Emini rally ignoring Trump’s Russia problem, expecting tax reform

Updated 6:55 a.m.

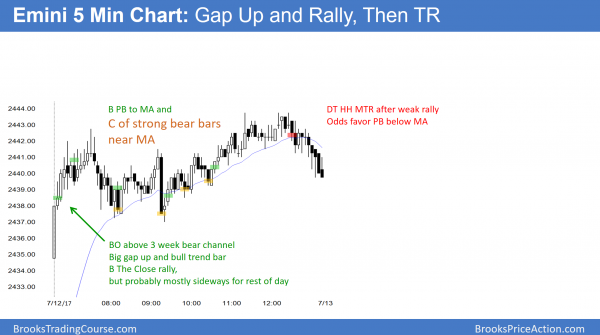

Today had a big gap up and then a series of bull trend bars. This is a trend from the open bull trend. It therefore increases the odds of a bull trend day. Yet, when there is a big gap up and immediate rally, the Emini usually enters a tight range for several hours. Less likely, it will form a parabolic wedge top and reverse down.

Since it is breaking above the top of the June 29 strong sell climax on the 60 minute chart, it will probably go sideways for a few bars. Because that is the 60 minute chart, that means a few hours. This is therefore consistent with the 5 minute chart.

The open is at the low of the day on the daily chart only a couple times a year. Since that is the case today, it increases the chances of a selloff to below the low. However, since the opening rally is strong, bulls will buy a reversal up. This would therefore create a double bottom near the moving average.

Pre-Open market analysis

The Emini sold off strongly yesterday, but reversed up. It is now in a 2 week triangle. Because the daily chart is in a trading range in a bull trend, the odds are slightly better for the bulls. Yet, since the weekly chart is so extremely climactic, the upside is probably small. The odds are that the Emini will have to fall below the weekly moving average before it can go much higher.

Since most days over the past month have had a lot of trading range price action, the same is likely today. Yet, yesterday’s reversal up was strong enough so that the Emini today will probably trade at least a little higher. If the bulls can break above the July 3 major lower high, the rally will probably test the all-time high.

Overnight Emini Globex trading

The Emini is up 11 points in the Globex session. Furthermore, it has rallied 8 points in the past 30 minutes. It therefore will test the July 3 neck line of the June 29 and July 6 double bottom when the day session opens. If the bulls can break strongly above that high, they then will have at least a 50% chance of continuing up to a new all-time high and then the 2,500 Big Round Number.

The bears needed a breakout below the double bottom. They will be disappointed by this rally. The odds are that they will exit their shorts on any early pullback. Consequently, there is an increased chance of a bull trend day today. However, since most days over the past month have had reversals, the bears will short if there is a reasonable top today.

While it is possible that the Emini sells off from its gap up, the break, this gap up will also be a break above a 3 week bear channel. Since it will probably be far above the channel, the odds are that traders will buy the 1st reversal down. Consequently, the best the bears can probably get is a trading range today.

Yesterday’s setups

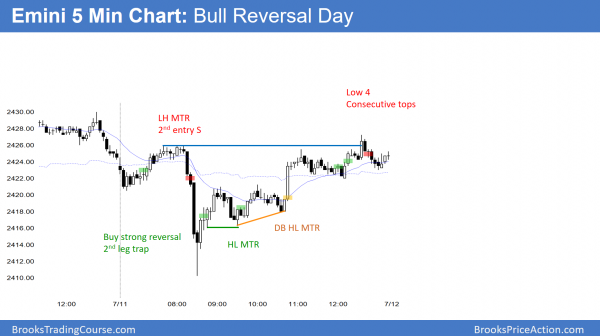

Here are several reasonable stop entry setups from yesterday.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart might form a bear reversal bar after breaking above the June high. Furthermore, the rally has a wedge shape. In addition, it is at a measured move target. Finally, it is at the top of the 2 year trading range.

The EURUSD Forex market has been in a bull trend for 7 months. Since it is still in a 2 year trading range, the odds are that the rally is simply a bull leg in the range instead of the start of a successful breakout.

Hence, it will probably stall soon and begin to trade sideways to down for several months. While the top of the range is about 200 pips higher, it has reversed down many times around the current price level. Consequently, bears will be more aggressive and bulls will begin to take profits above prior highs.

While the momentum up is strong on the 240 minute chart and higher time frames, the bears will try to create a bear reversal day either today or soon. If they are successful, traders will sell below the low of that bar. Their goal would be about 10 bars and 2 legs down to support. The obvious magnets are the higher lows and the bull trend line on the daily chart.

Tight bull channel so only minor reversal

The bulls know that the weekly chart is at the top of the 2 year range. However, they also know that the 6 month bull channel is fairly tight. Consequently, they are willing to buy at the high. This is because they will make a profit if it continues up.

Furthermore, if it instead reverses down, the 1st reversal down in a tight bull channel will probably be minor. Therefore, they can buy more lower, confident that the selloff is more likely a bear leg in a trading range than the start of a bear trend. As a result, they could then avoid a loss by exiting around their average entry price on the next bull leg in that new trading range.

Overnight EURUSD Forex trading

The EURUSD market reversed up from a small selloff over the past hour. The bears want today to close near its low, or at least below its midpoint. This would therefore create a bear reversal bar on the daily chart. Since the daily chart has a wedge top at resistance, bears will then sell below that low tomorrow.

The bulls always want the opposite. Hence, they want today to rally and close above its midpoint. That would therefore create a bull body on the daily chart. In addition, they want the day to close on its high. That would be a strong breakout above the June high.

Even if the bulls are success, the odds are that the bears will take control within a few days. This is because of the appearance of the daily and weekly charts.

Since the new high at resistance creates opportunities for bulls and bears, the EURUSD Forex market might go sideways for another day or 2 as it decides on the direction of the next couple of weeks. Day traders will continue to scalp. But, since the daily chart is at the top of its 2 year range and probably at the top of a smaller range for at least a couple of weeks, swing traders will begin to look for shorting opportunities on the daily and 240 minute charts.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a big gap above a 3 week bull flag, the Emini was mostly sideways and weakly up for the rest of the day.

The Emini rallied from the open after a gap above a 3 week bear trend line. Yet, as is usually that case after a gap up and rally, it spent the rest of the day mostly sideways. The bulls want follow-through buying tomorrow, which would probably result in a new all-time high.

Since today’s breakout was strong, bulls will probably buy the first reversal down. Consequently, the best the bears can probably get tomorrow is a bear leg in a trading range day.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, Question for you. One of my favorite entries in ES is entering on a “counter trend-trend bar-close” Which of course is a common “limit order entry”. I tend to just place the order on the exact close of the bar. I end up with a fair amount of trades….but several times each day I miss moves because I don’t get filled. I have given some thought to just hitting “market” as soon as the bar closes every time…that way I would always get filled. (I have same issue with “buy the close” sell the close”) My personality tends to be “rigid” and inflexible once I decide on an entry, I NEVER deviate from my setups……discipline is never a problem for me. I’m like a robot…LOL I guess in the back of my mind I am afraid I might get crappy fills…and end up with losers that might have been winners…if i got the closing price. Just curious how you handle your entries in this situation. Thanks, Steve

When I am stalking a counter trend close, I usually place a limit order 1 tick from the close. For example, if I buy a bear close in a bull trend, I am watching intensely. My finger is on the button, ready to buy with a limit order 1 tick above the close as soon as the bar closes. Less often, I will just hit buy the market.

This is different from buying bull closes in a buy the close rally. If the bull breakout is very strong, I tend to just buy at the market as soon as the bar closes. If there is hesitation in the rally, I more often place a limit order to buy at the close of the bar that just closed.