FOMC Fed interest rate hike creating breakout mode

Updated 6:51 a.m.

The Emini opened with 4 dojis in the middle of yesterday’s 5 hour trading range. This neutral open increases the chances of a trading range day. Yesterday’s highs and lows are therefore targets.

Because a strong trend day is unlikely at this point, the Emini will probably not break far beyond yesterday’s range. There will more likely be buyers below and sellers above.

While the Emini is trading below the moving average, it is more likely still in breakout mode. The market is deciding whether to 1st test yesterday’s high or low. After reaching the 1st target, it will probably reverse.

Pre-Open Market Analysis

The Emini gapped down yesterday and therefore created a 3 day island top. It trended down, but found support at the moving average. While an island top late in a bull trend has an increased chance of leading to a swing down, most reversals become trading ranges. The bears need strong follow-through selling today or tomorrow.

Since island tops often lead to island bottoms, the Emini might gap up one day later this week. That would therefore create an island bottom and it would be a sign that the bulls regained control.

Today will probably not add information because the market will probably want to remain neutral going into tomorrow’s FOMC announcement. Since the FOMC statements are in transition, there is an increased chance of a big move after tomorrow’s announcement. Furthermore, there is an increased chance that it could lead to a move up or down that could continue for a week or more.

While today is the last day of the month, it will probably not significantly change this month’s appearance. Support is at this month’s open and low. Therefore, those are magnets today.

Overnight Emini Globex trading

While yesterday’s rally lasted 5 hours, it was in a broad bull channel and it failed to make a new high. It was therefore probably a bear flag. The Emini is down 6 points in the Globex session. Hence, it is in yesterday’s 4 hour trading range. In addition, traders are waiting for tomorrow’s FOMC Fed interest rate hike announcement.

The Emini is in a Big Up, Big Down pattern over the past 5 days. In addition, it had a Big Down, Big Up pattern yesterday. Therefore, it will probably be sideways today. While a big trend is possible, it is unlikely. Hence, the odds favor both at least one swing up and down. Traders need to wait for evidence of which will come first today.

EURUSD Forex Market Trading Strategies

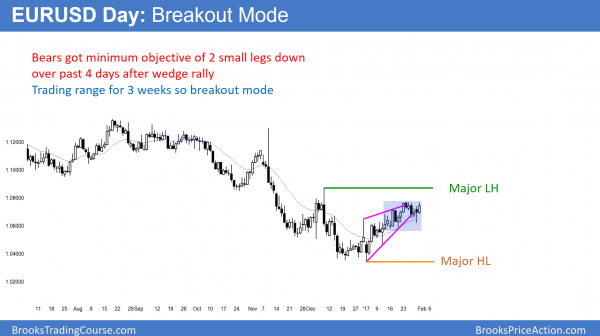

The daily chart of the EURUSD Forex market had 2 small legs down over the past 5 days after a wedge bear flag. It has been sideways for 3 weeks and is therefore in Breakout Mode.

The EURUSD Forex market rallied 60 pips overnight to end the selloff from the wedge top. Hence, it is staying in its 3 week trading range going into tomorrow’s FOMC announcement. There is a major lower high above and a major higher low below. Both are therefore magnets.

Because the daily chart is still forming lower highs and lows, the probability slightly favors a bear breakout and test down to the January 11 1.0453 low. Yet, if a rally breaks strongly above the December 8 1.0872 major lower high, the rally would then probably continue up to test the November 9 1.1299 high. This would therefore turn the weekly chart back to neutral from bearish.

The chart will probably remain in a trading range today while waiting for tomorrow’s FOMC announcement.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trading range day, but reversed up from below yesterday’s low. It formed a higher low major trend reversal and rallied in the final 2 hours.

The Emini sold off in an early weak bear trend, but reversed up from below yesterday’s low. After a rally above the moving average, it sold off again to test yesterday’s low. It then reversed up from a higher low major trend reversal.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hey Al,

Over the last few months I’ve had my best trading focusing on one particular setup only — buying a morning sell-off in the first few regular trading hours. Ex. Bar 26 at 8:30 today. From there I usually look for about 4 points give or take a point depending on what follows. I use 10 point stops. This allows me to create a high win % and I love that.

I find myself thinking a lot about what I will do when market conditions change. I don’t know if my edge is that I can create winners and the math works, or I just happen to be in with all the intraday dip buyers — and once they disappear so will my edge.

Do you encourage me to try adding more setups to the mix? I just feel like there are none I can see that are as clear as the one I’ve been seeing lately.

This particular setup has also helps me feel calm as a trader. I don’t trade everyday and I like that. Over-trading has been a problem for me in the past.

Thanks for all you do!

I have known traders over the years who had a favorite setup. All a trader needs is one. I think diversification always improves performance so I think it is good if a trader can find a few setups that he can trade comfortably. I think it will improve his profitability and his performance (smaller drawdowns, smoother equity curve). However, you are right about the importance of staying in a comfort zone. You will know when the time is right for you to add setups.