Year end stock market rally forming bull flag

Updated 6:52 a.m.

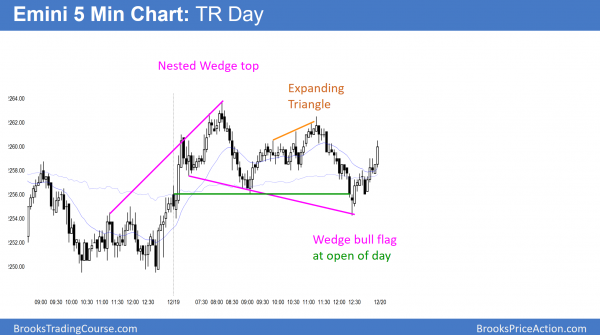

On the open, the Emini broke above the 60 minute moving average and at the 3 day bear trend line. Because the Emini has tested the line many times and had been unable to selloff strongly, the odds favored a bull breakout. A bear channel is a bull flag. This is especially true when the higher time frame (60 minute chart) is strongly up.

While the Emini is Always In Long, it is still within the 4 day trading range. As a result, bulls will be quick to take profits unless there is a strong breakout above last week’s high. Since the rally has been strong, bears will need either a micro double top or 2 – 4 strong bear bars to take control.

Will today be a strong trend day? That is unlikely because of the 4 day trading range and Christmas week. Yet, the bulls are in control, and the 60 minute moving average is now support. The odds at this point are that today will either be a weak bull trend day or a trading range day. If there is a deep pullback over the next 30 minutes, today will probably be mostly a trading range day.

Pre-Open Market Analysis

The weekly chart had a doji reversal bar after the prior week’s strong bull breakout. Even thought the weekly chart has had 3 pushes up this year, last week is a weak sell signal bar. Furthermore, the 6 week rally that formed the 3rd push up was strong. As a result, sideways is more likely than down.

In addition, the month long rally on the daily chart since the election has been in a tight bull channel. Therefore, the 1st reversal down will probably be minor. Hence, a bull flag is more likely than a bear trend.

The weeks before and after Christmas often have mostly small trading range days. Because a trend can come at any time, traders need to be prepared for a big swing. Yet, they know that most swings for the next 2 weeks will only last 2 – 3 hours. They therefore will take quicker profits, and will be more willing to look for reversal setups.

The daily and 60 minute charts have formed a bull flag over the past 3 days. The odds are that there will be at least a small rally this week. Furthermore, because the month long rally has been strong, many bears will not sell until there is at lease a micro double top.

Overnight Emini Globex trading

The Emini traded in a narrow range overnight. The 6 day trading range is therefore continuing. Because the rally on the daily and 60 minute charts was strong, the odds favor at least a small 2nd leg up. Yet, trading ranges have inertia. Therefore the odds are that today will have mostly trading range price action. Furthermore, the next two weeks usually have lots of small days and protracted tight trading ranges.

While that is likely, the odds are that there will be several breakouts that go far enough for swing trades. Because the odds favor mostly trading range trading, it will be easy for swing traders to miss early signs of a breakout. Yet, if they can anticipate a breakout and see a good signal bar in good context, they probably will be able to enter early.

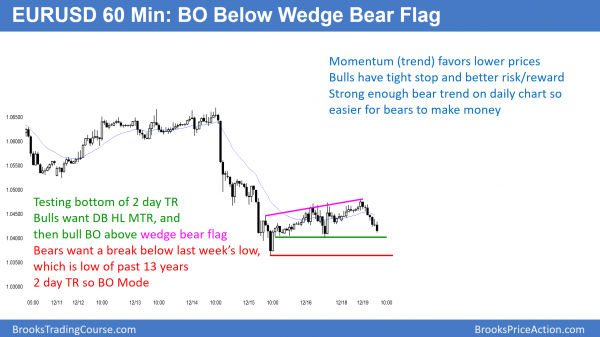

EURUSD Forex Market Trading Strategies

The 60 minute EURUSD Forex chart sold off for 6 hours last night. Yet, it is still testing the bottom of a 2 day trading range. The bulls have a 40% chance of a major trend reversal on the 60 minute chart, and then a rally for a couple of weeks.

While the EURUSD daily chart broke below the 2 year trading range to a 13 year low, the follow-through bar on Friday had a bull body. In addition, Thursday’s breakout bar had a prominent tail. As a result, traders believe this increases the odds of a failed breakout to almost 50%. The bears need follow-through selling this week. They want big bear bars closing on their lows. Furthermore, they want the closes to be far below the December 2015 bottom of the 2 year trading range.

The bulls always want the opposite. They see Friday’s bull body as a buy signal bar for a failed bear breakout. Yet, Friday had a big tail on top. Many bulls therefore will not buy above Friday’s high to bet on a reversal up. Since the reversal up would be after a protracted trading range after a bear trend, it would create a Lower Low Major Trend Reversal. Because the bulls are looking to buy in a bear trend, they was a strong buy signal bar or a strong reversal up. They have neither at this point. As a result, the odds favor at least a little more sideways to down trading before a reversal attempt.

Many bulls wait for at least a micro double bottom and a good buy signal bar. They will also buy if instead the daily chart forms several consecutive bull trend bars. Without either of these buy setups, bulls will wait. As a result, a reversal up at this point will probably be minor. Therefore, it would more likely form a bear flag than a bull trend.

Overnight EURUSD Forex Trading

While the EURUSD Forex market sold off for the past 8 hours, it has not yet fallen below the bottom of the 2 day trading range. The momentum down on the 60 minute chart is strong. Hence, the bulls will probably need at least a micro double bottom before they can reverse up from a double bottom with last week’s low. Therefore, the best the bulls will probably get today is a 30 pip tall trading range.

Because the 8 hour selloff fell only 70 pips, it probably is simply a test of last week’s higher low. As a result, today will probably be in a trading range from 1.0400 to 1.0430 or so.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had several reversals and formed a trading range day.

The Emini has been in a bull flag for 7 days on the daily chart. The odds favor a test of the all time high. The bears will probably need at least a micro double top before they can get a reversal. Even if they succeed, the rally has been so strong that bulls will buy the selloff. Therefore, the 1st selloff will probably become a bull flag.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Brookspriceaction.com not available…can’t get into the trading Room.

Yes, they sent out an email to get traders into the room.