Market breakout after September FOMC interest rate hike announcement

Updated 6:49 a.m.

While the Emini gapped up and began with 2 bull bars, both had tails on top. The Emini is Always In Long, but at resistance. Neither bar was big, and they could not break above yesterday’s high or the daily moving average. Whenever there is confusion and disappointment, day traders expect trading range price action. They therefore expect breakout attempts to fail, and they use limit order entries more often.

The odds still favor at least one swing up or down before the report. The Emini is now deciding on the direction. The gap up favors the bulls. This stall at the top of the 9 day trading range favors the bears. When both have reasonable arguments, the Emini usually goes sideways. It might stay sideways for an hour or more before deciding whether to break above the range or reverse back down to the middle.

Traders are waiting for a strong breakout up or down. Despite the Limit Order Open, the odds favor at least one swing move. Yet, the odds of a big trend before the report are small.

Pre-Open Market Analysis

The momentum up on the weekly and monthly charts is strong. Hence, the odds are that there will be at least one more new high.

Yet, the reversal down 2 weeks ago was also strong. Furthermore, the Emini has been below its moving average. Therefore, the odds favor a 2nd leg down.

Most noteworthy is that the gap between this pullback and the July 2015 high is still open. The odds are it will close. There is a 60% chance that it will close before there is a new high. Because today could have a huge move after the 11 a.m. announcement, the gap might close today.

While the odds favor the gap closing before the new high, day traders are open to anything. Therefore, they will buy if the gap does not close and there is instead a huge rally. That rally could reach a new high.

Today’s FOMC announcement

The Fed releases its September FOMC interest rate hike decision today at 11 a.m. The daily chart has been in a tight trading range for 8 days. It is therefore neutral and in breakout mode.

Ignore the pundits on TV. They have no better than a 50% chance of being right when they predict what the market will do. traders usually should wait until at least 10 minutes after the report before trading. This is because there is a 50% chance that the 1st move will reverse. Since the move might be big, traders who enter in the first few minutes have a 50% chance of a big loss.

Once the initial swing begins, there is a 50% chance of a channel and a later reversal, and a 50% chance of a relentless trend. If there is a strong trend, the Emini could reach a new high above 2185.00 today. If there is a strong selloff, the Emini could reach its minimum downside target of 1 tick below the July 2015 high of 2084.50.

Emini Globex session

While the Emini traded below yesterday’s low after the Japan announcement last night, it immediately reversed back up. By trading below yesterday’s low, it triggered a Low 2 sell signal on the daily signal. Yet, the reversal back up leaves it in Breakout Mode going into today’s FOMC announcement.

Although the daily chart is still in a 9 day tight trading range, most days have had swings up and down. Hence, traders will look for swings during the 1st few hours today. However, the Emini usually enters a very tight range an hour or two before the report.

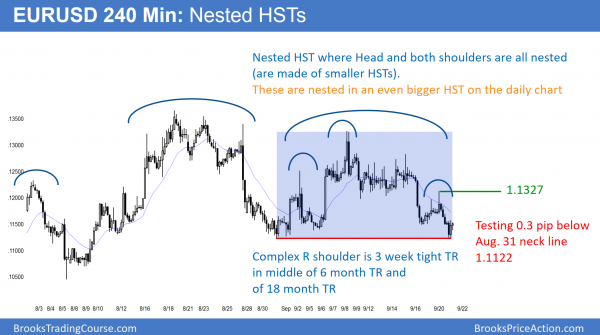

Forex: Best trading strategies

The 240 minute EURUSD Forex chart sold off after the Japan announcement last night, but reversed up from the exact bottom of the 3 week trading range. It is therefore still in breakout mode going into today’s FOMC announcement.

The EURUSD Forex market is in breakout mode going into today’s 11 a.m. PST FOMC announcement. It is in a 3 week trading range at the apex of a 6 month range, in the middle of an 18 month range. The 5 minute chart will probably be sideways going into the report, and day traders will probably mostly scalp with limit orders.

The direction of the breakout is independent of the report. The market believes the Fed will raise interest rates now of soon. What traders do not know is whether more money will buy or sell the EURUSD after the report.

Because the 1st breakout after the report fails more than 50% of the time, day traders should wait at least 10 minutes after the report before taking a trade. If there is a big breakout, there is a 50% chance of a trend into the end of the session. There is also a 50% chance that the trend will stall or reverse after an hour or so. Day traders should be open to anything, and they should try to swing trade.

Overnight EURUSD Forex sessions

While the EURUSD Forex market sold off after the Japan announcement last night, it reversed up and formed a double bottom with the August 31 low. It is still in the apex of nested trading ranges. Hence, it is still in breakout mode going into today’s FOMC report. It has been in a 20 pip range for 4 hours. Yet, day traders are ready for a breakout at 11 a.m. PST.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

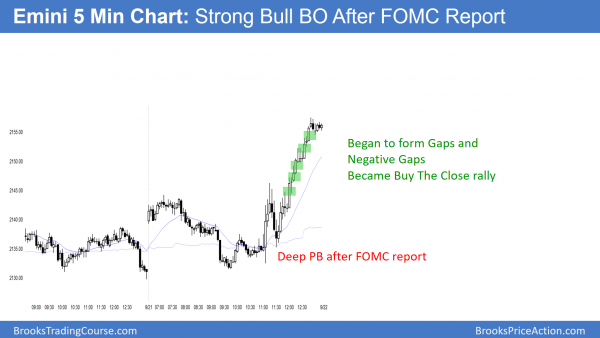

While the Emini pulled back deeply from its bull breakout on the FOMC report, it still closed at the high of the day. Once it began to form Negative Gaps and Gaps, it was in a strong Buy The Close rally.

Since the Emini bears were unable to get their bear breakout today, the odds now favor a new high. If tomorrow gaps up, it would create a 3 week island bottom. This therefore would increase the odds of a new high. Yet, the new high will probably not last long. The bull breakout will probably fail and the Emini will therefore then reverse down. As a result, the gap above the 2 year trading range will then close.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.