FOMC interest rake hike and Fed statement volatility

Updated 6:58 a.m.

While the Emini opened with a big bull bar and a follow-through bull bar, it was below the moving average and in yesterday’s tight trading range. Limit order bulls and bears made money in the first few bars. It was in a tight trading range for the 1st 6 bars. These are therefore signs of trading range price action.

There probably will be at least one swing up or down before the 11 am report. The Emini is still deciding whether it will be up or down. Until there is a strong setup or a strong breakout up or down, traders will continue to scalp with limit orders. This early tight trading range trading reduces the chances of a big trend before the report.

Pre-Open Market Analysis

The Emini continued its rally yesterday, despite today’s probable interest rate hike. The market usually enters a trading range during the hour or 2 before the announcement.

Furthermore, traders should not trade during the 1st 10 minutes after the announcement. This is because there is at least a 50% chance that the initial breakout will reverse. Furthermore, most trends after FOMC announcements begin at least 2 bars after the announcement.

The 60 minute chart has not touched its moving average in 7 days. Since that is unusual, it is unsustainable. Therefore it is a buy climax. The odds are that it will hit the moving average today. Yet, it could happen before or after the report.

Change in Fed policy today

After several years, this is the day that the Fed officially changes its policy. While there is a 90% chance of a rate hike, there is less certainty about the statement. Most traders expect the Fed to be cautious. Therefore the market would be surprised if the Fed either said that they anticipate no more hikes in 2017 or that they will begin raising rates aggressively.

The Emini has rallied strongly going into the FOMC meeting. Because markets try to become neutral before a catalyst, this high price is what traders see as fair. If the rate hike and statement are as expected, the odds are that tomorrow will not trend strongly up or down. Yet, because the event is so important, any trading range after the report could have huge swings.

Overnight Emini Globex trading

As was likely, the Emini traded in a tight, 5 point range overnight. Because of the 11 am announcement, this will probably continue today as well. While there is usually at least one swing before the announcement, the odds of a big trend before are small. Yet, the probability of a big more or multiple big moves after the announcement is high.

EURUSD Forex Market Trading Strategies

The bear flag on the 240 minute chart has grown to more to about 10 bars. Therefore the chance of a bull breakout above is almost as high as of a bear breakout.

Like all financial markets, the EURUSD is waiting for the statement after the FOMC meeting today. As a result, the EURUSD will probably be in a small range before the report. Therefore, traders will scalp, but only if the range is at least 30 pips tall.

The momentum down on the daily chart has been strong. Yet, the bears have been unable to break below the two year trading range. The EURUSD is in breakout mode. As a result, the math for the bulls is as good as for the bears.

Today’s Fed announcement will probably either lead to a strong bear breakout or a strong reversal up. Because the move could be strong, it could last for days or weeks. Most traders should not trade during the 10 minutes after the report because there is at least a 50% chance that the initial breakout will reverse.

Overnight EURUSD Forex trading

As was likely, the EURUSD traded sideways overnight. Because of today’s FOMC meeting, this will probably continue today. Yet, there will probably be a big breakout after the 11 am announcement. The breakout can be up or down. There is a 50% chance that the initial breakout will reverse.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

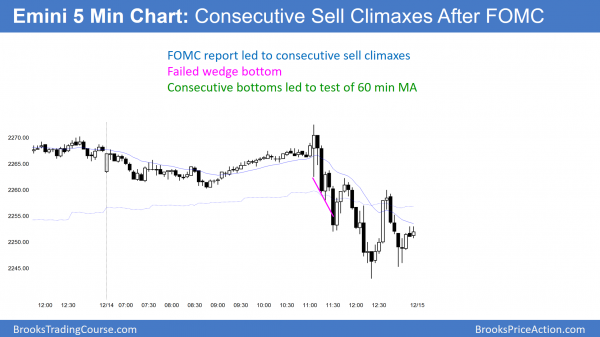

The Emini finally pulled back to the 60 minute moving average after the FOMC report. It reversed up from consecutive sell climaxes, but could not hold above the 60 minute moving average.

The Emini finally pulled back to the 60 minute moving average after more than 50 bars. The odds are that there will be buyers here. The Emini also fell below yesterday’s low. That is the 1st break below a 10 day bull micro channel. The odds are that the pullback will last 1 – 3 days before the bulls try for a new high.

While the odds favor a pullback on the daily chart instead of a reversal, the buy climax is so great that the Emini might be putting in a top for the next several months. The odds favor a pullback, but if there is a series of bear bars on the daily chart, the bears will take control.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi AL,

When FOMC announced rate increase there was a gap on EU between 1.0648-1.0622. I sold the close of second bear bar (1.0577) and used SL of 1.0652. Was that a correct SL or should I have used SL around 1.0625, just above the first bear bar after gap?

Many Thanks