Posted 7:00 a.m.

The Emini had an opening reversal down from the 15 minute moving average, and is always in short. Yesterday had a lot of two sided trading. The market is now between the support of the 60 minute moving average and yesterday’s low, and the resistance of the 15 moving average and yesterday’s close. This is enough room for a trading range. The follow-through from the opening bear reversal was bad and this also increases the chances that the selloff is a bear leg in what will become a trading range. There is not yet a strong bottom and there is the magnet of support below. This increases the chances of at least a little more down. However, the odds favor mostly trading range trading today. As always, if there is a strong breakout in either direction, and it has strong follow-through, traders will more willing to swing trade.

My thoughts before the open: Trading range and breakout mode

The daily chart bounced at a 50% pullback from the February rally, and the 60 minute chart stalled after a 50% bounce yesterday from the March selloff. One time frame will win and the other will lose. This is a type of breakout mode. Tomorrow has an FOMC announcement, and the breakout might come after the report. Although today will probably have at least one swing trade, it will likely be mostly sideways, like the past several days. Traders learning how to trade the markets, however, always need to be prepared for the less likely option, which is a strong trend in either direction.

Summary of today’s price action and what to expect tomorrow

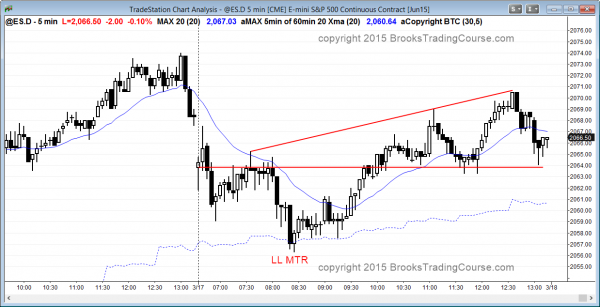

The Emini reversed up from a lower lower major trend reversal at the 60 minute moving average, and then down from a wedge bear flag to close around the open of the day.

The Emini sold off on the open from a test of the 15 minute moving average, but the follow-through was weak and this made a rally likely at some point. The lower low major trend reversal tested yesterday’s close and formed a wedge top at a measured move up from the low of the day to the open of the day. The market closed around the open and created a neutral, doji day going into tomorrow’s 11 a.m. FOMC announcement.

These meetings might lead to big moves over the coming months as the Fed’s approach to interest rates begins to change. Tomorrow will probably have a big breakout and trend on the report, but there is often a false breakout first.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al if we buy the course now and when you add new video it’s going to be update to us free or we have to pay for new video if we want them.

Hi Nano,

Sorry for late reply but yes, buying course now includes free updates as they become available. Al is currently working on a major update for later this year.

Richard

I hope there’s will be more video for Forex

I’m a complete newbie. Does your course begin with people like me in mind? If not where/what do you recommend for me to learn from to be able to begin your course? Thanks.

I planned the course for beginners and experts, but not for newbies…yet. I am currently working of some videos that I will add to the course within a few months and I created them for traders starting out with virtually no background (newbies!).

Thanks for the reply. I’ll be standing by till then.