Possible Emini island top and exhaustion gap

Updated 6:42 a.m.

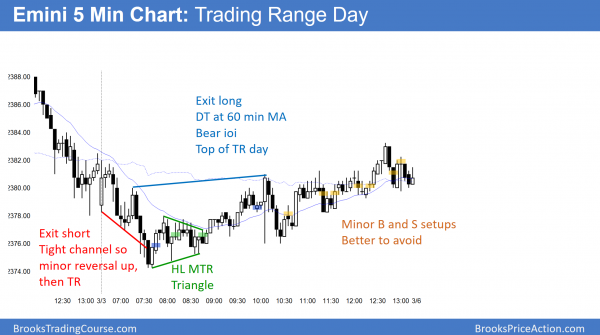

Because the bears failed to get a gap down, the odds are that today will not be a big bear trend day. As strong as the 2 day selloff has been, it is only a 50% pullback to the 60 minute moving average. Yet, the selloff was big enough to make bulls hesitant. Therefore, the Emini will probably not rally strongly all day. Hence, both the bulls and bears have problems. As a result, today will probably be a trading range day.

The Emini is trying to rally up from yesterday’s low, but the first few bars have prominent tails. Furthermore, they are in the tight trading range at the end of yesterday.

While today is probably going to be a trading range day, traders are deciding where the bottom will be. The odds favor a trading range open, and an eventual rally to test the 2388 lower high from yesterday.

Pre-Open market analysis

The Emini sold off yesterday and therefore reversed all of Wednesday’s rally. Yet, the selloff held above the 60 minute moving average and Wednesday’s low until the close. There is still a 70% chance of a test of last year’s close at some point this year. In addition, there is a 60% chance within the next couple of month’s. Yet, because most reversals fail, it is too early to conclude that this is the top.

Possible island top

If tomorrow gaps down, it would create an island top. The recent gaps will probably all close. Wednesday’s gap was big and led to a buy climax. In addition, the climax was at the resistance of the 2400 big round number. Furthermore, it was in a cluster of measured move targets. A big gap down tomorrow followed by a big bear trend day would increase the chances that the 5% correction has begun.

Weekly support and resistance

If the Emini sells off about 20 points tomorrow, then the weekly chart would have a bear reversal bar. Because it would be after a buy climax and at resistance, the odds of the 5% correction would be higher. If there is a strong selloff, traders need to be aware that the context is good for a 5% correction. They therefore have to be ready to swing trade their shorts.

Because the bulls obviously want follow-through buying, they will try to reverse this 2 day selloff. Hence, they want another strong bull bar on the weekly chart.

Overnight Emini Globex trading

While the selling continue overnight, the Emini is reversed up to near the top of the Globex range. Because it is still down 3 points, today might gap down. Yet, if it does, the gap will be small. Therefore traders will doubt the strength of the bears. In addition, they will see the 2 day selloff as probably just a bull flag in the month-long bull trend.

The past 2 days were a Big Up, Big Down pattern. Hence, traders are confused. When traders are uncertain, they tend to take quick profits. This is because they doubt swings up or down will go far. As a result, the Emini usually enters at least a small trading range. Hence, today will probably be a small trading range day.

On the other hand, if today has a gap down open and the Emini sells off from there, traders will begin to thing that the reversal down to the December 30 close has begun.

EURUSD Forex market trading strategies

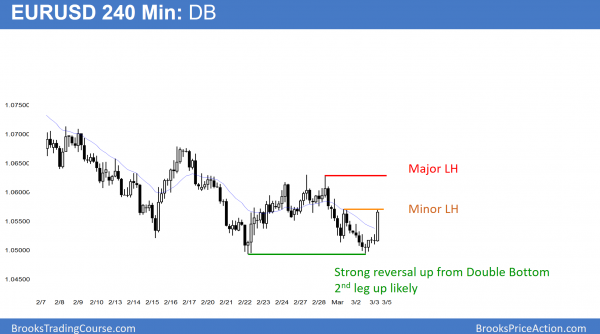

The EURUSD 240 minute Forex chart reversed up from 1 pip above the February 22 low. Hence, this is a double bottom. However, the bears want a double top bear flag with last week’s minor lower high. Yet, the buying is strong enough so that bulls will buy the 1st reversal down.

The EURUSD Forex market has been sideways for 3 weeks. Yet, there is major support 40 pips below at the January 11 low. That support is close enough to make traders think that the 4 week selloff has to test to within 10 pips. Yet, the bulls have been able to halt the selling for 10 days. A reversal up from here would be the 3rd reversal up. If the reversal is strong enough, traders will believe that the rally back to the top of the 5 month trading range has begun.

The bears want a strong break below the January 11 higher low. If they succeed, they then want a break below last year’s low, hoping for a test of par.

Head and Shoulders Bottom on daily chart

Traders see the daily chart as having a head and shoulders bottom. Bulls need a strong reversal up. While 60% of major trend reversals do not lead to major reversals, they often go far enough up for swing traders to make a good profit. The target for the bulls is the top of the 5 month trading range, which is the neck line of the 5 month head and shoulders bottom.

If the bulls break strongly above the neck line, the next resistance is the 1.1500 top of the year long trading range.

The bears always want the opposite. They therefore want the higher low to fail. In addition, they want the selloff to break strongly below the January low. In addition, they then want a break below par (1.0000). Since trading ranges resist change, the odds are that the year long trading range will continue. It is therefore likely to continue to disappoint both bulls and bears.

Overnight EURUSD Forex trading

The EURUSD Forex market reversed up for the 3rd time from around 1.0500 last night. In addition, the reversal was strong enough to make traders buy the 1st reversal back down. Hence, this is a credible double bottom with last week’s low on the 240 minute chart.

Furthermore, if the rally goes above the 1.00630 high from last week, that would be a break above the neck line of the double bottom. Hence, traders will look to see if the rally could break above the February 16 1.0679 major lower high.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a trading range day.

The Emini closed near the midpoint of the week. It is therefore becoming neutral. This was the 9th consecutive bull trend bar on the weekly chart, which is rare. Next week will therefore probably have a bear body.

A gap down any day next week would create an island top. That therefore would increase the chances that the pullback to the December close has begun.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.