Posted 7:02 a.m.

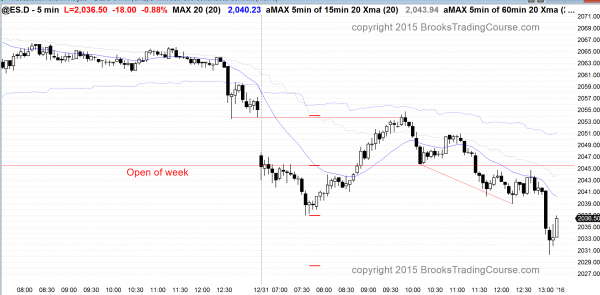

The Emini opened with a gap down, but it was followed by several bars with prominent tails. This was weak follow-through selling and it reduces the chances of a strong bear trend. The Emini is Always In Short, but it is far below the moving average, it is forming a lot of tails, and bulls have been able to make profitable limit order scalp. These facts increase the chances that it will go sideways to up until it gets closer to the moving average. A lot of trading range price action today was already likely, from what I wrote below. If there is a strong breakout up or down, or a strong buy or sell setup, traders will swing trade. Until then, they will continue to scalp.

Pre-Open Market Analysis

S&P 500 Emini: Day trading strategy for trading range price action

The Emini is down 8 points in the Globex session. I said before the open yesterday that the Emini was overbought on the daily chart and would probably pull back. The pullback continued through the night.

Today is particularly interesting because it is the last day of the year (and of the month). This means that monthly and yearly support and resistance can act as magnets, especially in the final hour. Monthly support and resistance include the opens, highs, lows and closes of this and last month. All are probably too far to be factors today.

This month’s open was 2080. Since that is 35 points above the current Globex price, it will not likely be reached today. The same is true of the low of this and last month. They are too far below to have much chance of being tested today. That leaves the yearly chart. The most important price is the close of last year at 2020.25. Although that is 26 points below the Globex price and unlikely to be reached, it is possible. Its importance is that if today closes below that level, the Emini will be down on the year, which it has not been since I think 2008.

Most likely the yearly chart will have a doji candlestick pattern, with a close just above the open. The monthly chart will also be a doji, but with a bear body.

New Year’s Eve can be very quiet. Much of the trading over the past several days, especially yesterday, has been within tight trading ranges, and that will probably true as well today. However, even the tightest of tight trading ranges can still have a big move on huge volume in the final 30 minutes. Just look at 2009. There were many bars that were only 1 tick tall and had fewer than 1,000 contracts traded. However, in the final 30 minutes, there was a big Sell The Close bear breakout, and one of the bars had 76,000 contracts! Those who trade the market for a living know that the computers never go on vacation and a big move with huge volume can come at any time. Those learning how to trade need to learn how to accept what the market is doing and trade appropriately. They cannot look at the market and deny that what is in front of them can possibly happen.

Today will open with a gap down. The next support is the low of the pullback from 2 days ago, around 2035. Resistance is at yesterday’s low and then the 60 minute moving average. Although the big gap down will increase the chances of a trend day, the odds still favor mostly tight trading range trading. Unless there is a strong breakout up or down, day traders will be inclined to mostly scalp. If there is a lot of tight trading range price action, they will look to enter with limit orders at the top and bottom of the range, and scalp.

Forex: Best trading strategies

I have been saying for the past week that the EURUSD would probably test down to around 1.0800 because that was the bottom of a weak rally that began on December 23. A weak rally after a buy climax is usually a bull leg in what will become a trading range. That made the test down likely.

In the European session, the EURUSD sold off for a few hours, but it has been sideways for the past hour. The overnight bear breakout was the start of a 2nd leg down in a 2 week trading range on the 60 minute chart. Trading ranges usually have many 2 legged moves. Since there is still room to the target below, this 2nd leg down might fall further.

The bears want the overnight selloff to create a measuring gap. This could happen if there is a bounce today that stays below yesterday’s trading range. The gap could be the middle of the move down from the December 28 high. As you might expect, the measured move projection is around 1.0800, which is the bottom of the December 23 pullback. The bears see that as the neck line of a head and shoulders top. Most head and shoulders tops fail to reverse a market.

Even if there is a breakout below, the odds still are that it will be bought. The December 3 rally was so strong that a deep pullback lasting a month or more was likely, and that a 2nd leg up from there is likely as well. The EURUSD is probing to find where the buyers will come back and create that 2nd leg up. Less likely, the bears will succeed in pushing the market below the bottom of the December 3 strong bull trend reversal. Until they do, the probability favors a 2nd leg up.

New Year’s Eve is usually a quiet day for financial markets. They tend to spend most of their time in tight trading ranges. If the range is too tight, most traders should not trade. Those who do will use mostly limit orders to buy bear bars and below bars near the bottom, sell bull bars and above bars near the top, and scalp for 10 – 20 pips. If there is a strong breakout in either direction, they will swing trade, they instead expect breakouts to be brief and quickly reverse.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had several good swing trades up and down. It was a trading range day, but closed near the low.

The swings today oscillated around the open of the week. The market tested it late, but could not get above it and reversed down to a new low. The week ended up as a doji candlestick pattern, reflecting its neutrality. It is in the middle of a 2 month trading range. There is still a 50% chance of a new all-time high before a test of the August low. Because today was neutral, it increases the chances of more trading range trading on Monday. Monday is the 1st day of the year, which gives it more of a chance of a low probability event, like an unexpected big move up or down or a surprise reversal.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.