Posted 6:59 a.m.

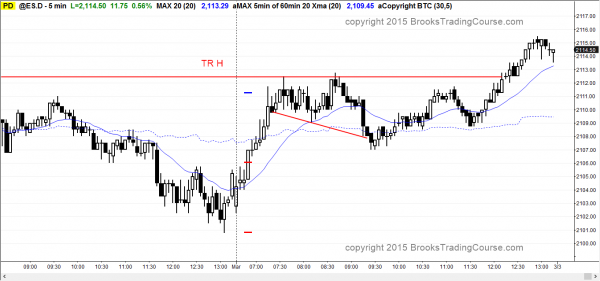

The Emini broke above the small trading range at the end of yesterday and tested the bottom of the upper trading range. Although it formed 7 consecutive bull bars, there were no consecutive big bull bars closing on their highs. This increases the chances that this is a bull leg in a trading range.

The two magnets today are the top of the 3 day trading range and last week’s low. Last week created a sell signal bar on the weekly chart and traders want to know if there are sellers or buyers below.

At the moment, the Emini is always in long and the first reversal down will probably be bought after 9 bars without a bear body. However, unless the bulls start to create consecutive big bull trend bars and unless they break strongly above the 3 day trading range, this rally will be just another leg in the trading range. Bears need to wait for a 2nd entry short or for a strong reversal down.

My thoughts before the open: More pullback from a wedge top

The 60 minute chart turned down from a small wedge top that was nested within a larger 60 minute wedge top. The small wedge was the 3rd push up of the larger wedge. Although the Emini can continue down in the current 3 day bear channel for a long time, the rally on the daily chart in February was strong enough so that the market is more likely to go mostly sideways first.

In particular, traders want to see a rally that tests the top of the 3 day trading range. If the market gets there, the bears will want a small 60 minute double top lower high major trend reversal. The bulls want a breakout above the top of the trading range. This would be a breakout above the lower high in the bear channel. The bear channel continues as long as it forms lower highs. Once there is a breakout above a significant lower high, the bear channel (a weak bear trend) will have converted into either a trading range or a bull trend.

The rally in February had 10 consecutive bull bodies on the daily chart. This is climactic. What follows is usually a tight trading range that lasts at least 10 days. The current tight trading range has gone on for 5 days and it might continue for a month before the market decides between trend resumption up and trend reversal down.

When the market is in a tight trading range, most of the days are small, which means that big trend days are less common and trading range days are more common. Traders are willing to swing trade, but only if they see strong breakouts with follow-through. Until then, they will be more inclined to scalp for quick profits.

Traders learning how to trade the markets need to be careful when the ranges are tight because these are times when stop orders lose and limit orders win. Since beginners should only enter with stop orders, they need to wait for clear setups or 2nd entries, and not take weak stop entry setups.

Summary of today’s price action and what to expect tomorrow: Bull trend resumption or 60 minute lower high major trend reversal?

The Emini began with a trend from the open bull trend. After a 4 hour trading range, the bulls got trend resumption up and a breakout above the high of the 3 day trading range.

The bulls bought strongly from the open. The rally was a parabolic wedge that tested the top of the 3 day trading range. After a 4 hour pullback, the bulls resumed the trend up. However, there are still wedge tops on the 60 minute chart. The bars will try to create a 2nd leg down from those tops. It can come from a major trend reversal, which could even begin at a new all-time high.

Last week created a small sell signal bar on the weekly chart. Traders want to know if there are buyers or sellers below, and the Emini might have to go below to find out, and it might have to do it before it goes above the all-time high.

The day ended with a 2nd leg up in a 2 week long trading range, and it could easily turn down tomorrow. Until there is a strong breakout above the top of the range, which is the all-time high, the odds favor more sideways trading. Also, the odds favor a failed breakout if the bulls do push to a new all-time high.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.