Stock Market Zero Sum Game and Eternal Bull Market?

The Dow will break strongly above 20,000, even if it falls to 10,000 first! That is because the world creates more workers in an increasingly efficient world economy every day. As a result, the world’s wealth is steadily increasing. Since the stock market contains a big part of the world’s wealth, it, too, will steadily increase. Yet, there will always be shockingly big bear trends along the way. For example, the Dow lost 89% after it crashed in 1929, but is now 500 times above the crash low.

500 year long bear market?

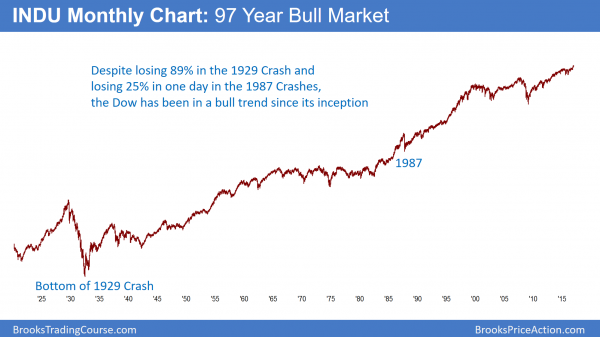

This is a monthly chart of the Dow Jones Industrial Average over the past 97 years. Despite losing 89% after 1929, it has been in a bull trend since its inception.

The world has 7 billion people. But, within a few hundred years, the population will begin to decline. I don’t know if the maximum number will be 15 or 50 billion people, but only so many can fit comfortably on the planet. A luxury car might comfortably fit 4 people, but no one would enjoy the luxury with 15 packed in.

As poverty decreases and education increases, family size decreases. In addition, there are many other demographic forces. In many countries in Europe, the birth rate is already too low to maintain the population. As a result, if not for immigration, these countries would be shrinking. Furthermore, if they shrank enough, their economies would shrink as well. The countries would have fewer dollars. At the extreme, if there was no one left, the countries would have no money.

Governments will limit birth rates

Too many people will reduce everyone’s quality of life. The world will therefore have to make too many bad choices over food, water, energy, wild spaces, and every other resource. Hence, governments, including ours, will limit population.

If 500 years from now, the world’s population falls from 15 billion to 10 billion over the following 500 years, the loss in the world’s earnings will probably be greater than the increase in productivity. As a result, the bull market that has gone on for thousands of years will eventually turn into a bear market. In addition, it could last hundreds of years, instead of just 3, as it did after the 1929 Crash. That bear market will probably end up as part of a trading range or broad bull channel that could last forever.

Big gains need both improved productivity and more workers

At some point, the population will stabilize or enter a range. Once that happens, increases in productivity will increase the world’s wealth and the stock market again. Yet, without an increasing number of workers adding to the added wealth, the growth will never be as high as it has been. Neither you nor I will be around to know if I am right, but I believe I am.

Zero Sum Game

Sometimes someone says, “Al, if trading is a zero sum game, then half of all firms lose money and go out of business.” While that statement is true, the “if” is a flawed premise. Over the course of a few months, the size of the world’s economy can stay the same or even shrink. During those times, trading is a zero sum game. Hence, every dollar made by one firm is lost by another. Yet, over the course of years, the stock market goes higher. That means that the total dollars increase.

The world’s wealth has relentless increased since the beginning of civilization. It is directly correlated to the number of people on the planet. The more people working, the more goods and services. As a result, the world’s wealth increases.

Gross Domestic Product (GDP)

On the news, you always hear about GDP being 1 – 3% in the US. That is misleading. When the news says that the GDP is 1%, what they mean is that the growth in the Gross Domestic Product is 1%. During a recession, there is no growth. In fact, the economy shrinks, which means that the GDP is negative. Yet, there are far more up years than down. Therefore, the total wealth of the world steadily increases.

The pie is growing. Hence, it is not a zero sum game. The fight is not over a fixed number of dollars. It is over who is going to get the biggest share of the new dollars that constantly appear.

Because the bull market will continue for another several hundred years, we never have to worry about a zero sum game. As traders, we simply have to work on being the best that we can be, knowing that there is more than enough money for everyone.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al – Thank you as always for your insight. In the context of posting the INDU chart, showing scale on the Y axis would help, especially given this is a logarithmic scale chart. There are many new traders who may not recognize this important difference. Your point on the ongoing bull is well-taken, thank you.

I intentionally removed the Y axis, because, as you know, the price scale gets scrunched to the top on a log chart. Most of the bars on the chart are very low prices relative to today, and I thought that it would distract readers from the point that the market has been in a bull trend forever. You are right, though, that I should have at least mentioned that it is a log chart.

Interesting update, thanks for sharing your thoughts.

Interesting insights Al, thanks so much for posting them.

In terms of market valuations today compared to the past 100 years, it looks like we are in the uppermost 5% of overvaluation when compared to historical norms:

http://www.multpl.com/shiller-pe/

The bull argument would be that stocks are still cheap relative to treasury yields, but I still think at some point, something has to give and the market will correct lower.

It is kind of scary to think that the S&P500 could fall by 50% from here and wouldn’t be particularly cheap when compared to historical p/e ratios. However, with so many state pension funds and 401ks dependent upon stocks producing at least 7% per annum to meet their payout obligations, one wonders if the Fed is cornered into a position where they will never allow stocks to fall meaningfully again, due to the implications mentioned above. Interesting times.

The Fed is limited in what it can do. There are trade-offs and at some point, they can only fix one problem by creating another. As bond rates go up and old debt comes due, the government will refinance at a higher rate. The debt payment will be so large that the only solution will be to print money.

That normally would cause massive inflation, and a very cheap dollar. Because Europe has the same problem, no one knows what will happen. My guess is that everything is in for a repricing down. Stocks and bonds are both probably too high because of extreme government borrowing.

A prolonged mess is looming, but it can years to begin. Once here, I suspect it will result in a huge trading range with big swings, and that it will last about a decade, like in the 1970s.