prominent tail on top for 6 months.

- Sometimes in a buy vacuum, sellers stop selling until the price reaches a measured move or other resistance.

- The next measured move is 4537 based on the height of the pandemic crash.

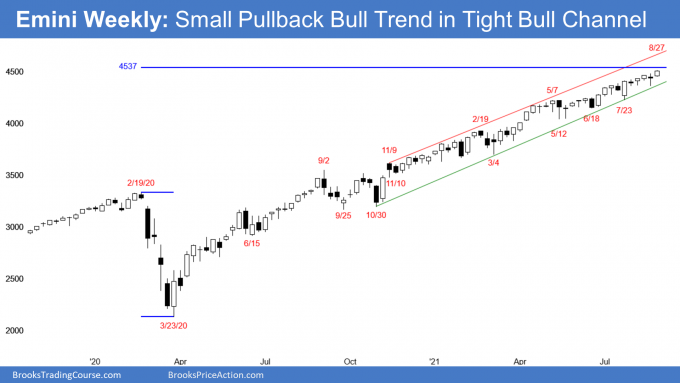

The Weekly S&P500 Emini futures chart

- This week’s candlestick on the Emini weekly chart was a bull bar closing at a new high.

- With last week closing near its high, next week could gap up, creating a gap on the weekly chart.

- The next targets for the bulls are the 4537 measured move (based on height of the pandemic sell-off) and the top of the weekly trend channel line at around 4600.

- The Emini has been in a Small Pullback Bull Trend for more than 60 bars, which is unusual, and therefore unsustainable and climactic.

- A Small Pullback Bull Trend ends with a big pullback. The biggest pullback so far was the 10% selloff in September. A bigger pullback means 15 to 20%.

- The bears have not been able to create consecutive big bear bars.

- The rally is in a tight bull channel, which is also a sign of strength for the bulls.

- Until the bulls aggressively take profits, the bears will not sell. The bears need to see one or more big bear bars before they will look for a 2- to 3-month correction.

- Until then, traders will continue to bet on higher prices and that every reversal attempt will fail.

- The 2 common ways for a tight bull channel to end are either with a break below the bull trend line (bottom of the channel) or a failed breakout above the channel.

- When a tight channel lasts an unusually long time, some bears who have been scaling in and using wide stops can no longer sustain the growing losses. That occasionally leads to a violent short covering rally.

- Once the last bear buys back his shorts, there is no one left to buy. Bulls see the big rally as an opportunity to take windfall profits.

- With no one buying and bulls selling, there can be a climactic reversal down (blow-off top). That is what happened in the bond market last year.

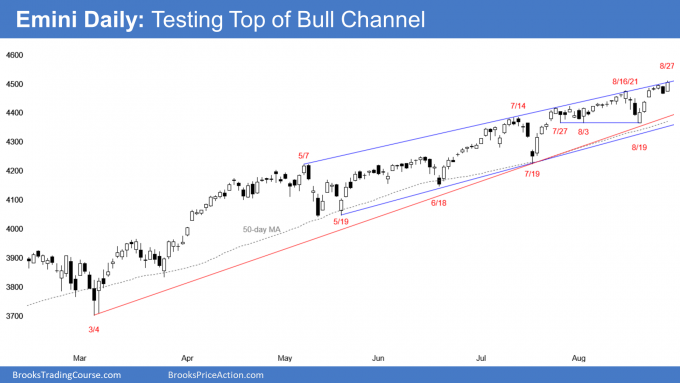

The Daily S&P500 Emini futures chart

- On the daily chart, the Emini closed above the 4500 Big Round Number and at the top of the bull channel.

- Bulls want a big breakout above, and then an even stronger bull trend. That happens 25% of the time, and it happens because traders who have been selling for the past 20 – 30 bars (days) finally give up.

- 75% of the time, a breakout above the top of a bull channel fails by about the 5th bar. However, those 5 bars can still be still very big, and therefore there is a reasonable chance of a sharp rally over the next week.

- If the bears get a reversal down within a week, it will be from a higher high major trend reversal and from an expanding triangle that began with the July 26 high.

- There have been many reversal attempts on the daily chart over the past year and a half. Traders bought every one, correctly betting against a successful reversal.

- While the trend has been overextended and extreme, bulls continue to bet on higher prices because they know that most reversal attempts fail in a strong trend.

- Traders need to see aggressive profit-taking and consecutive strong bear bars before they will be willing to short aggressively. Traders will not believe a correction is underway until it is already about half over.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.

Emini – all time frames. Can you clarify the supply/demand equation?

When the bears give up to cover, who is selling to create the buy vacuum to the blow-off top? Don’t the bulls also dislike the current high price so who is creating the buy vacuum, leading to even higher prices?

Also, when no one is buying at the blow-off top, who starts buying at the top for both the bulls and the bears to be able to sell?

Can you explain who is providing supply on the other end of these trades?

Thank you very much if you have time to further explain the supply discussion.

The bears create the blow-off top. In a tight bull channel that lasts more than 60 bars, the bears keep adding to their shorts, betting the rally is near the end. At some point, even though they know there might soon be a 20% correction, their losses are so big that they have to buy back their shorts. This short covering rally will make other bears panic, and they too will buy back their shorts. The faster up it goes, the more bears panic, until the final weak bear has covered.

Weak bulls who were hoping for a pullback panic as well. They buy the acceleration up, afraid of missing an even stronger bull trend.

Once the weak bears and weak bulls buy the big bull breakout, there is no one left to buy. The market has to go lower to find a price where there will be buyers. But it is often much lower because strong bulls and strong bears sell the big bull breakout, knowing that there could be a big selloff that lasts a long time.

Traders know that a blow-off top can go very far up before reversing. A bear simply cannot risk losing too much of his account, even when he is confident the sharp rally will be a climactic top. He can sell again after the reversal begins. And the bulls sell, too, know that a blow-off top can lead to a bear trend and not just a pullback.

In that final acceleration up, fast-money momentum bulls are also buying, as are high frequency trading firms. That huge buying from bulls and bears can lead to a break far above the bull channel. But it will fail 75% of the time.

Smart bulls know that the rally will probably be the end of the bull trend for 20 or more bars (on whatever time frame the top forms). They use that final surge to take windfall profits. And they take them quickly, know that a great price will not last. That, and the absence of weak bears buying back short and the presence of strong bears finally shorting, causes the sharp reversal down.

Hi Al,

You told us that the market may enter into a TR for many years after this wild bull trend but, do you think what is happening now is comparable to the beginning of the dot-com bubble?

Picking top is a losing strategy. There have been many tops over the past decade, and each failed. Therefore, this is probably not the top. Traders will continue to buy every reversal attempt until one is so big that traders will hope for a bounce that will allow them to exit their longs with a smaller loss.

One of the tops will actually be the final top for many years. No one knows until a year or two after the top forms. Until then, traders know the trend is their friend. They will make much more money buying every selloff, and they will lose a lot of money selling every top.

Hi Al,

When you say ” 15 to 20% correction” 15-20% of what, the last bull leg or the entire 13 year bull run? Usually does it refer to the current last bull leg?

Thanks

Denise

When traders talk about a correction, they mean from the all-time high. If the highest price ever for a market was 100, then a 20% correction is a selloff to 80.

Thanks Al!