Trump rally stalling at Dow 20,000

Updated 6:51 a.m.

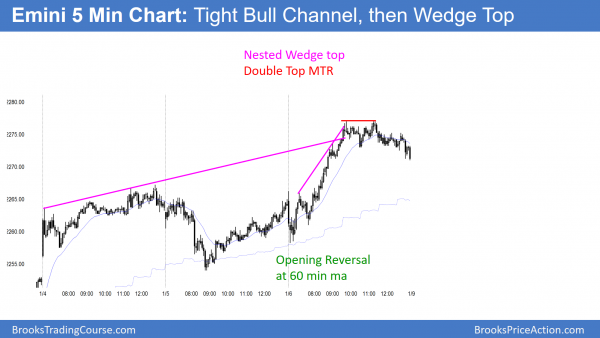

The Emini reversed down from above yesterday’s high on the open. Yet, it then reversed up from the 60 minute moving average. The bars are big and limit order bulls and bears made money. In addition, it is in the trading range of 2 days ago.

The consecutive bear bars made the Emini Always In Short. The opening reversal up from the moving average was not strong enough to make the Emini Always In Long. This is a trading range open and it increases the odds that today will be another trading range day.

Yesterday was a small enough day so that today could be an outside down day. Yet, the bears would need to break below the 60 minute moving average. Even if they succeed, the odds are against a strong trend day. Big bars and big reversals within the tight 3 day range make a trading range day likely.

If the bulls can stop the selling, they will then try to get above yesterday’s high again. At the moment, Dow 20,000 is probably not within reach today. As a result, the bulls might not exert themselves too much. Therefore the upside is probably limited.

Pre-Open Market Analysis

Yesterday was another trading range day. Yet, the daily and weekly charts are in bull trends. In addition, there is a strong magnet of Dow 20,000 just above. While the odds favor a breakout above Dow 20,000, they also favor a test below the August trading range high of 2179.25. The Emini is deciding which will come first. Because the Dow is so close to 20,000, the odds are that the market will rally and then pullback.

Yet, last week was a bear bar. It therefore is a bad buy signal bar for a High 1 bull flag. As a result, there are probably more sellers than buyers above its high. The bull breakout would therefore probably fail within a few bars. Since this is a weekly chart, that means a few weeks.

Most days will probably continue to be trading range days until there is a breakout. Yet, the daily ranges have been big enough for swing trading.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex session. Dow 20,000 is within reach today. Yet, the Emini is at the top of a month-long trading range. While the bulls might get a breakout to a new Emini all-time high today, the odds are against much higher prices without a pullback first. In addition, most days have been trading range days over the past month. Therefore, today will also probably be a trading range day.

Because today is a Friday, weekly support and resistance can be magnets. They are especially relevant in the final hour. The most important targets are last week’s high, the all-time high of 3 week’s ago, and this week’s open. If the Emini closes around here today, it will be a buy signal bar for next week.

EURUSD Forex Market Trading Strategies

If the weekly EURUSD Forex chart closes today around its current price, it will create a buy signal for next week. S

The EURUSD daily chart reversed up strongly yesterday. Because this is coming after a wedge bottom, the odds favor at least a couple legs up. In addition, it is a reversal up from the bottom of a 1 year trading range. This therefore is another reason for follow-through buying. The 1st targets are the major lower high of the 2 month bear trend. The 1st is the December 8 high of 1.0870.

The next is the November 8 lower high around 1.1300. Yet, the EURUSD is more likely to enter a trading range for at least a couple of months before reaching that higher target, if it will get there.

The bears want the 3 day rally to be a bear flag. While they might be right, the rally is strong enough so that sideways is more likely than down. Hence, the 1st reversal down on the 60 and 240 minute charts will probably be a bull flag, not a resumption of the bear trend.

Overnight EURUSD Forex trading

If today closes near the high of the week, week will be a buy signal bar for next week. There would be a Lower Low Major Trend Reversal. In addition, there is a small wedge bottom. Furthermore, it would be a micro double bottom. Because only 40% of major reversal setups lead to swing trades, it is more likely that the chart will be mostly sideways or down over the next several weeks. However, it is a good buy setup for TBTL Ten Bars, Two Legs up. That is about a couple of months.

Since this is not how strong bear breakouts typically behave, the bears will probably need at least a few weeks to create a better bear flag. As a result, the near-term risk to the downside is small.

This strong 2 day reversal is still below last week’s minor lower high. The bulls need to get above lower highs before the bears will give up. The bears see this 2 day rally as a bear flag and a bull trap. Yet, they should not have allowed it to be this strong. The odds favor a rally above at least last week’s minor lower high.

Because most reversals lead to trading ranges and not opposite trends, the odds are that the bulls will be disappointed by today’s price action. Yet the odds still favor at least sideways to up for another couple of weeks.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied strongly in a parabolic wedge and then entered a trading range at the end of the day.

While the Emini rallied strongly, the Dow was unable to get above 20,000. It came within 1 penny. It is close enough so that it might gap above it on Monday. The bears want a double top major trend reversal on the Emini daily chart. However, they will probably need a good bear sell signal bar on Monday or Tuesday. They then would need a strong reversal down. The odds still favor a move above Dow 20,000 soon.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Thank You Al for the commentary . Since you expected the probability Eur/USD going to sideways higher than bull reverse . It’s Buy Low Sell higher, proper approaches to use it for the coming weeks for 4 hours and 1 hour chart if EUR/USD didn’t reverse up strongly .

Thank You.