Posted 6:54 a.m.

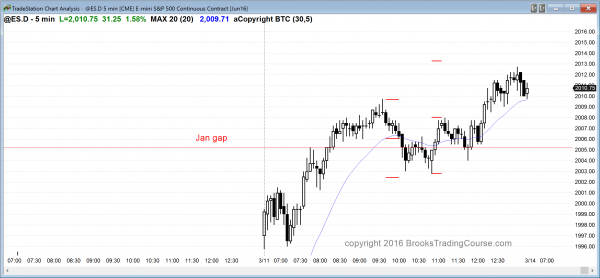

Although today gapped above last yesterday’s high and traded above last week’s high, it opened with a tight trading range and small bars. This makes it likely to have limited upside.

Any reversal down would trigger an expanding triangle top and a failed breakout above last week’s high, but the bears will probably need a 2nd signal or a big bear breakout before traders become confident of a swing down.

The Emini is Always In Long, but the upside is probably limited. Any rally will probably stall and go sideways for a couple of hours within an hour until it reaches the moving average. It would then decide on direction. This quiet open increases the chances of a trading range day.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to day trade an expanding triangle

If you look at my post last weekend, you will see a chart with a map of what I thought was most likely. I said that the odds were that the Emini would have a 1 – 2 day pullback, and then a move above the February high for a few days. At that point, it would try for a Low 5 sell setup, like in October, and it would be at important resistance at the bottom of the 3 month trading range. So far, the Emini is following this likely path.

When the Emini is creating a top, traders always have to be aware of the pain trade. When you think the Emini should do anything, those who trade the markets for a living are humble and are ready for the market to do the low probability, opposite thing. This creates a pain trade because too many traders are committed to a position that is wrong, and they are painfully force out with a much bigger loss than they would have had if they were objective instead of emotionally attached to a belief.

My minimum objective has been met. The Emini had its small pullback and its test of last week’s high. Four of the past 5 days have been dojis within a tight trading range. The Emini might continue mostly sideways until Wednesday’s FOMC report. That might be the catalyst for a big move up or down. If the move is up, it will probably fail in the January gap below 2021, but as long as it stays below the July high, the bulls have not yet won, and the odds still favor a bear breakout of the 2 year trading range.

Yesterday reversed up from an expanding triangle bull flag, where the 1st and 2nd lows were on March 8. It is easier to see it on the 15 minute chart. When there is an expanding triangle bottom, the day trading tip is to watch for a reversal down above the high, which would be an expanding triangle top. A reversal down from above yesterday’s high would be the setup. This is consistent with the daily chart being in a 5 day tight trading range. Breakouts above and below usually fail.

As always, traders will be ready to swing trade breakouts up or down, but the odds favor another trading range day, like yesterday. The swings were big yesterday, and they could be big again today.

Today is Friday so weekly support and resistance can be magnets. Last week’s high and close, 2000, and the bear trend line, and the January gap are all targets, as is the weekly moving average below, but that might be too far.

Forex: Best trading strategies

The EURUSD had a big selloff early yesterday and an even bigger reversal up. The selloff formed a double bottom with last week’s low, and the reversal up just about reached the measured move target. It is now near the top of its 4 month trading range. Yesterday’s move was extreme, and extreme moves are unsustainable. However, there usually is follow-through buying after a pullback. On December 4th, I said that the December 3 rally was so exceptional that 2 things were likely. It was likely to have a protracted pullback that could last a month or more, and it was then likely to have a 2nd leg up. It did both.

The same is true, but to a lesser extent this time. December 3 was a reversal up from an overbought market. Yesterday was a big move toward the top of a trading range. This means that whatever 2nd leg up we see will probably be disappointing. For example, maybe the EURUSD will go sideways into Wednesday’s FOMC report, the rally to test yesterday’s high without even going above that high. That would meet the minimum of what is likely. Since the EURUSD is near the top of its 3 month range, the odds are that the bulls will be disappointed, and that the bull breakout attempt will fail to get above and stay above the February high.

Traders are always open to the exact opposite of what is likely, but place trades bases on what is likely at the moment. Since yesterday was a buy climax, a trading range is likely today. The pullback could easily fall another 100 pips down to the breakout point around 1.1060 or to the bottom of the 1st pullback after yesterday’s breakout. Whenever and wherever the pullback from yesterday’s high ends, there is a 60% chance of at least one more leg back up to yesterday’s high.

The overnight selling looks severe on the 60 minute chart, but it is not especially big when compared to yesterday’s rally. The pullback on the 60 minute chart is still a bull flag. Because the leg down was strong, the bulls will probably have to go sideways for at least a couple of days and form a double bottom before they will be able to get their 2nd leg up. It might come after Wednesday’s FOMC report.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a bull trend resumption day.

The market was quiet today, and this might continue into Wednesday’s FOMC announcement because the February rally was climactic on the daily chart, and the bulls will want to wait for about 10 bars before buying again. Today is a sell signal bar for the Low 5 top that I have been talking about for the past week. The rally might go up for a few more days, but a 2 week trading range is likely after today’s move above last week’s high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

BTC Admin,

Which module of the course talks about Low 5 setups? Thanks.

Hi Dave,

Al talks more about Low 5 (and High 5) in the new course. I believe it is not covered directly in current course Module 10 Pullbacks and Bar Counting, where Al goes as far as a H4/L4 example and warns not to pick tops/bottoms on such signal in a strong trend. But the slides around 7m:30s tell you clearly that you just increment the count each time a new High or Low appears.

Again, it will become much clearer in new course with many chart examples. I will check and see if I can get a sample up.

Hope that helps.

The L5/H5 setup is intriguing, probably a very rare occurence. I learned from Al that L4/H4 can often be understood as L2/H2 on a higher time frame, let’s say you switch from the 5 min to the 15 min chart. I wonder what the general context of the L5/H5 on a HTF would be.

Also, what should a trader do when he sees a failed L4/H4? The market tries something four times and now makes a fifth attempt?

Thank you!