Post debate stock market breakout

Updated 6:45 a.m.

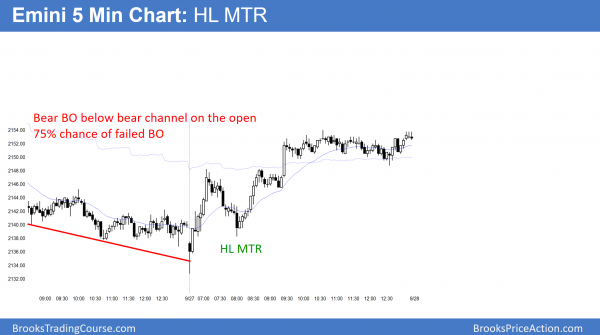

The Emini reversed up sharply from a bear breakout below a bear channel and from below yesterday’s low. It is back at the August 2 trading range low and the apex of the 5 day triangle. This is a sharp opening reversal at support. There is a 30% chance that this is the low of the day. The Emini is Always In Long.

While this rally might be a bull trap and it might be putting in an early high of the day, it is more likely the start of a bull trend day or a bull leg in a trading range day.

Yesterday failed at the moving average all day. The bulls need closes far above the moving average if they are to create a bull trend. Without that, the odds of a bull leg in a trading range go up.

Pre-Open Market Analysis

The Emini gapped down yesterday and it therefore created a 2 day island top on the daily chart. That top is also a lower high major trend reversal. Yesterday was also a bear trend day. Yet, after a 9 day bull micro channel, the odds are that the bears will need at least a micro double top or a big bear breakout to convince traders that this is the start of a swing down. Since the price action lacks high probability for the bulls or bears, the odds favor a trading range.

The Emini has been mostly in a trading range for 2 years, despite the small breakout in July. Gaps and island tops and bottoms are fairly common in trading ranges, and therefore have little predictive value. Yesterday’s island top is no more important than the 3 week island bottom that preceded it. The Emini is still in breakout mode.

Buy climax on the monthly chart

Friday is the final day of the month. The Emini already has had 7 consecutive bull trend bars on the monthly chart. Since that is rare, it is climactic. If Friday closes above the September open, September would become the 8th consecutive bull trend bar. That has never happened since the Emini began the 18 years ago.

There have been several time when the Emini had 7 consecutive bull trend bars. Each instance led to about a 100 point correction before the rally continued much higher. The odds therefore are that the Emini will have a 100 point pullback in October or November.

Emini Globex session

While the Emini rallied strongly after the debate, it has retraced about 50% of the rally. It has been sideways for several hours at this support level, which is only 2 points above yesterday’s close. Big up, Big Down means Big Confusion. The trading range will probably continue on the open.

Traders are still deciding if the weekly chart will have one more leg up before a correction. Most noteworthy is their decision about the monthly close on Friday, and there are still 4 trading days left before we find out.

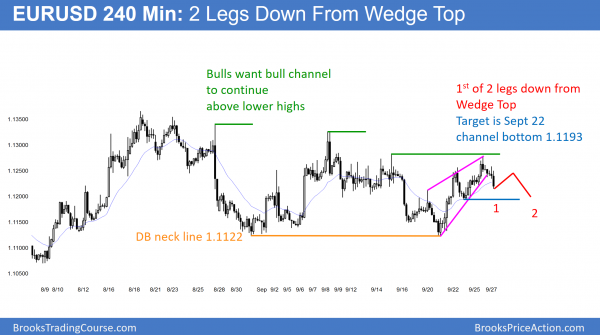

Forex: Best trading strategies

The 240 minute EURUSD chart turned down from a wedge top in a trading range. The 1st target is the September 22 higher low of 1.1193, which is the bottom of the channel.

The 240 minute EURUSD Forex chart completed a 2nd leg up after a double bottom. Yet, it is still at the apex of a 2 year nested trading range. It is in breakout mode.

The bears want yesterday’s reversal down from a wedge rally to lead to 2 legs down. The bulls want a resumption of the 4 day rally and then a breakout above recent lower highs. Because of the trading range price action, the odds favor more trading range price action. Therefore, probably neither the bulls nor the bears will like the follow-through from any breakout.

Since the bears have a wedge rally in a trading range, and most breakouts fail, they have slight advantage over the next couple of days. Yet the big picture still is that the daily chart still is in breakout mode.

Overnight EURUSD Forex sessions

The EURUSD sold off overnight after the debate. Because the selloff was from a wedge top, it will probably have at least 2 legs down. Hence, bears will sell the 1st rally.

One of the 1st targets always is the last higher low in the rally. Hence, the bears expect a test of the September 22 low of 1.1193. The rally was also a Spike and Channel bull trend. Traders therefore expect a test of the bottom of the channel, which is the same price. The overnight selloff is strong enough to that the selloff will probably fall below this target. Furthermore, it might do so on the 1st leg down. However, the odds are that the bears will take partial profits at this support. Therefore, there will probably be a bounce there,

While the bulls might continue the bull channel indefinitely, the odds are that the EURUSD is now in the 1st of 2 legs sideways to down. The momentum down on the 5 minute chart over the past hour has been strong. Therefore, traders will sell a rally to the moving average. Hence the best the bears can probably get over the next couple of hours is a trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up sharply from below yesterday’s low and formed an outside up day.

While the bull reversal today was strong, it came after a 3 day tight bear channel. This means that the Emini will probably test down before going much higher. The key price is still the September open, which is about 10 points above today’s high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al regarding H2 34, I am still having difficulties to understand, why everybody was so keen to buy bar 34 close.

Rather than exposing yourself to scaling in and further SL, doesn`t it make more sense from point of managing position to buy once market started

breaking above?

Also, when price went only 4 tics below 32 and did not let bears to take 1 point profit and bulls could not buy low of TR, do you believe bulls made

perfect setup for stronger BO as bulls were chasing it and bears adding fuel and being trapped?

I don’t know if you were in the trading room, but I talked about consecutive buy climaxes and that there was a 40% chance of a big move up from the 34 close, and a 40% chance of a reversal down. Either could come after a protracted TR.

Over the next few bars, there was a 60% chance of at least one more small push up. The highest probability trade was to buy the close or the low of 35, which was a weak sell signal bar.

Buying above the 40 small double bottom was also reasonable, but most scalpers want the highest probability, and that was the limit order buy at the 35 low.

I agree with you about the trapped bears increasing the probability of the stop entry buy.

Hi Al,

I couldn’t convince myself to take the H2 at MA (bar 35) as it I thought it was near top of TR. Of course, it turned out to be a great missed trade.

Wondering what’s your thought on the probability when the signal formed?

Thanks.

I thought there was about a 50% chance of a deeper PB, but a 70% chance that any deeper PB would form a higher low and be profitable for the bulls. The bulls needed a wide stop to increase the probability. They pay for it with more risk (wide stop).

Al,

Today was a good Leg 1 = leg 2 measured move trade (starting at 2132 … with PB at around 2140… which eventually went to 2152), but I did not capture the entire move. I got in at the PB 2140… and out at 2148, which was a double top (DT at 10:05 EST…2148 and 2148 at 11:40). The MM started at 2132… with 2152/54 being the distance. So my thoughts were hindered by the previous days of breakout failures. Is there any advise as to how you handle that trade and what would have made you stay in that MM trade?

Thank you for your insight- Richard

I think it is a personality thing. I tend to scalp more and look to re-enter. I have friends who just stay long until it is clearly not long. I think that is better for most traders. However, it takes time to believe that this suits your personality. One choice always is to trade very small, put in a bracket order, go to the grocery store, and come back in an hour or two. I traded with a very good trader for years who disappeared every day for 2 hours while his orders were resting in the mkt.