Market Overview: S&P 500 Emini Futures

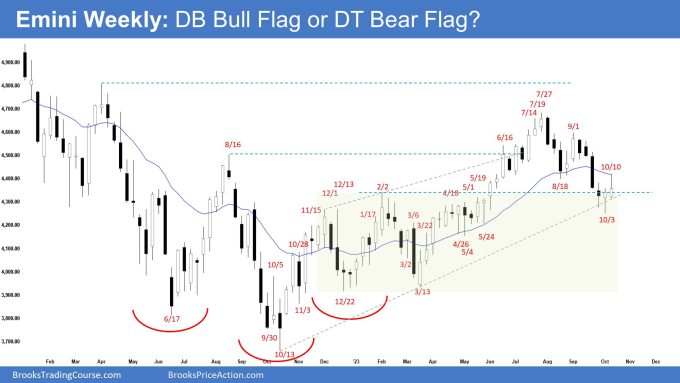

The market traded higher but closed with a long tail above forming a weak Emini follow-through bull bar. The bulls want the Emini to reverse back above the 20-week exponential moving average. The bears want another leg down to complete the wedge pattern with the first 2 legs being August 18 and October 3.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bull bar closing in the lower half with a long tail above.

- Last week, we said that the odds slightly favor the market to trade at least a little higher. Traders will see if the bulls can get a strong follow-through bull bar or will next week trade slightly higher, but close with a long tail above or a bear bar.

- This week tested the 20-week EMA but closed with a long tail above.

- The bulls got some follow-through buying albeit weaker.

- They want the Emini to reverse back above the 20-week exponential moving average.

- They hope to get a retest of the July 27 high from a double-bottom bull flag (Aug 18 and Oct 3).

- They see the move down simply as a 50% pullback (of the move which started in March) within a broad bull channel.

- If the market trades lower, they want a reversal from a double bottom with October 3 or a wedge bull flag.

- The bears got a two-legged pullback testing the breakout point (Feb 2) and the bull trend line.

- They want a strong breakout below the bull trend line with follow-through selling.

- If there is a pullback (bounce), they want another leg down from a double top bear flag (Sept 1 and Oct 12) to complete the wedge pattern with the first 2 legs being August 18 and October 3.

- Since this week is a bull bar closing in the lower half with a long tail above, it is a buy signal bar albeit weaker.

- Odds slightly favor the market to still be in the sideways to up pullback phase.

- Traders will see if the bulls can continue creating follow-through buying or will next week trade lower and retest Oct 3 low instead?

- While the market may still trade sideways to down for a couple more weeks, the market is likely still Always In Long (bull trend remains intact; higher highs, higher lows).

- The pullback to October 3 has also fulfilled the minimum requirement of TBTL (Ten Bars, Two Legs).

The Daily S&P 500 Emini chart

- The market traded higher in the first half of the week and formed a small pullback on Thursday and Friday.

- Last week, we said that the odds slightly favor the Emini to trade at least a little higher.

- The bears got a second leg sideways to down from a lower high major trend reversal and a double top bear flag (Sept 1 and Sept 14).

- They got a 50% pullback of the rally which started in March, testing the February 2 high which was the breakout point of the rally.

- They want another leg down from a double top bear flag (Sept 1 and Oct 10), completing the wedge pattern with the first two legs being August 18 and October 3.

- If the market trades higher, they want a smaller double top bear flag with October 12 and reverse down from around the bear trend line.

- The bulls want a reversal up from a double bottom bull flag (Aug 18 and Oct 3), a micro double bottom (Oct 3 and Oct 6) and a higher low major trend reversal (Oct 13).

- They hope to get a retest of the July 27 high and a strong breakout above.

- They see the large two-legged move down (Aug 18 and Oct 3) simply as a 50% pullback and a test of the breakout point (Feb 2) of the rally.

- They see Thursday and Friday simply as a small pullback and want at least another leg sideways to up next week, trading far above the 20-day EMA.

- The next targets for the bulls are the bear trend line and the September high.

- The last two bear bars had prominent tails below and a lot of overlapping ranges.

- Odds slightly favor at least a small second leg sideways to up next week.

- Traders will see if the bulls can create more bull bars closing near their highs or will next week trade slightly higher but stall around the October 12 high area.

- For now, while the market may still trade sideways to down for a few more weeks, the bull trend remains intact.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Really enjoy comparing my analysis to these articles. Always look out for them on a Sunday. Thankyou.

Dear Thomas,

Thank you for your continuous support..

Wishing a blessed week ahead to you and your loved ones..

Best Regards,

Andrew

Good analysis as always.

Dear Jord,

Thank you for going through the report.

Have a blessed week ahead to you and your loved ones..

Best Regards,

Andrew