September stock market crash

Updated 6:43 a.m.

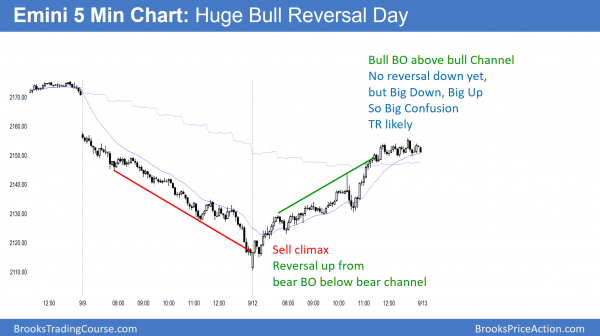

The Emini gapped below yesterday’s low, yet reversed up sharply. The odds are that the 2 hours of sideways to up trading has begun. While there is always a 50% chance of follow-through selling in the 1st 2 hours after a sell climax day, this reversal up was strong enough to create a Big Down, Big Up candlestick pattern. As a result, the best the bears will probably get over the next hour or so is a trading range. The Emini is Always In Long. Traders now will decide if the rally is the start of a bull trend day, or, more likely, a leg in a trading trading range

Pre-Open Market Analysis

The Emini had a big bear trend bar on Friday on the daily chart. It closed below the lows of about 40 bars. Furthermore, it closed on its low. These are signs of a strong bear breakout.

Yet, the bears need follow-through selling today. They would therefore like a big bear trend bar closing on its low. That would increase the chances of some kind of measured move down. In addition, it would increase the chances that the reversal will last more than a week or two. There is already about a 70% chance that the Emini will fall below the top of the 2 year trading range.

Sell climax

Friday was a sell climax day, and therefore there is a 50% chance of follow-through selling in the 1st 2 hours. Yet, there is only a 25% chance of a strong bear trend day. Furthermore, there is also a 75% chance of at least a couple of hours of sideways to up trading that begins by the end of the 2nd hour.

Emini Globex session

The Emini traded down and reversed up. Since Friday’s selloff will probably be a bull flag on the weekly chart, the odds are that there will not be strong follow-through selling today. Furthermore, the selling was strong enough so that there will probably not be a strong reversal up this week. As a result, the Emini will probably be confusing this week. Yet, the odds favor at least a little more down on the daily chart.

Forex: Best trading strategies

The 60 minute chart of the EURUSD Forex market is turning down from a Head and Shoulders Top (HST). Because most reversals fail, the pullback back up has been strong, and the bears reached their minimum goal of 2 legs down from the high, the odds are that the EURUSD will form a trading range. Whenever there is a reasonable argument for both the bulls and bears, as there is here, the odds are that the market is balanced and it will go sideways.

While the EURUSD has nested head and shoulders tops, a head and shoulders top is a trading range. Bulls see it as a triangle or some other type of bull flag. Only 40% of major bear reversals lead to bear trends. Because tops are usually trading ranges, it is more likely that the market continues sideways. It would therefore disappoint both the bulls and the bears. However, Friday’s selloff triggered the short. The bears need follow-through today. Yet, the odds still are against the conversion of the trading range into a bear trend on the 240 minute chart.

Stock market selloff

Friday’s big selloff in the US stock market did not have a significant effect on the EURUSD on Friday. If the stock market continues to selloff, it will affect all financial markets. Yet, it is impossible to know if the result will be a bull or bear trend. Traders should therefore simply trade what is in front of them.

Because the stock market selloff is probably just a bear leg in a bull flag on the weekly chart, Forex traders do not yet see it as significant.

EURUSD overnight Forex session

The EURUSD overnight traded mostly sideways and within Friday’s range. This is what most commonly happens as a reversal begins to form. Most reversals end up as continuation patterns, not opposite trends.

While there was a 50 pip selloff overnight, the EURUSD has been in a 20 pip range since. The selloff will probably end up as a sell vacuum test of the bottom of the 4 day range. Until there is a strong breakout of the range, Forex day traders will scalp, as they do on most days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up strongly today after Friday’s sell climax.

The Emini reversed most of Friday’s selling today. While it has had many similar reversals after strong bear breakouts over the past 2 years, most have evolved into trading ranges. With the FOMC meeting next week, the odds are that the bulls will be disappointed by a lack of follow-through buying tomorrow. I have said that bulls would buy the selloff. Yet, the selloff was very big, just like the reversal up. Big Down, Big Up creates Big Confusion. Confusion is a hallmark of a trading range. Hence, the odds are that the Emini will be sideways for the rest of the week.

While the bulls want strong follow-though buying tomorrow, today was a buy climax. That means that the bulls have only a 25% chance of a strong bull trend tomorrow. However, they have a 50% chance of some follow-through buying in the 1st 2 hours. Finally, there is a 50% chance of at least a couple of hours of sideways to down trading beginning by the end of the 2nd hour.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Wow, what a day. Big daily bull bar like this right after a big daily bear bar on Friday.

Made a nice OR long break out play on bars 10-13 and should of just gone into a coma and come back at 4PM!!

Instead I sat flat on a large profit until 48-49 where I got the wild idea to try a counter trend play. Then I was abruptly introduced to bars 50, 51 & 52.

Those took all my profit from 10-13 and I ended the day even money, generating some nice commissions for my Broker.

I’m taking that “free” lesson as: just completely forget about counter trend and shorts on any day with this much overall upward pressure.

Have a good evening,

Rob

I can relate to this a lot Rob! I too was looking for reversals all day and ended up not trusting my instincts and taking more longs. Even by bar 41 I was thinking, “Probably a fade the close bar, buy climax”. Then I saw 42, 43, 44 and I was thinking “FF Reversal”. Then by the bar 52 BO I was only up nine ticks and pretty negged out so ended out sitting the rest of the day…

My lesson yesterday was to not take preconceived ideas of what the market “should” do into the trading day, and just trade the chart in front of me.

Best of luck today!

Al, when you say that there is a 70% chance of a test of the TR high and BO point (seems obvious) yet only a 25% chance of another strong trend day like Friday, I’m assuming that you mean the chances are therefore that we get some kind of weaker trend day, like a trending trading range day? Or at least a TR day with a close below the open?

There is 70% chance of a dip below the top of the 2 year TR in the next week or two, maybe after next week’s FOMC report.

Friday was a sell climax. There is a 75% chance of at least 2 hours of sideways to up trading that begins by the end of the 2nd hour. I am writing at 7:02. This has probably already begun. There is only a 25% chance of a strong bear trend day. Right now, there is about a 25% chance of a strong bull trend day. While the open has been bullish, a trading range soon is more likely than a relentless bull trend.