Emini end of quarter window dressing and July 4 seasonally bullish

Updated 7:00 a.m.

The Emini sold off strongly from yesterday’s high. The bears want a strong bear trend day. They they want today to again trigger the sell signal on the weekly chart by falling below last week’s low. Yet, after Tuesday’s wedge bottom, a higher low and 2nd leg up are more likely than a bear trend day. While the Emini is Always In Short, it formed a good bull bar on the 4th bar. This reduces the chances of a big bear trend day, even if there are a couple more brief legs down.

The bulls are trying to form a test of the low of last week, and then a bull channel for the rest of the day. They probably will need to go sideways for an hour or so before they can take control, if they take control. They want a higher low major trend reversal after Tuesday’s wedge bottom.

The odds are against a big bear trend day. More likely, today will be a trading range day or a weak bull reversal day (bull channel). However, the bulls have not yet stopped the selling and the Emini might test below last week’s low before the bulls can form a trading range or bull channel.

Pre-Open market analysis

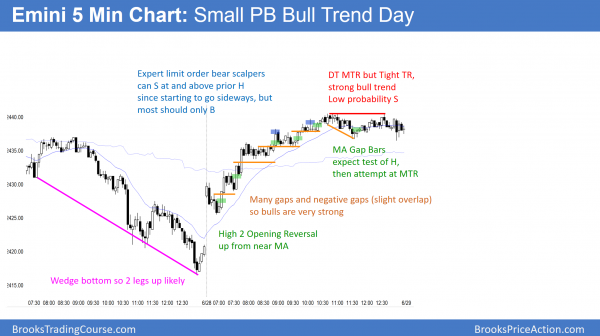

The Emini yesterday was in a small pullback bull trend. Furthermore, it traded above Tuesday’s high, completely reversing the selloff. In addition, it traded far above the low of last week. The odds are against a strong bear trend day today. However, since there has been so much trading range trading over the past month, the odds are against a 2nd consecutive strong bull trend day as well. Therefore today will probably be another trading range day.

Weekly and monthly charts

Tomorrow is the last day of the week and month. Therefore, weekly support and resistance will be important through tomorrow’s close. Although the bulls would prefer a close at a new all-time high tomorrow, they will be happy if they can just prevent the bears from forming a bear body on the weekly and monthly charts. Consequently, they want tomorrow to close above the open of the week and the open of the month.

Since the weekly chart is so unusually climactic, the odds are that a breakout to a new high would be brief and not go very far.

Because yesterday triggered a sell on the weekly chart by breaking below last week’s low, the bears want follow-through selling. Hence, they would like this week to close below last week’s low.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex market. When a reversal up is strong, like yesterday, the odds are against a reversal back down today. Hence, a bear trend day is unlikely. However, despite yesterday’s small pullback bull trend, it was mostly sideways for 4 hours. In addition, it is at the top of a 5 week trading range. While the momentum up was strong, the odds are that it will be mostly sideways today.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday.

EURUSD Forex market trading strategies

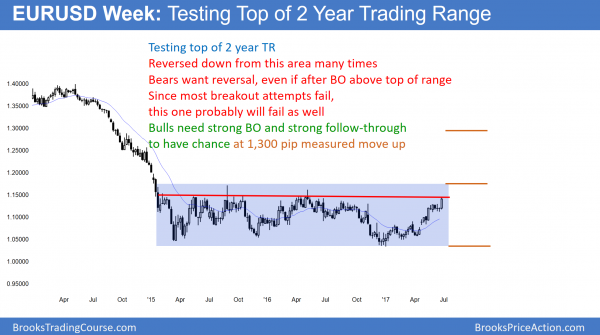

The EURUSD weekly Forex chart has broken above the November 9 major lower high. It is now testing the top of the trading range. Since most trading range breakout attempts fail, this one probably will as well. The bulls need both a strong breakout above the range and strong follow-through buying before traders believe that the trading range has evolved into a bull trend.

Since bear trends need lower highs, the breakout above the November 9 major lower high on the daily chart is important. Before this week, the EURUSD chart was slightly more bearish than bullish. Since the daily chart is now no longer making lower highs, traders will conclude that the 2 year bear channel has ended. It is now more solidly in neutral. To become a bull trend, it needs to break strongly above the top of the range.

Since the weekly chart has tested this 1.1400 – 1.1500 many times over the past 2 years and reversed down every time, what is more likely? A reversal is always more likely than a breakout when any market is in a range. Hence, as strong as this 6 month rally has been, it is more likely to be just another bull leg in the range than the start of a bull trend. Yet, if the bulls create a few more bars like this week over the next few weeks, the probability will shift in their favor.

If a failed breakout is likely, what will happen? Look at all of the other attempts over the past 2 years. Each was followed by a trading range lasting a month or two. Therefore, that is what is likely to happen here.

Overnight EURUSD Forex trading

The EURUSD 60 minute chart rallied strongly for 2 days. However, the rally has had several buy climaxes, and that usually leads to a trading range. While the momentum up has been strong, the daily chart is now at an area where is has stalled many times over the past 2 years. Furthermore, it has been in a 40 pip range overnight. The odds are that today will continue that range. Hence, day traders will scalp today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off from yesterday’s high and traded below yesterday’s low. In addition, it traded below the open of the month and the bottom of the month long trading range. Finally, it came close to the 2400 Big Round Number. Yet, it reversed up strongly in the 2nd half of the day

The Emini fell below the open of the month and the low of the 3 week trading range. The bears want the month to close below its open so that June will be a bear reversal bar on the monthly chart. Yet, the bulls reversed up strongly from just above the 2400 Big Round Number and the low of the June trading range. Big Down, Big Up creates Big Confusion. Since confusion usually results in a trading range, tomorrow will probably be a trading range day. Moreover, it might be mostly between the low of last week and the open of the month.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

Was the entry below 19 just 3D? Thanks

The Always In Bears have to sell again if they exited on the reversal up. Because the 3rd bar down was a doji, many traders waited to see if it had a bear close. Once it did, many sold at the market. Others sold below the bar. The result was a bear bar closing on its low. This represented everyone deciding that the bears were back in control.