Posted 7:08 a.m.

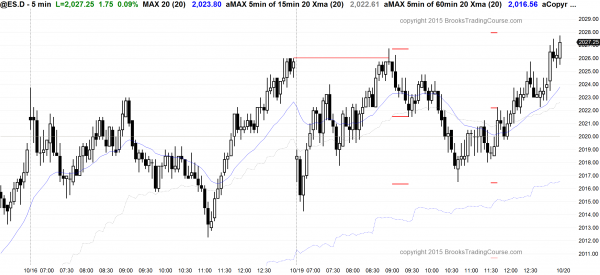

The Emini reversed up from above yesterday’s low with 4 bull trend bars closing above their midpoints. It is testing near the top of Friday’s trading range. Because Friday was a trading range day, the odds of a trading range day today are higher. While it is possible that this initial rally is an opening reversal test of the moving average and an early high of the day, it is more likely that the 1st reversal down will be bought and the best the bears probably will get over the next hour is a trading range. The Emini is Always In Long, but unless it breaks strongly above Friday’s high, which is not likely, it will probably be more of a trading range day. This means that it will probably have at least one swing up and down, and each will last at least a couple of hours.

Any day with early trading range price action can convert at any time into a strong trend day. If that happens today, day traders should not be in denial. They should look for a swing trade in the direction of the trend. Without a strong breakout up or down with strong follow-through, swings up and down that last for a couple of hours is more likely.

Pre-Open Market Analysis

S&P 500 Emini: learn how to trade a candlestick pattern: expanding triangle bear flag

The Emini broke above the September high last week and reversed down for 2 days and the broke out again. In the Globex session, the Emini is beginning to reverse down again. That would be a 2nd entry short in a 3 month trading range. That is a higher probability short. Traders learning how to trade the markets need to understand that trading ranges constantly disappoint bulls and bears.

I have been writing about this over the past couple of weeks. If the 3 week rally is a reversal of the August bear trend, then the bulls will not be disappointed very much or very often. If instead they are repeatedly disappointed by bad follow-through, deep pullbacks, and pullbacks lasting more than 3 days, then they will conclude that their rally was simply part of a trading range. They will then look to buy only pullbacks, and they will sell to take profits on rallies, rather than buy high, expecting a bull trend.

If today creates a sell signal bar on the daily chart, the candlestick pattern is also an expanding triangle bear flag with the August 28 and September 17 highs. All major trend reversals with reasonable setups have about a 40% chance of a swing down, and a 60% chance of a small gain or loss. If today is a bear bar closing near its low, today will be a decent sell signal bar going into tomorrow. If tomorrow then trades below today’s low, the sell would trigger.

The fight today is over whether or not the bears can create a convincing sell signal bar on the daily chart. If the bears are successful and the Emini begins to trade down today and tomorrow, the first obvious downside targets are the moving average, which is around last week’s low, and then the October 5 gap. The bulls will try to prevent today from closing below the open and below its midpoint. If they are unsuccessful, those who trade the markets for a living will become less confident that the reversal of the past 3 weeks will lead to a new high, and more confident that it was either a bull leg in a 3 month trading range or bear flag.

I wrote that the rally was strong enough to increase the probability to 50% that the bear trend on the daily chart had ended. A strong reversal down over the next couple of weeks will increase the probability for the bears back up to 60%. The bears still have room on the upside before they give up. Some bears will conclude that the bulls have regained control of the Emini rallies back into the 7 month trading range, especially if it goes about the August 17 top of the bear breakout. That would at least return the market to the neutrality of the 1st 7 months of the year. Other bears will not give up the bear case as long as the Emini still creates lower highs. They need to see a new all-time high before they will conclude that a broad bear channel is no longer in effect.

The bear case would have higher probability of a fast selloff if the reversal down began at a major resistance level and with a reliable pattern. The Emini is testing the bottom of the 7 month trading range and the top of the 3 month trading range and it is therefore at important resistance. An expanding triangle is a reliable pattern. The bears next need a strong reversal down. Will they get it during the next 3 weeks? Probably not. Why not? Because the Emini is in a trading range, and markets have inertia. They tend to continue to do what they have been doing for a long time, and 80% of attempts to change the behavior fail. This means that every rally and selloff, no matter how strong is likely to fail. This includes a reversal down, if the bears are able to create one.

All trading ranges eventually have a successful breakout. However, until there is a breakout, there is no breakout, and the odds are that every attempt to breakout will fail. This is true for this 3 week rally, and it will be true if the Emini reverses back down again. As long as traders continue to take profits on their longs near the top and on their shorts near the bottom, the trading range will continue. A buy low, sell high, and scalp mentality is the key feature of a trading range, as are repeated disappointment and ongoing confusion. The Emini was in a trading range for the 1st 7 months of the year, and it has been in a lower trading range for 3 more months.

Forex: Best trading strategies

The EURUSD traded down for several days after testing the September 18 lower high. The bears see the selloff as a double top bear flag, but since the EURUSD has been in a trading range for several months, all of the reversal patterns and breakout attempts have a low probability of success. The bull breakout last week reversed down and disappointed the bulls. The reversal down of the past few days will probably disappoint the bears, and the trading range will probably continue. The 60 minute chart shows a spike and channel bear trend. The bear breakout on October 16 was the spike. There was a 3rd push down overnight, and 3 pushes down in a channel usually results in the market behaving like bull flag. This means that there is usually a bull breakout of the bear channel, and then more sideways trading. The selloff last night was strong enough to have a 2nd leg down today or tomorrow, but the chart will soon probably test back up to the top of the bear channel within the next 2 days. This would be a 60 – 80 pip rally.

The daily chart of the USDCAD has 3 pushes down in a tight bear channel after a strong reversal down from a higher high major trend reversal. The selloff is testing the March high, which was the top of a 3 month trading range. There are probably enough traders who see the 3 week selloff as simply a test of support so that the USDCAD daily chart will probably test up this week. The targets are the top of the bear channel on the 60 minute chart, which is the October 7 high. This is also around the 20 day EMA, and it is about 120 pips above the current price.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a trading range day, as expected.

The Emini rallied for a couple of hours at the start and end of the day, and a 2 hour bear swing in between. The day was a trading range day that closed on its high. Although the bears want an expanding triangle bear flag, today was not a good signal bar for the bears, There are still targets above, and the Emini might rally another 20 or more points before there is a swing down. If the bears get a good sell signal bar within the next few days, the swing down might begin on the following day. It does not matter that the daily and 60 minute charts are overbought. There is no top yet.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hello, you said in your 7:08am post What made you think the market would have a swing up and a swing down both lasting at least two hours? I understand that day was likely going to be a trading range day, but why two swings in opposite directions both lasting at least 1 hour? Is this just a common thing to expect on trading range days?

Thank you for the countless hours you spend helping others. Your time is very valuable and we are grateful for your dedication to helping others.

When a day is likely to become a TR day, it is likely to have at least a swing up and a swing down, both lasting at least 2 hours. You never know which will happen first. Without that, traders would usually describe the day as something other than a TR day. This means when traders expect a TR day, they expect at least 2 swings.