Emini possible blow-off top preceding congressional budget vote

Updated 6:47 a.m.

Today gapped up and began with a big bull bar. However, the 2nd bar was a bear bar, which is bad follow-through. It therefore increases the chances of an early swing down to yesterday’s high or close. The bears need 2 – 3 bear bars with at least one being big and closing on its low. If they get that, the odds will favor an early high of the day.

Because the 60 minute chart is at the top of a tight bull channel and in a buy climax, there is an increased chance of a parabolic wedge top and swing down today. Since the 6 day rally is strong, the bulls will buy a reversal down. This means that a selloff might last 2 – 3 hours and then reverse up. Less likely, today will trend down all day.

The bulls want a 6th bull trend day. Yet, the early bear bars make this less likely. If the bulls get an early rally, it will probably evolve into a trading range after 1 – 2 hours, and it would have a 50% chance of reversing into a swong down.

Pre-Open market analysis

The bulls want a 6th consecutive bull trend day. There is a measured move target at 2759.75 based on Friday’s gap up. The Emini is also around the 2750 Big Round Number. Finally, the 60 minute chart is still in a parabolic wedge rally. These are all reasons for traders to be ready for a bear trend day today or tomorrow. The 1st pullback in a strong bull trend usually lasts 1 – 2 days.

The momentum up is strong. Consequently, the odds are the bulls will buy the pullback. The bears will probably need at least a micro double top before they can begin a move down to last week’s low. Remember, last week was probably an exhaustion gap bar on the weekly chart. Its low is therefore a magnet.

Since last week was a possible exhaustion move, traders will look for a micro double top this week on the daily chart. If the bears get it, they will have a 40% chance of a test of last week’s low within the next 3 weeks.

Overnight Emini Globex trading

The Emini is up 5 points in the Globex session. It will therefore possibly gap up to another all-time high. Since the 5 day rally is extreme, the odds favor a pullback for a day or so beginning today or tomorrow.

The past 2 days had strong bear bars on the open. Both days reversed up. However, this is a sign of increasing selling pressure. Hence, if today again opens with bear bars, there is an increased chance of a trend down.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

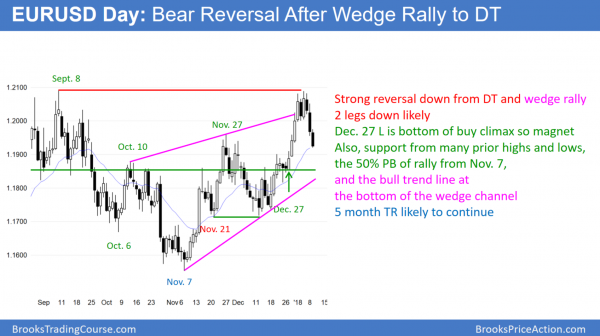

The EURUSD daily Forex chart is reversing down strongly from a wedge rally to a double top. The selloff is likely to have at least 2 legs down. It will probably test the December 27 low. That is the bottom of a buy climax rally and therefore support and a magnet. Furthermore, it is a 50% pullback from the 2 month rally, the bottom of the wedge bull channel, and an area of many prior highs and lows.

The EURUSD daily Forex chart has sold off for the past 3 days. It has now reversed about 2/3rds of the buy climax up from the December 27 low. The selloff is strong enough so that it will probably have at least 2 legs down. For example, it is comparable to the late September reversal down, which needed a a wedge bottom before the bulls bought again.

The momentum down over the past 3 days is strong. The selloff will therefore likely fall to at least the next major support. That is the December 27 low, which is the bottom of a buy climax. In addition, it is around a 50% pullback of the rally up from the November 7 low, and an area of many prior highs and lows. Furthermore, it is the middle of the 6 month trading range. Finally, it is the bottom of the wedge bull channel.

Because these are many reasons for support, the daily chart will probably bounce there for a week or two. After that, traders will decide if the reversal will continue down to the bottom of the 6 month trading range or rally back to the top. Trading ranges often spend most of the time in the middle. This is an example. Consequently, the daily chart might form a 200 pip tall tight trading range for the next few weeks around the middle of the 6 month trading range.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has sold off in a series of tight bear channels for 3 days. This is extreme, which increases the odds of a trading range today or tomorrow. The target for the bulls today or tomorrow is the trading range above 1.1950 that began yesterday and continued through the Asia session.

Yet, the 1st reversal up will be minor. This means that the bears will sell around 1.1950 – 1.2000. The odds favor a move down to the December 27 low around 1.1850.

The bears made money in the European session by buying with limit orders at and below prior lows. This increases the odds of a trading range today. The bulls will continue to sell rallies. If the day becomes a trading range, day traders will scalp. However, swing traders will continue to hold for a test of the 1.1850 area.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

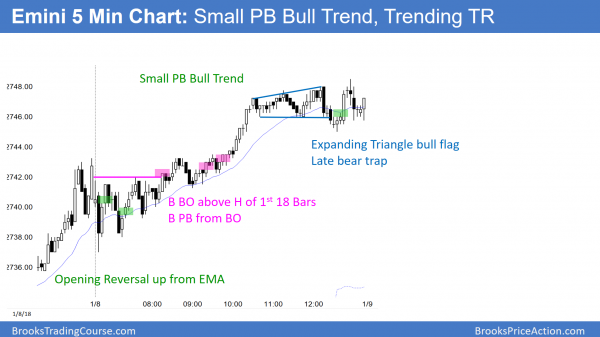

The bulls got a double bottom opening reversal up from the moving average. They had a spike and channel rally, which formed a trending trading day. There was a bear trend reversal that led to a test back down to the open of the day.

The Emini has rallied for 6 days. It is now at a measured move target on the daily chart based on Thursday’s gap up. While there is no clear top on the weekly chart, this week is still relatively small compared to last week. The bears want to keep it small, which means they want a trading range for the remainder of the week.

The bulls know that the 2 week rally is extreme, and it is a possible blow-off top on the daily chart. However, they will keep buying until the bears get a strong reversal down.

Today was a reversal day and therefore a sell signal bar on the daily chart. However, since the 6 day rally is strong, the bears will probably need at least a micro double top before they can begin a swing down on the daily chart. Consequently, the bulls will probably buy a 1 – 2 day selloff. Yet, all higher time frames are move overbought than they have ever been in the history of the stock market. This increases the chance of a climactic reversal from a blow-off top, and it can come at any time.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Good morning Mr Brooks do you trade forex more these days or still trading emini more?? what is your preference these days ?

Hi Al,

It seems in the past that bullish overnight gaps used to close during the RTH day session about 65% of the time, yet lately far more are staying open (Example: Emini has 5 open bullish overnight gaps so far in 2018, and had numerous in 2017).

I find myself hesitant to take long entries lately as a result – do you think I should stop paying attention to overnight gaps? Thank you for any insight you may feel like sharing.

It depends on your goals. If you are talking about day trading on the 5 min chart, the gaps are less important. The 5 min bars are all that a trader needs. The gaps are magnets, but no more important than any other support or resistance.

The Emini is in a blow-off top. Everyone knows that there is a risk of a sudden reversal. However, the reason the mkt is going up is that institutions are comfortable handling the risk of a reversal down. They know that if they trade properly, the odds are very good for longs because buy climaxes can last a long time. Therefore, they can make a lot of profit quickly. Their risk is not great if they are quick to manage.