Emini Island bottom after second failed island top

Updated 6:50 a.m.

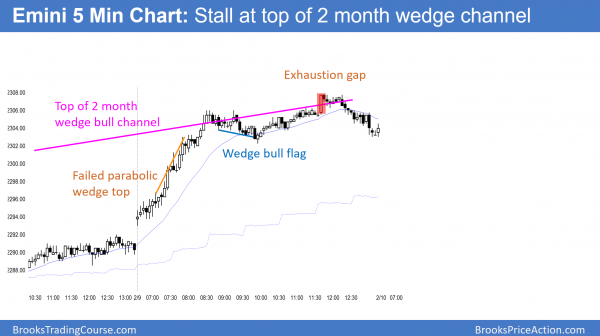

Because today gapped up, it continued yesterday’s bull channel. Yet, the odds still favor a break below the channel because traders see bull channels as bear flags. The odds are that a channel will lead to a trading range instead of a new bull breakout.

The Emini is Always In Long, but it is testing the all-time high. Since the first several bars were dojis, the bulls are not yet strong. This reduces the chances of a successful breakout to a new high. Furthermore, it is trading range price action. It therefore increases the chances that today will be like most days over the past month and have a lot of trading range trading.

Traders are expecting either a breakout above the all-time high or a reversal down. They want to see a strong trend bar and follow-through bar up or down. Until then, this is a limit order market and most traders should wait for the breakout. Alternatively, if the Emini goes sideways for an hour or two, stop order traders will look to buy a reversal up from a double bottom. In addition, they will look to sell a reversal down from a double top.

Pre-Open Market Analysis

The Emini gapped down yesterday and therefore created another island top. Yet, the bulls quickly closed the gap. Since the daily chart is still above the moving average, the odds still favor a new all-time high. In addition, that would be a break above 2300.

Because the rally has lasted a year, the Emini is late in a bull trend. Since gaps usually close then they form late in a bull trend, the odds are that the Emini will trade down to the August high before it reaches its measured move targets between 2340 and 2375. There is no strong top yet. Therefore, most traders want to see one or more strong bear bars before they conclude that the 5% correction has begun.

Daily chart in breakout mode

Since the Emini has been mostly sideways for 2 months, most days have been trading range days. Therefore the odds are that any day will be mostly another trading range day. Yet, traders know that the range has lasted for 2 months, which is a long time. They are therefore prepared for a strong breakout soon, which could be up or down. If there is a bull breakout, it probably will not get far before reversing down to test the August high.

Overnight Emini Globex trading

The Emini is up 2 points in the Globex market. Since the daily chart is in a bull trend and yesterday reversed up from below Tuesday’s low, the odds favor higher prices over the next week. It is stalling just below 2300. The all-time high is a just below 2300, and it is the top of the island top. Yet, the odds favor a breakout above resistance within a week, but not a big rally.

Because yesterday was a bull channel on the 5 minute chart, it is a bear flag. Therefore, even if today gaps above yesterday’s high, the odds favor a break below yesterday’s bull trend line, and then a trading range for at least a couple hours. There is only a 30% chance of a successful bull breakout above yesterday’s bull channel.

While the daily chart is bullish, the 5 minute and 60 minute charts are in weak rallies. They therefore have a lot of trading range price action.

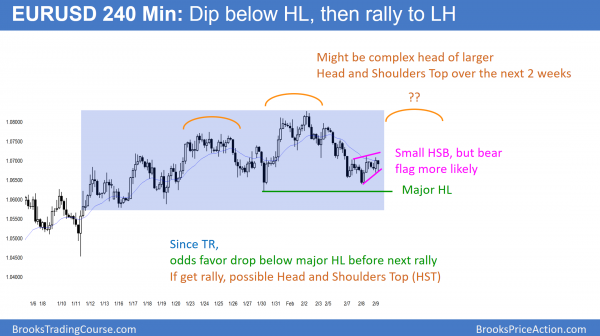

EURUSD Forex Market Trading Strategies

The 240 minute EURUSD chart is in a trading range and therefore will probably fall below the major higher low before rallying much higher. Regardless of whether it does, the rally will probably form a head and shoulders top.

The 240 minute EURUSD Forex chart is finding support above its major higher low of last week. Yet, because it is in a trading range, it will probably fall below that support before rallying. Whether or not it does, the next rally will probably stall below last week’s high. The bears will therefore attempt to create a big head and shoulders top.

Overnight Forex trading

The EURUSD Forex market was in a narrow range overnight. It is therefore deciding whether to fall below its major higher low from last week. While the 240 minute chart has a small head and shoulders bottom over the past 3 days, it is more likely a bear flag. Therefore, it will probably lead to a break below last week’s low.

Since it has been in a trading range for a month, the bear breakout will probably reverse up. Therefore the trading range will probably continue. The rally to test last week’s high will probably fail. The bears will then therefore try to create a head and shoulders top.

If there is a bear breakout over the next few days, the bulls will probably buy below last week’s low. If there is a bull breakout, bears will probably sell above the small head and shoulders bottom. This is because the odds favor a break below last week’s low before there is much of a rally.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped up and the entered a strong bull trend for 2 hours. It broke above the top of the 2 month wedge channel, but stalled. Furthermore, it broke above the island top on the daily chart and 2300. It pulled back after a buy climax at the end of the day.

After a strong breakout to a new all-time high, the Emini spent most of the day in a broad bull channel and trading range. In addition to the new high, it broke above the 2300 big round number.

Furthermore, it broke above the top of the 3 month wedge top. Yet, it stalled there and pulled back at the end of the day. Since most bull breakouts above bull channels fail, the odds are that this one will fail within 5 days.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

Would you say that the emini is headed for the MM targets above? You mention in your commentary that the breakout will fail within 5 days… what would make you believe different?

The odds are that it will reach the targets because a trend rarely ends before reaching every target. Yet, when there is a gap late in a trend, the gap usually closes before reaching the targets. I therefore think that the Emini will correct down about 5% and then have one final rally to the targets before a test down below 1800.