New S&P500 all time high, but Nasdaq divergence

Updated 6:49 a.m.

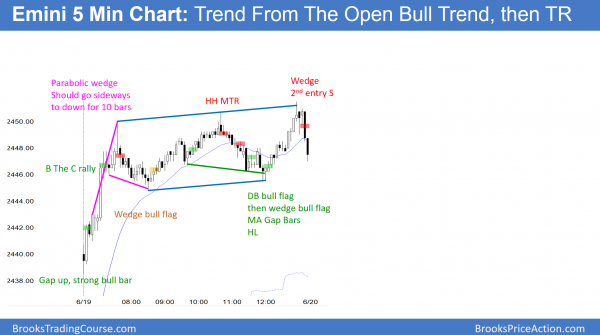

Yesterday was a spike and wedge channel bull trend. The odds favor a trading range. Furthermore, the odds favor disappointing follow-through for the bulls. Hence, today will probably close below its open and form a bear bar on the daily chart.

Since today is opening in the middle of yesterday’s range, there is an increased chance of an inside day. If there is a break above or below yesterday’s range, the odds are that the break will not go far. Instead, today will probably overlap much of yesterday’s range.

At the moment, the Emini is Always In Short, but at the bottom of yesterday’s wedge bull channel. Since most channels evolve into trading ranges, the odds are that the Emini will bounce soon. If instead it sells off, there will probably be buyers at the 60 minute moving average and yesterday’s low. If it rallies, there will probably be sellers near yesterday’s high.

Unless there is a strong breakout out of yesterday’s range, the odds favor a trading range day. That means there will probably be at least one swing up and one down, and both will probably last at least 2 hours. The Emini is now deciding if the 1st swing will be up or down.

Pre-Open market analysis

The Emini broke to a new all-time high yesterday. Furthermore, all higher time frame charts are in strong bull trends. In addition, the bulls want to rally up to the 2,500 big round number.

Yet, it was a weak bull trend day. In addition, the odds are against a big breakout above the old high because of the extreme buy climax on the weekly chart.

The Emini tends to rally from June 26 to July 5. That means that it tends to be sideways to down for the week or so before June 26. While calendar trades are unreliable, even when they have a theoretically high probability, this slightly reduces the chances of a strong rally over the next week.

Because most breakouts fail, this further lessens the chances of a strong rally from here. Finally, the daily chart is trying to form a wedge higher high major trend reversal. The odds favor a 100 point pullback to the March 27 low at some point over the next few months.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex market. If it opens here, it will test the bottom of yesterday’s trading range. Furthermore, the daily chart has been in a tight trading range for 3 weeks. Therefore, bear scalpers will sell breakouts above the trading range high. In addition, because the weekly chart is so extremely overbought, bear swing traders will buy puts and put spreads at new highs.

Since yesterday was a trading range and most days over the past month have been trading ranges, the odds again favor another mostly trading range day.

Furthermore, yesterday was a bull trend bar that broke above the range. Because traders usually are disappointed when there is a trading range breakout, the odds favor either a doji bar or a bear bar on the daily chart today. If the bulls get a bull bar today, that would be follow-through buying. However, the odds would then favor a disappointment bar tomorrow.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday.

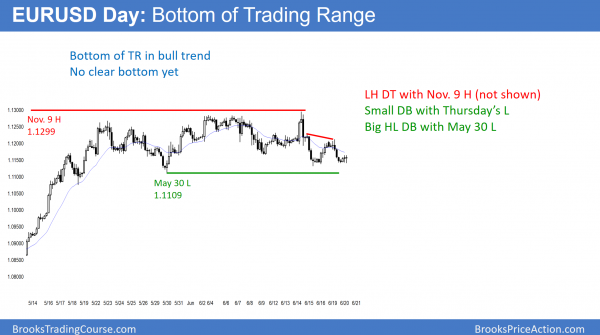

EURUSD Forex market trading strategies

The EURUSD 240 minute Forex chart is near the bottom of a trading range. Because the trend before the trading range was up, the odds slightly favor a bull breakout. Since there is no clear reversal up yet, the selloff might test below the bottom of the range before the bulls buy again.

The EURUSD Forex market has been in a trading range for 5 weeks. Since it is now near the bottom of the range, traders will begin looking to buy. Because trading ranges often breakout before reversing, the bears might get lower prices before the bulls buy again.

Furthermore, every trading range has both a bull and bear setup. The bears have a double top major trend reversal. Yet, only 40% of major reversal setups lead to major reversals.

The bulls have a double bottom bull flag. However, there is no clear bottom yet. In addition, the momentum down last week and yesterday was strong. Hence, the bears might get a breakout below the May 30 low before the bulls buy again for another test of the November 9 high.

The odds still favor a successful break above that high. If instead the bears break strongly below the 5 week range, they will then probably get a measured move down. As a result, the selloff then would likely test the 1.0900 top of the November to April trading range.

Overnight EURUSD Forex trading

The EURUSD Forex market has been in a 25 pip range for the past 20 hours. Day traders therefore will mostly scalp. Because the EURUSD is at major support, there is an increased chance of either a swing up or a bear breakout and a swing down. However, until there is a breakout, there is no breakout. In the meantime, day traders will therefore look for 10 pip scalps.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

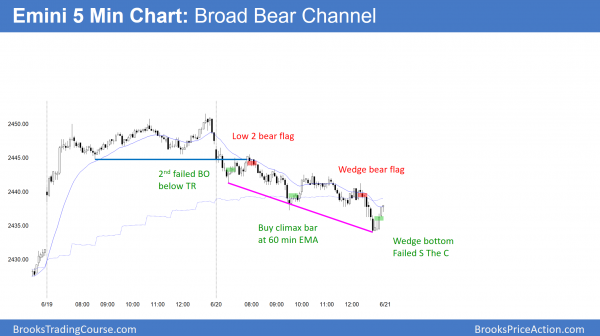

The Emini sold off in a broad bear channel. Furthermore, it reversed yesterday’s rally. It is a sell signal bar on the daily chart for tomorrow. However, it is also a pullback from yesterday’s rally. In addition, most tops in trends fail.

The Emini reversed yesterday’s rally. In addition, it is a signal bar for a failed breakout above the 3 week range. Furthermore, the 3 week range is now an expanding triangle top.

Since the weekly chart is so unusually overbought, a reversal down from here has a higher probability of leading to a swing down. Therefore traders will be watching for signs of a bear trend day tomorrow.

The bulls want today to be simply a pullback from yesterday’s new high. They know that most reversals fail. Hence, they see today as a high 1 bull flag. However, it is too big of a bear bar for traders to buy above its high. Therefore, a strong bull trend is unlikely tomorrow.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.