Trump rally above Dow 20,000 big round number

Updated 6:50 a.m.

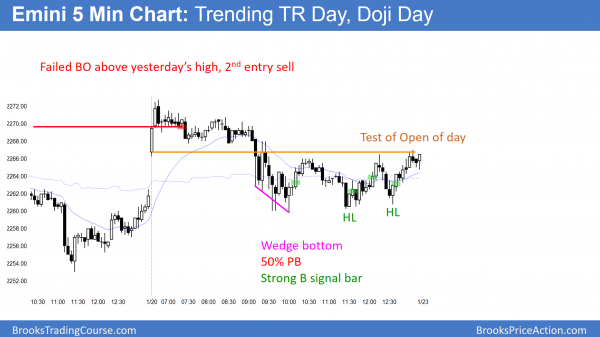

The Emini gapped up and formed 2 good bull bars. It was therefore Always In Long on the open. Yet, it is at the top of the 3 week tight trading range. This is therefore a test. The bulls want an early low of the day and a break above the resistance. The bears want a sell vacuum test of resistance, and an Opening Reversal down.

While the bears reversed down on the 3rd bar, the odds are that there will be a 2nd leg up. The bears need a series of strong bear bars and a break below the day’s low.

The bulls know that the selloff could easily continue to below the low of the day. They will buy a reversal up from around the moving average, whether or not there is a new low. The Emini is Always In Long, but it might pull back deeply before continuing up.

Pre-Open Market Analysis

The Emini formed an outside down day yesterday. Furthermore, it closed near the daily moving average. The bulls have allowed only 1 close at or below the moving average prior to yesterday in the past 40 days. This was therefore a sign of strength for the bears.

Because the momentum up on the daily chart is strong, the odds still favor a test above Dow 20,000 before a test of the August high. Yet, one or two big bear bars will make traders conclude that the Emini has begun a 5% correction down to close the gap above the August high.

Because today is a Friday, weekly support and resistance are important magnets. Since the Emini is in a tight trading range, the targets are last week’s high and low, and this week’s open.

Overnight Emini Globex Trading

The Emini is up 5 points in the Globex session after yesterday’s reversal. Yet, it is still in the middle of its 6 week trading range. Hence, it is still in breakout mode. It is therefore deciding between a new high and a test of the August high.

Because the Emini has closed below the daily moving average only once in the past 60 days, a bull breakout is slightly more likely. However, the tight trading range tells traders that the Emini is balance. Thus, the odds for the bulls are only slightly better than for the bears.

The breakout might come today once Trump begins to unveil his plans. Yet traders might wait for news over the weekend. Hence, Monday might gap up or down and start the breakout.

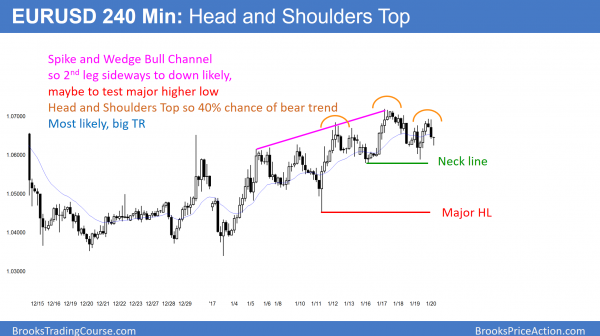

EURUSD Forex Market Trading Strategies

The 240 minute EURUSD chart is sideways after a wedge rally. The odds favor a 2nd leg sideways to down. Therefore, the EURUSD will probably test the major higher low. All reversals have a 40% chance of an opposite trend. Hence, a big trading range is more likely.

The rally on the 240 minute EURUSD chart had 3 pushes up. It therefore formed a wedge top. Hence, the odds are that it will soon work lower for several days to test higher lows in the 3 week rally.

The 3 week rally on the daily chart has not been strong. Yet, the momentum up on the 240 minute chart has been strong to create at least one more new high. Nevertheless, the odds favor a pullback over the next several days whether or not there is one more small new high first.

Overnight EURUSD Forex trading

The EURUSD Forex market has gone sideways into Trump’s inauguration. Hence, there are bull and bear patterns. On the 240 minute chart, the bears see a Head and Shoulders top. That always also forms a Double Bottom Bull Flag. Since most reversals do not reverse, the odds are that the trading range will simply get bigger.

Because a top is a trading range, the market is in breakout mode. Thus, traders expect a measured move up or down.

While the EURUSD sold off for the past 4 hours, bulls see it as a 50% pullback from yesterday’s rally. It has gone sideways for 4 hours. Hence, it is waiting to see what Trump will do during his 1st day. The odds therefore favor a trading range today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed down from above yesterday’s high. It then reversed up from the 60 minute moving average and a 50% pullback. It was a trending trading range day that closed at the open. It therefore was a doji day.

Today again closed above the daily moving average. The odds still favor a breakout to a new high before a pullback to the August high. With the uncertainty with President Trump, the Emini could have big moves and big reversals over the next few months. Hence, Monday could gap up or down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

“The Emini gapped up and formed 2 good bull bars. It was therefore Always In Long on the open” Al, The emini did have a “gap up” open, Does your statement above imply that even though there is a “bull gap” you don’t automatically consider the market “always in long” ? You don’t assume it’s long just from the bull gap ? You still need to see bull trend bars before you feel it’s “long” ? thanks, Steve

Yes

In general, a gap up has at least a 40% chance of a reversal down within the 1st few bars. Most traders do not have an opinion until they see the close of the 1st bar or two. For example, if there is a big gap up above yesterday’s high, but the 1st bar is a big bear reversal bar closing on its low, traders will not believe that the market is long.

In this particular case, the 1st bar was a big bull trend bar that closed on its high. The odds were that the mkt would go at least a little higher. Therefore, traders saw the market as Always In Long after the close of the 1st bar. Yet, the 3rd was was a big enough bear bar to create a Big Up, Big Down breakout mode situation, which means that the Emini had become neutral.