Posted 7:15 a.m.

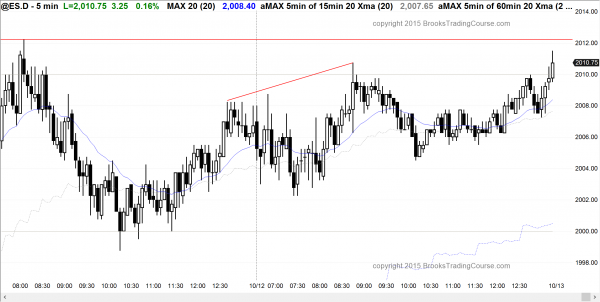

Friday’s tight trading range continued on the open, and an early tight trading range increases the chances of a lot of trading range price action for the rest of the day. Friday was a doji day after Thursday’s buy climax. The climax was at resistance. The odds are that the Emini will need to pull back for a day or two. Today will probably be the start of that pullback.

Friday’s range was small and today could easily go above Friday’s high and then below its low. With the double top on Friday, the bulls need a breakout above it to make the bears give up and consider the possibility that the bulls will control the market for one or two more days. The bears hope that the double top holds and that the Emini simply works down below Friday’s low, creating the 1st pullback in a 6 day bull micro channel that had a buy climax on Thursday.

When the day begins in breakout mode, day traders need either a strong buy or sell signal bar, or a strong breakout up or down with follow-through. Until then it will continue as a limit order market. Most traders should wait for the breakout or a strong buy or sell setup. However, even when the trend becomes clear, the odds still favor a trading range day, and that any trend will be limited to a 2 – 3 hour swing. If instead there is a relentless strong trend, day traders will change to swing trading all day. It is more likely that today will be a trading range day.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade the markets after trend exhaustion

The Globex market traded in a narrow range overnight. Last week’s rally was a buy vacuum test of resistance at the September high. The next resistance at the bottom of the 7 month trading range around 2040 – 2050 is the final major resistance below the all-time high. The momentum up over the past 2 weeks makes it likely that the bulls will get there over then next couple of weeks. They need a breakout above that level to make the strong bears give up. It is impossible to know at this point just how strong the bears are or when they will return. However, if they are not strong as they were in August, the bulls will overwhelm them and get a new all-time high. That is the fight that we are about to see soon.

Bear trends and final legs in bull trends often have extremely strong rallies. For example, look at a 5 minute chart on September 14, 2012, and look at how strong the rally was over those two days. It became the high of the next 4 months. We just do not know yet if the current rally is the same, or if it is the start of a bull trend. Either the bulls need to do much more or the bears need to come back. We will soon find out. If the bears come back, they could either reverse the market down sharply, or simply stop the bulls for a month or two and then get a strong bear breakout. If they are successful, the selloff will probably fall below last October’s low and possibly get a 16 handle for a correction of 20%.

With the Emini stopping Friday a tick above the September high, the bears have a possible double top. The bulls are probably exhausted and were unable to break strongly above that high. The odds are that the Emini will get a pullback today or tomorrow. For example, today might trade below Friday’s low. The first reversal down will probably be bought, but the pullback might last for a few days before the bulls come back. If a 2nd rally fails, then the bears will have a micro double top with Friday’s high and a higher probability of a bigger pullback, and even a chance with a double top with the September high.

The rally last week on the 60 minute chart was in a channel, and a bull channel usually behaves like a bear flag. There should be a bear breakout today or tomorrow, and then a test of the bottom of the channel in the 1960 – 1970 area. The upside over the next couple of day’s is probably limited and the odds favor a pullback or at least a tight trading range. There is always the possibility of a strong trend up or down, but the odds are that the bulls accomplished their near term goal buy going above the September high, and the lack of a big breakout above that high means that they are probably exhausted. When that happens, there is usually a pullback before they will buy aggressively again.

Forex: Best trading strategies

The weekly charts of the EURUSD and USDJPY have been in tight trading ranges for months and are in breakout mode. The markets are evenly balanced, and there is a 50% chance of the breakout being up or down. Once it comes, there is a 50% chance that it will reverse. Until then, ever strong move up or down will continue to last for only a few days. Day traders are looking to sell every rally on the 60 minute chart and buy every sell off. On the 5 minute chart, they are scalping with limit orders, selling above highs and buying below lows. They are scaling in and scalping for 10 – 30 pips.

The USDCAD has the best potential for a swing trade (a move of at least 100 pips) within the next week because it has been in a 600 pip long tight bear channel on the 60 minute chart. This is a type of sell climax, and the odds are that it will soon be followed by a two legged move up, and the move will probably retrace at least a third of the bear trend. The targets for the bulls are the major lower highs in the 60 minute bear trend. The obvious ones are around 1.31, which is about 150 pips above the current price. The stops for the bears are now very far above. They need to reduce risk, and the easiest way to do that is to buy back some of their position.

The bulls know that and are looking to buy as well, expecting the rally to last at least a few days. They have a potential double bottom on the 60 minute chart. The bears see it as a potential bear flag. Whether or not the bears get one more push down, the odds of a short-covering rally this week are probably 60%, and bulls who trade the markets for a living will be looking for a candlestick pattern or a strong bull breakout to buy.

Traders learning how to trade the markets should realize that when a bear channel is tight like this, the bears are strong. After they buy back their shorts, the odds are that they will sell again. The first attempt by the bulls, even if it results in a rally that lasts 300 pips, will probably be followed at least by a test back down, and possibly by a resumption of the 60 minute bear trend.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a tight trading range all day.

Today was Columbus day and the banks were closed. The Emini stayed in a tight trading range. This is the 2nd day of weak follow-through after Thursday’s buy climax. Today finished as a doji inside day, and a breakout pullback buy setup. After 2 dojis, a buy climax at resistance, and a 6 bar bull micro channel on the daily chart, the odds are that there will be sellers tomorrow above today’s high, and that the Emini will then pull back for 1 – 3 days.

Since the rally was so strong, even though it stopped at the resistance of the September high, the odds are that the first pullback below the low of the prior day will be bought for at least a small test back up and possibly a test of the 2040 – 2050 bottom of the 7 month trading range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.