President Trump Christmas rally Emini bull flag

Updated 6:50 a.m.

While the Emini gapped up and had 4 bull bars, the gap was small and 3 bars were dojis. Furthermore, this is at the top of a 5 day trading range. The bulls want a strong breakout to a new all-time high. Yet, this rally lacks consecutive big bull bars. It therefore lacks urgency. Hence, it is a sign that the bulls are not eagerly buying high prices yet. The odds are that this rally is not the start of a strong bull trend.

While today might still be a bull trend day, it will probably not be a strong bull trend. Furthermore, yesterday was small. The bears therefore want this early rally to fail. In addition, they want an early high of the day and a selloff to below yesterday’s low. Whether or not that happens, the odds are that the Emini will have at least 2 hours of sideways to down trading because of this weak rally within a trading range.

Pre-Open Market Analysis

The Emini yesterday broke above the bear trend line of the 3 day bull flag. Yet, it failed to break above last week’s lower highs. As a result, it is still within the trading range. Furthermore, the odds favor a bull breakout. This is because the bull flag on the daily chart is only 4 days and the rally was strong.

The bears will probably need at least a micro double top before they can reverse the trend. They therefore will probably need at least a test of the all-time high. Less likely, if they create a series of strong bear bars, traders will conclude that the bull trend has ended. Yet, even if the bears take control the selloff would more likely create a trading range than a bear trend.

Overnight Emini Globex trading

The Emini is up 6 points and it might gap up today. Yet, it is still within its 5 day bull flag. The odds are that it will test last week’s all-time high. A rally today might be the start of that test. Because it is still within a trading range, the bulls need a strong breakout above the range. Otherwise, the rally will be just another leg in the trading range, which would delay the breakout.

Since a reversal down from around last week’s high could create a micro double top, a reversal down could last a couple of weeks. This is because the daily chart is so overbought. Many bulls will want to reduce position sizes because the stop is far below. In addition, they might want to take some profits before the end of the year. Finally, there is a big gap above the August high. Since big gaps late in trends usually fill, the odds are that the Emini will test the August high at some point in the next few months.

EURUSD Forex Market Trading Strategies

While the daily chart has nested 3rd pushes down, there is no bottom yet and there is room to the bottom of the wedge channels.

The EURUSD bounced up from the bottom of the 3 day trading range. Yet, yesterday’s rally was weak. It was therefore more likely a bull leg in the range or the start of a small bear flag than the start of a bull trend.

Because the selloff over the past 6 week’s has been strong, the odds still favor lower prices. Yet, the bear legs on the daily chart have been big. Therefore, the stop for the bears is 200 – 400 pips above, which makes bears hesitant to sell at the low. Hence, many will wait for a bounce into a bear flag before selling.

Furthermore, the EURUSD is at the bottom of its 2 year range and has not yet broken strongly below. In addition, the follow-through selling after big bear days has been bad. As a result of all of these mixed forces, the odds favor a trading range soon. Because there have been 2 pushes down from the December 8 lower high and the selloff was strong, the bears might get one more push down before a trading range begins.

The bulls will probably need at least 2 weeks of sideways trading before they can reverse the bear trend. Without that, the odds favor lower prices. Currency markets sometimes have big reversals at the start of the year.

Overnight EURUSD Forex trading

The EURUSD 60 minute chart continued lower last night and fell below last week’s low. The bulls are therefore hoping for a lower low major trend reversal. Yet, on the daily chart, there is room to the bottom of the wedge channels, a measured move target, and par (1.0000). Because all support is a magnet, the odds favor lower prices.

Since the 2 day selloff had bad follow-through after every big bear bar, the 60 minute chart might enter another small trading range. In the absence of a strong reversal up, the odds are that it will create another bear flag.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

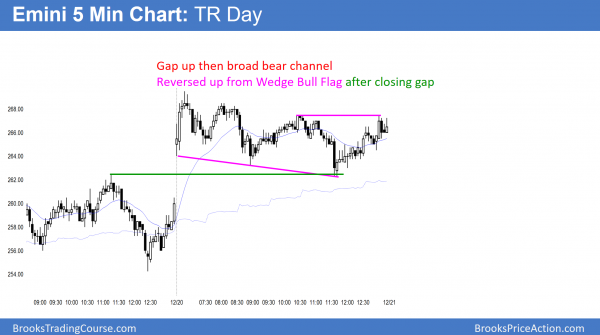

The Emini had a weak rally on the open. Yet, it formed and early high and traded down in a broad, almost flat bear channel. After closing the gap, it rallied from a wedge bear flag, but failed at the last lower high. It was a small trading range day.

The Emini formed another small trading range day today. The odds are that the range will be small until January. Furthermore, most days will probably have mostly trading range trading.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hey AL,

Hope all is well and Merry X-mas. In regard to using the continuous chart for trading. I notice there may be an advantage to using it. Is that you take on using continuous charts? Being able to visualize a gap on the open…opens up a whole new perspective. Is that what you visualize and is it something you use all the time for order placement?

Thank you for the advice- Richard

Everything has advantages and disadvantages. I personally prefer day session, continuous chart because I believe that offer the most reliable trading for my style of trading.

Hi Al,

I thought there was a gap between 55 and 57. Since every other gap closed today, I expected the 62 BOF to go back and fill it, which it did.

Would you think this was too trivial and was just a fluke?

(The other supporting argument was that 62, 63 MDB was in some ways Bear BO of a Bear Ch and thought it might test the other end of the ch).

Thanks and I appreciate all your work.

Although the logic is good, in a small trading range day, that is not how I think. I just assume that almost every limit order trade will be profitable if managed correctly. While the 55 low was not a great buy, it was not unreasonable. I believe that is the main reason why the reversal up from 62 got there. Scale in bulls made money.