Weekly Emini Low 2 bear flag but weak sell signal bar

I will update again at the end of the day

Pre-Open market analysis

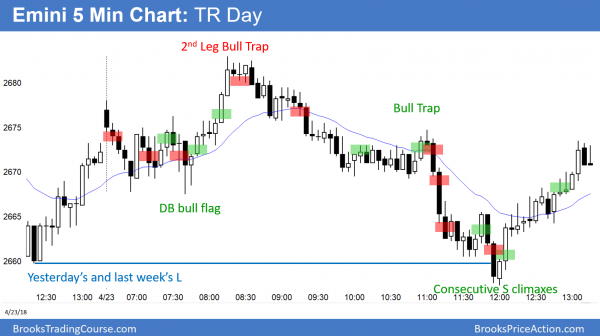

The Emini yesterday formed another trading range day. Since last week was a doji bar on the weekly chart, it is a weak sell signal. Yesterday fell below that low and triggered the sell signal. There were bulls below and the Emini reversed up strongly into the close.

The daily chart is still in a Small Pullback Bull Trend. Pullbacks typically last 1 – 3 days. Therefore, the bulls need a reversal up today. Since last week’s range was small, the bulls might be able to trade above its high. That would create an outside up week and it would be a sign of strong bulls.

Overnight Emini Globex trading

The Emini is up 13 points in the Globex session. Hence, it might gap above yesterday’s high. If so, the gap will be small. Small gaps usually close within the 1st hour and are not significant signs of strength.

The past 10 days have been mostly trading range days. If today is another, the Emini will probably go sideways for the next week. The bulls need a strong bull trend day today or tomorrow to convince traders that the 3 month correction has ended. Without that, traders will assume that the trading range will continue for at least another week.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

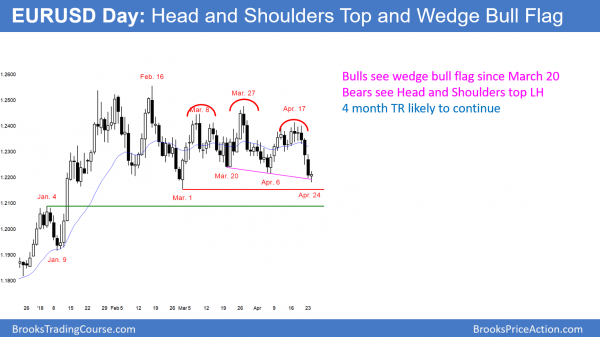

EURUSD wedge bull flag and head and shoulders top

Since the EURUSD daily Forex chart has been in a trading range for 4 months, there is both a buy and sell setup. The bulls have a wedge bull flag, which is a pullback from the rally that began on March 1. The bears have a head and shoulders top.

The EURUSD daily Forex chart has been in a trading range for 4 months. Therefore, every attempt to break out is likely to reverse. Furthermore, there is always both a reasonable buy and sell setup. But, since trading ranges resist breaking out, most of these patterns fail. This trading range lasted about as long as prior ranges over the past 3 years. Therefore, the odds of a breakout over the next month are higher.

Yet, until there is a breakout, there is no breakout. Traders need to see consecutive strong trend bars breaking out of the range to believe the breakout will succeed. The bears need at least 2 closes at least 50 pips below the 1.2150 March 1 bottom of the range before traders will believe that there will be a 300 measured move down.

Consequently, traders will keep looking for reversals. Since the daily chart is now near the bottom of the range, bulls want to buy. But, the selloff has had 3 strong bear bars. Therefore, the bulls will want at least a micro double bottom.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart has been in a 40 pip range overnight. It reversed up from below the 1.22 Big Round Number, and it has been straddling it. The bulls hope that this is the end of the selling. If they can create a micro double bottom this week, they will buy for a leg up. Since trading ranges resist breaking out, the odds are that the daily chart will begin a bull leg within a week or so.

Therefore, the bulls will begin to buy reversals up for scalps. However, they will not swing trade until there is a strong bull breakout above the 4 day bear channel.

The bears will now switch to selling rallies and scalping. If they are able to create a strong break below the 1.2150 March low, they will again swing trade.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a huge bear trend today. The open of the

month will probably be a magnet until the month closes on Monday.

Today was a Surprise Day. That is a low probability event. It therefore catches both bulls and bears by surprise, and they use the 1st bounce to reposition. The bulls will sell out of longs and the bears will sell into shorts. Consequently, there is usually at least a small 2nd leg down within a week.

Since today was a sell climax, there is a 75% chance of at least a couple hours of sideways to up trading tomorrow that starts by the end of the 2nd hour. There is only a 25% chance of another strong bear trend day. The Emini will probably hover around the open of the month for the remainder of the month.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hey Peter – Al is likely talking about the daily chart. The bears need a breakout and follow through bar (two consecutive closes) below the 3/1 double bottom bull flag.

If you look at the weekly chart the bears need a breakout with follow through below the week of 3/2 and would need to fill the gap from jan 12. Otherwise it is a possible measuring gap projecting prices to a new high around 1.27.

As of now prices are in a bull flag trading range. If the bears fail to breakout below, the bulls will try for (and likely get) a breakout above to the measured move target. At that point it could become a final flag reversal on the daily and weekly charts (and second leg up / low 2 on monthly).

Hope this helps,

Josh

Thank you very much, Josh !

Hi Al,

to start i would like to gratefully thank you for sharing your kniwledge and insights.

I have a question about your comments about the EUR USD.

You say :

“The bears need at least 2 closes at least 50 pips below the 1.2150 March 1 bottom of the range before traders will believe that there will be a 300 measured move down..”

In which time frame those two closes should ideally be ?

Thank you in advance

Kind regards

Peter

Josh is right. I was talking about the daily chart.

Thank you very much, Al !