Trading range before Wednesday’s September FOMC announcement

Updated 6:55 a.m.

While the Emini gapped above Friday’s high and began with consecutive bull bars, limit order bears made money. This therefore reduces the chances of a strong bull trend day.

The Emini is Always In Long, yet the rally has not been strong. While it might still break above the 7 day tight trading range today, the odds are against a strong bull trend day unless the bulls can create consecutive big bull bars closing on their highs. More likely, this initial weak rally is a bull leg in what will be a trading range day. Therefore, the odds are that there will also be a swing down, or at least a couple hours of sideways trading.

The bears need a strong reversal down if they are to get a bear trend day. At the moment, this is unlikely, and the best they probably will get over the next 2 hours is a trading range.

Pre-Open Market Analysis

The Emini has been in a tight trading range on the daily chart for 6 days. It is therefore in Breakout Mode going into next week’s FOMC meeting. Traders don’t care if the Fed raises rates. All they care about is that Wednesday’s FOMC meeting is a catalyst for a breakout up or down. They will therefore trade in the direction of the breakout if it is strong. Yet, they will be quick to trade in the opposite direction if it reverses.

Overnight Globex trading

The Emini is up 10 points in the Globex market. It will therefore probably gap up on the open. Hence, the bulls would see this as the end of the September selloff. Yet, the Emini is still within its 7 day trading range and below the moving average on the daily chart.

Because the bear breakout 2 weeks ago was so strong and the Emini has been unable to get back above the high of the sell climax, the odds still favor a 2nd leg down. The Emini is trying to get neutral before Wednesday’s FOMC announcement. No one knows exactly where the institutional bulls and bears are balanced. Wherever the Emini is just before the announcement is the balance area.

The Emini reversed up from a Double Bottom Higher Low Major Trend Reversal on the 5 and 60 minute charts last week. That rally is still underway. But, because the Emini is near the top of the 7 day trading range, it is at a resistance level. The bulls want a break above the tight trading range and a rally to a new high. The bears want this rally to fail and lead to a 2nd leg down. The momentum favors the bulls, but the probability still favors the bears.

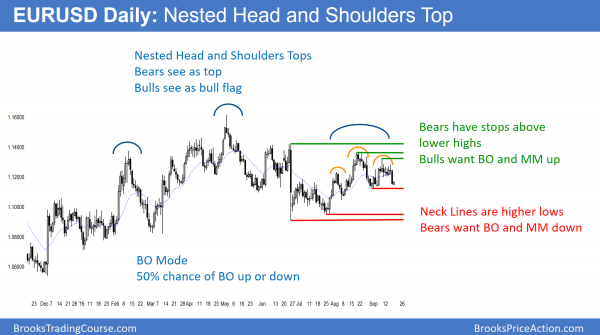

Forex: Best trading strategies

The EURUSD daily Forex chart has nested Head and Shoulders Tops (Lower High Major Trend Reversals). This is a Breakout Mode candlestick pattern. Hence, there is a 50% chance of a bear breakout and Measured Move down. There is also a 50% chance of a breakout above the lower highs. That would therefore hit the stops of the bears. The bulls would then look for a Measured Move up.

The EURUSD had a strong bear breakout on Friday. The bears need a break below the August 31 neck line of the Head and Shoulders Top. Because most breakouts fail, the bulls need a strong breakout. They also want immediate follow-through selling. Therefore, if today is a big bear trend bar closing on its low, there would be a 60% chance of a some kind of measured move down.

The bears have nested head and shoulders tops on the 60 minute and daily charts. This increases the chances of a swing down. Yet, many traders will be hesitant to hold because of Wednesday’s FOMC meeting. As a result, even if there is good follow-through selling today, the EURUSD will probably go sideways on Tuesday and before the announcement on Wednesday.

Trading range so probably disappointing follow-through selling

Because the EURUSD daily chart is in a trading range, bulls and bears expect disappointment. As a result, the odds are that today will not be a strong bear trend day. Yet, traders will be ready to swing trade their shorts if it is.

Since Friday was so strongly bearish, the best the bulls probably can expect today is a bull leg in a trading range. Therefore the odds are against a strong bull trend day.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

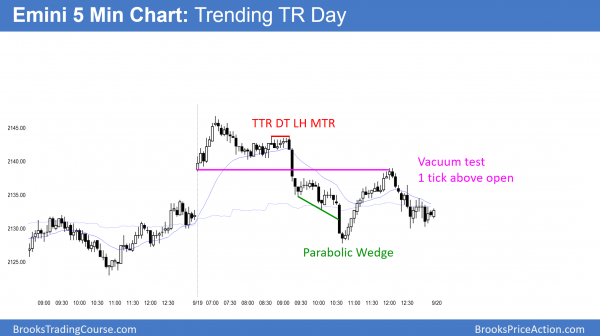

The Emini had a weak rally to the daily moving average. After a Tight Trading Range Double Top Lower High Major Trend Reversal, it reversed up from below the 60 minute moving average. The bottom was a parabolic wedge. Today was a Trending Trading Range Day.

Today was the 7th day in a tight trading range below the moving average. Tomorrow will probably be mostly sideways going into the Wednesday 11 a.m. PST FOMC announcement. Whether or not the Fed raises rates, the odds favor lower prices on the daily chart over the next week or two. Furthermore, because the weekly chart is bullish, the Emini will probably then have at least one more new high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al

Today was one of the day’s when there has been a wait for a MTR set-up for a test of the high after a bearish MA cross-over. However market didn’t behave that way. The breakdown started from the MA tag, and there was no attempt for a test of the high. This is a situation we face often whether the reversal traces a V-type path and not a W-type. It would be very helpful if you share your thoughts on this.

Thanks

I did not see the choice as between a V and W bottom. Today was a trending trading range day. I don’t know if you were in the chat room, but at the low, I said that the market was going back up into the upper range. It was simply deciding whether the bottom was going to be a parabolic wedge (which it was), or a High 4 buy setup (the 4th leg down never came). The market often does something that can be described in several ways. Almost all V bottoms are actually not V bottoms, and are really something else. Some would call this a V bottom. I thought that it was a parabolic wedge.

Thanks for marking the best trades of the day on the EOD chart Al! Very helpful.

Thank you !