Learn how to trade an expanding triangle: Updated 7:01 a.m.

The Emini began with a Trend From The Open bull trend and rallied above last week’s high. Hence, it triggered a buy signal on the weekly chart. Because yesterday was climactic, the odds are that this initial rally will end after 5 – 10 bars. The Emini then typically enters a trading range, which can last for hours.

Because this early rally is strong, the bears will probably need at least a micro double top before they can reverse the trend. The 1st reversal down will probably be minor, which means a leg in a trading range. Bulls will buy it, knowing that the odds are that there would be at least one more push up. The bears can also reverse the trend with a huge bear bar or series of bear bars. However, that is less likely than a double top.

Will the day end as a bull trend day? It is too early to know. As I said, a trading range will probably begin by the end of the 1st hour. The Emini would then therefore be in breakout mode. Hence, there would be a 50% chance of trend resumption up and of trend reversal down later in the day.

Learn how to trade an expanding triangle

S&P 500 Emini: Pre-Open Market Analysis

The Emini reversed up strongly yesterday from an Expanding Triangle Bottom. About half of Expanding Triangle Bottoms lead to Expanding Triangle Tops and a reversal down.

Last week’s 60 minute chart had a 19 bar bear Micro Channel. This is a type of buy climax. Hence, traders are looking for 2 legs sideways to down. While the past 2 days had 3 legs down, those were in a tight channel. Therefore, the 2 day correction is more likely the 1st of 2 larger legs sideways to down.

While yesterday’s rally was strong, the odds are that it is a bull leg in a trading range. Hence, bears will sell this rally, expecting a 2nd leg down. The rally might even go above last week’s high before the 2nd leg down begins.

New high likely in the cash index

The momentum up on the daily and 60 minute charts is strong. The cash index will probably make a new high within a couple of weeks. If so, the Emini will make another new high as well. Yet, there is only a 40% chance of a sustained breakout to a new high. As a result of the magnetic pull of the trading range, the breakout will probably reverse back into the range. On the monthly chart, the 2 year range will probably be the Final Bull Flag if there is a bull breakout. If there is simply a bear breakout, it will be a double top.

Overnight Globex price action

The 1st half of yesterday was a buy climax. It therefore was likely to lead to at least 2 hours of sideways trading, which it did. While there might be follow-through buying today, the Emini is at the 2100 resistance level. Also, the seasonal window of strength from June 26 to July 6 ended yesterday. Tomorrow is the unemployment report so today will try to be neutral. The Emini was in a tight trading range overnight. As a result of these factors, today will probably have a lot of trading range price action.

While the bulls will try for follow-through buying within the 1st 2 hours, the odds are that the Emini is in a trading range on the 60 minute and daily charts. Hence, any early buying will probably lead to a swing down and a trading range.

A trend can form at any time. Therefore, traders will be ready for a breakout and swing trading. However, a trading range is more likely, and day traders will initially expect to scalp until there is evidence of a trend day.

Forex: Best trading strategies

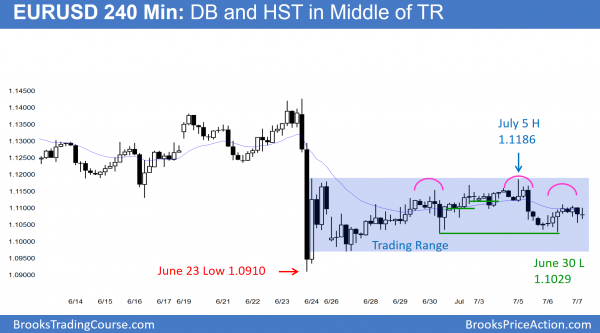

The 240 minute EURUSD Forex chart is in the middle of a trading range. Therefore, there is always a good buy and sell setup. The bears see a Head and Shoulders Top Bear Flag (pink) and the bulls see a Double Bottom Higher Low Major Trend Reversal (Green). The chart is in Breakout Mode. Hence, the probability of the direction of the breakout is almost the same for the bulls and bears. As a result of the bear trend leading up to the trading range, the bears have a slight advantage.

I have said many times since that the big bear breakout 2 weeks ago on the daily EURUSD Forex chart would probably lead to a trading range. Both bulls and bears correctly see it as a bear flag. Yet, every bar that gets added reduces the probability of a bear trend.

Because the bear breakout was the biggest bear bar in a bear trend that has lasted a long time, there is a 60% chance that it is an exhaustive sell climax. As a result, a breakout below its low will probably reverse up and add more bars to the trading range. Every trading range eventually has a successful breakout up or down. There is no sign yet that a breakout is imminent. Consequently, the trading range price action will probably continue.

Overnight Forex trading

As a result of the trading range on the daily chart, the EURUSD Forex market was in a 50 pip range overnight and had several reversals. With the range on the daily chart getting tighter and with tomorrow’s unemployment report, the odds are that today will continue in a tight range. Day traders will mostly scalp for 10 pips, and often enter with limit orders.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After an early follow-through rally, the Emini traded down in a tight bear channel. It reversed up from consecutive wedge bottoms (a variant of a High 4) at a 50% pullback from the 2 day rally.

The Emini was in a tight bear channel for most of the day. However, after the initial bear breakout, limit order bulls could have made about 20 profitable scalps. This is much more common in a trading range, and it was a sign that there would be a bull breakout by the end of the day.

Traders should conclude that the Emini is neutral going into tomorrow’s report. Although there is a 60% chance of a new high within the next few weeks, there is a 50% chance of a selloff first, like after tomorrow’s report.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Because this early rally is strong, the bears will probably need at least a micro double top before they can reverse the trend

I thought a micro double top is a with-trend signal?

Hi Ralph,

I guess you are thinking about a Double Top Bear Flag which is a with-trend signal in a bear trend. A Micro Double Top is a bear reversal signal in a bull trend as Al noted.

just to clarify – a micro double top is a bull bar followed by a bear bar with identical highs? (this is a single candle bull flag)?

It can be any 2 bars within 2 – 5 bars. If the mkt goes up, then down, then up again, and down again within those bars, no matter if the bars are dojis or trend bars, it formed 2 small tops.