Emini traders watching for possible government shutdown

Updated 6:44 a.m.

Today is the 3rd consecutive day that gapped up and sold off on the open. However, the 1st bar today was only a doji. This is a weaker start for the bears. It therefore increases the chances of an opening reversal up from around the 60 and 5 minute moving averages, which are close to one another. The bears need a strong selloff below the averages to make traders believe that today will be another bear trend day.

More likely, today will either be a trading range day, or the bulls will get a reversal up from support and form a bull trend day. With the uncertainty about the budget vote the odds are against a big trend day up or down. Therefore today will probably either be a trading range day or a weak bull trend day. While a weak bear day is also possible, a strong trend up or down is unlikely.

Pre-Open market analysis

The Emini sold off yesterday in a trend from the open bear trend. In addition, it traded below Friday’s high. It therefore closed the gap on the daily and weekly charts, which was likely. The gap is now an exhaustion gap. However, that is minor. Until there is a strong reversal down, the odds favor that every reversal will just be another bull flag.

Congress is working on a continuing budget resolution. If they fail to pass one in the next week, the government will run out of money and shut down. That would result in a selloff that would last at least a few weeks.

The buy climaxes on the daily, weekly, and monthly charts have never been this extreme. Therefore, the odds of much higher prices without at least a 5% correction first are small.

All bull trends are constantly trying to reverse. However, my 80% rule says that 80% of reasonable reversals attempts will fail. That means that betting that the current top will be the one that finally begins a 5% correction is a low probability bet. Traders will not believe that the correction is underway until there are at least 2 strong bear bars on the daily chart. But, at that point, the correction will already be half over.

Overnight Emini Globex trading

The Emini is up 6 points in the Globex market. Traders still see the 3 day selloff as a bull flag after Friday and Monday’s rally. The bulls tried for a bull breakout yesterday and failed. If the Emini opens here, it would be breaking above the 3 day bear channel again.

However, the bulls need a strong rally before traders believe that last week’s bull trend is resuming. Without that, traders will conclude that the sideways to down pullback is continuing. The Emini is probably waiting for the government shutdown vote that will take place before the end of the month.

The bears need a strong breakout below the 3 day bull flag before traders will conclude that Friday-Monday rally has failed. Even then, the odds continue to favor only minor reversals down on the daily chart until there are at least 2 consecutive big bear trend days.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

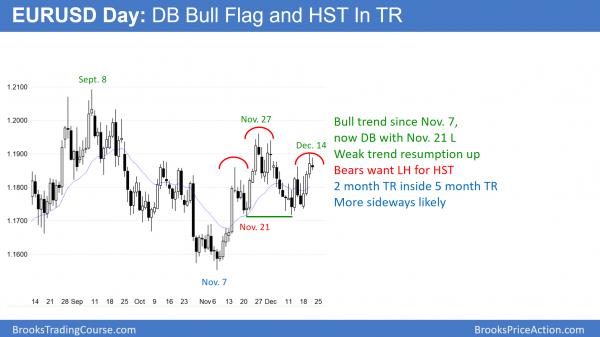

EURUSD Forex market trading strategies

The EURUSD daily Forex chart is in a 2 month trading range within a larger 5 month trading range. It has rallied weakly from a double bottom over the past 3 weeks and is now near the top of the 2 month range. The bears want a reversal down from a head and shoulders top.

The daily chart is in nested trading ranges that are 2 months, 5 months, and 2 years in duration. There is no sign of a breakout up or down. Every strong rally and selloff is still likely to reverse. The rally over the past 3 weeks is weak. It is now testing the top of the 2 month range.

The bears want a reversal down from here, which would be the right shoulder of a head and shoulders top. Even if they break below the November 21 neck line, they would only have a 40% chance of a swing down. Likewise, if the bulls break above the November 21 head, they would have only a 40% chance of a swing up.

Traders are looking for a catalyst that could lead to a swing up or down of 300 or more pips. The upcoming U.S. vote on its budget is a potential catalyst, as is any unexpected international event. Until there is a strong breakout with follow-through up or down, traders will continue to look for small reversals every few days.

The three day rally has enough momentum for the bears to wait for 2 – 3 sideways days before looking for a 3 – 5 day selloff. Consequently, this rally might have to get up to the November high before the bears regain control.

Overnight EURUSD Forex trading

The 5 minute chart has been in a 40 pip trading range overnight. This range broke through the bottom of the 4 day bull channel. However, the overnight lower high was too small for a convincing lower high major trend reversal on the 60 minute chart. Consequently, the odds still favor more sideways to up trading before the bears can create a credible top. Yet, if there is a strong downside breakout, traders would look for at least a 50% retracement of the 4 day rally.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

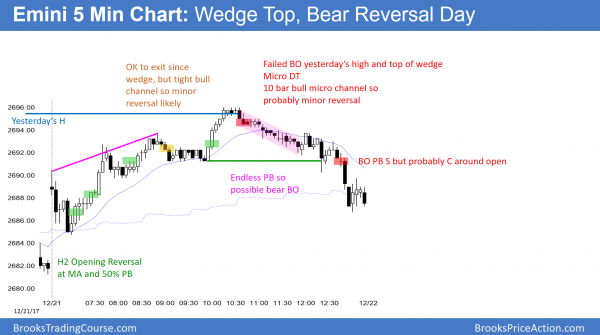

The Emini rallied to a wedge top. The reversal failed.

However, the breakout above yesterday’s high failed with a micro double top and then an Endless Pullback. The day closed near the low and was a doji day.

Yesterday was a bear bar and therefore a bad buy signal bar. That means when today went above yesterday’s high, there were likely more sellers than buyers. The day sold off and closed around the low.

It was the 4th day in a tight range after Monday’s gap up. If the bears get a gap down, they will have an island top. However, they need consecutive big bear days to make traders believe that a 5% correction might be underway.

Today is a Friday so weekly support and resistance are important. The obvious magnets are this week’s low and open.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.