Emini Trump rally exhaustion gap on weekly chart

Updated 6:55 a.m.

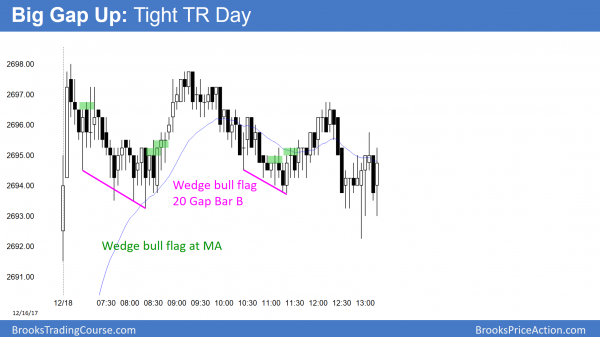

The Emini opened within yesterday’s tight trading range and began with 4 bear bars. They reduce the odds of a bull trend day today. At the moment, the Emini is Always In Short, and it is deciding between a bear trend day and another trading range day.

The magnets below are Friday’s high, the 60 minute moving average, and a measured move down based on yesterday’s range. Unless there is a strong reversal up, traders will sell the 1st rally for a 2nd leg down. The odds are against a strong break below support. Therefore, there is an increased chance of a reversal up from support, and then a trading range. A bull trend day is unlikely.

Pre-Open market analysis

The Emini gapped up yesterday. Since yesterday was a Monday, there is now a gap up on the weekly chart. Because of the extreme buy climax, the gap will probably be an exhaustion gap. That means it will probably close within a few weeks, and possibly this week. Most Monday gaps close before the end of the week. That makes gaps on the weekly chart even more rare.

The buy climaxes on the daily, weekly, and monthly charts are accelerating up in parabolic rallies. A parabolic rally can go a long way before it ends. Dow 25,000 is a Big Round Number that is just above, and therefore a magnet. However, since this rally is an extreme type of buy climax, the odds are 70% that it will end soon. A buy climax usually has to transition into at least a small trading range before the bears can get a bear trend. Because the monthly chart is so strong, a bear trend on the daily chart would still be a bull flag on the monthly chart. Consequently, the downside risk over the next several months is small.

When there is a big gap up on the daily chart, the Emini usually goes sideways for several days. The bulls then try for trend resumption up. The bears want a failed breakout and a reversal down. A gap down at any point in the next several weeks will create an island top with yesterday’s gap up.

Because of the holidays, there is an increased chance that the markets will have mostly small ranges for the next 2 weeks.

Overnight Emini Globex trading

The Emini is up 3 points in the Globex market. Yesterday was a strong breakout for the bulls. However, it was probably too strong to get good follow-through buying today. When there is a big gap up to a new high, the Emini often has to go sideways for several days. That is likely here.

In addition, this week and especially next week will probably have “Holiday Trading.” This means that most governments and institutions will avoid news. There will therefore be fewer catalysts. Furthermore, many traders will be distracted by the holidays. They therefore will have less energy to trade aggressively. As a result, most days will be in tight trading ranges. This will limit the number of good trading opportunities for day traders.

Yet, it is a chance to work on discipline and patience. Traders need to be selective in choosing their trades. In addition, if there is no good reason to exit, they should hold for their profit target. Because the market will probably move slowly, they will often have to hold onto a day trade much longer than they expect. In addition, the final profit will usually be less.

While the odds favor a lot of quiet trading until January, the computers are always looking for trades. Consequently, if there is a strong breakout up or down, traders should trade it and not deny that it is possible.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

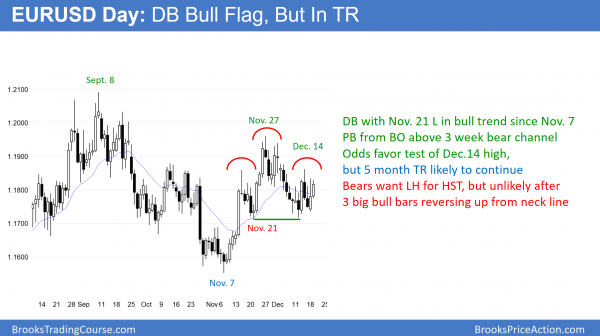

The EURUSD daily Forex chart has been in a tight trading range at the support of the November 21 low, 50% pullback, and moving average. The odds favor a test of the December 14 high. Less likely, the market will break strongly below the neck line of the head and shoulders top.

The EURUSD daily Forex chart has been finding support at a 50% pullback from the November rally, the moving average, and the November 21 low. It is starting to form strong bull bodies. Therefore, the odds favor a test of last week’s high rather than a strong break below the neck line of the head and shoulders top. However, it is in a 2 week trading range within a 2 month trading range, nested inside 6 month and 2 year trading ranges. Consequently, the odds are that every rally and selloff will reverse. Although every trading range eventually breaks into a trend, there is no sign that a trend will come anytime soon.

This week and especially next week will probably have “Holiday Trading.” This means that most governments and institutions will avoid news. There will therefore be fewer catalysts. Furthermore, many traders will be distracted by the holidays. They therefore will have less energy to trade aggressively. As a result, most days will be in tight trading ranges. This will limit the number of good trading opportunities for day traders.

Overnight EURUSD Forex trading

The 5 minute chart reversed up last night from yesterday’s selloff. That selloff was simply a 50% pullback from yesterday’s overnight rally. The 5 minute chart is still bullish, as it was yesterday. However, it is getting close to last week’s high at around 1.1860.

That is the top of the 2 week trading range. The overnight rally has been in a tight bull channel. However, it rallied only 30 pips in 12 hours. This lack of energy increases the odds that the rally is just a leg in the 2 week trading range. Consequently, bears will be more willing to sell rallies today and bulls will be more likely to take profits above prior 5 minute highs. Therefore, the odds are against a strong break above last week’s high, even though it is only 30 pips above the current price.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Today sold off in a spike and channel bear trend. It was in a trading range for the 2nd half of the day.

Today sold off, but the gap above yesterday’s high is still open. Yet, it will probably close this week or next week. Hence, it will probably be an exhaustion gap. The bears want a gap down this week to create an island top. They already have a wedge top over the past 3 weeks in a buy climax. However, until they get consecutive very big bear bars on the daily chart, the odds still favor a pullback and not a trend reversal.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.