Posted 7:08 a.m.

The Emini began with a trend from the open bull trend after a big gap down to the midpoint of the sell entries on the daily chart for the scale in bears. However, 5 of the 1st 6 bars had prominent tails, which is trading range price action. The next downside target is a 50% correction of the entire rally, and that is around 1910. Since the daily chart is probably in a trading range and this is a big move down, the odds of much more down are probably not high.

However, because the daily chart is also in a bear trend, the chance of a downside surprise (big bear trend day) is significant. At the moment, the price action is trading range price action, and this means that the day will probably spend a lot of time in a trading range. The swings might be big, but the odds of a trading range at this point are greater than those of a strong trend day in either direction. Day traders will be willing to swing trade, but most assume that any swing will end within 2 – 3 hours, and it will then probably be followed by an opposite swing.

If the Emini enters a clear trading range, traders should look to buy low, sell high and scalp. Scalps are 4 or more points when the range is this big. If a reversal is not clear, traders should wait for a 2nd signal or a strong breakout. Be very careful buying a strong breakout near the top or selling a strong breakout near the bottom, unless the day becomes a clear trend day.

Pre-Open Market Analysis

S&P 500 Emini: Day trading strategy when the candlestick pattern is a gap down

I have been saying that the strong rally in the Emini over the past week is a rally in a bear trend. As I am writing, the Emini is down 49 points. The bulls are hoping that this selloff will lead to a higher low major trend reversal, and it might. I think that there is better than a 50% chance that the Emini will test between 2000 and 2050 before the next bear leg begins, and that there is a 50% chance that it will test the October low, whether or not it tests higher first.

The first important support is last week’s low close of 1868.75. There are scale in bears who sold that close. They were disappointed by this rally. Although they scaled in higher, they would like the Emini to get back to the low close. Many will exit breakeven on their 1st entry and with a profit on their second.

Many will be so disappointed that they will simply try to get out breakeven on their entire short. They need the Emini to fall halfway between their 2 short entry prices, which is around a 50% pullback. That is just about where the Emini will open today. If disappointed scale in bears buy back shorts here, there could be an early reversal up and a bull trend day. If they instead are confident that they have regained control, they will not buy. Other bears will short. The result will be a test of last week’s low close.

The Emini fell big and rallied big. Big down, big up creates big confusion, which is a hallmark of a trading range. The odds are that the Emini is in a trading range, and that bulls and bears will buy this selloff, even if it falls to last week’s low close at some point this week.

However, the odds also are that the daily chart is Always In Short and that the trading range will have a bear breakout and then some kind of measured move down. The current trading range on the daily chart can be brief, and it might already have ended with the overnight sell off. I think it is more likely that September will be an inside bar on the monthly chart, which means that the trading range will probably last at least a month or two.

The Globex 5 minute chart is in its 3rd leg down. When the Emini opens, it will be around a 50% pullback from last week’s rally in an environment where a trading range is likely. Although a big gap can lead to a big trend in either direction, and a big gap down usually means that the odds of a bear trend day are slightly higher than those for a bull trend day, and day traders should not be in denial if there is an early low of the day and strong reversal up. A big gap increases the chances of a trend day. There should be at least one big swing up or down today.

The day’s range and the bars will probably be big. Traders learning how to trade online can see where the stops have to be. If the risk is too much and they are unwilling or unable to use the correct Emini stop, online day traders should either not trade, or trade some other market, like the VXX or XIV, or options.

Forex: Yen and Canadian Dollar strength overnight

i am writing 45 minutes before the NYSE opens on Tuesday. The Yen and Canadian Dollar were strong overnight. The EURUSD was in a trading range overnight, as it has been for 4 days.

The daily chart of the EURJPY broke below a wedge bear flag last week and is falling toward the bottom of the July 9 bear channel at 133.30, which is 140 pips below. The overnight selling on the 5 minute chart is in its 2nd leg down. The rally after the first leg down last night was strong, and this means that there is a 40% chance that the bulls will be able to create a swing up today from a lower lower major trend reversal. However, there is a 60% chance that the best the 5 minute bulls will get is a trading range, and those trading Forex markets for a living will focus on selling rallies until there is a clear bottom or a strong reversal up. However, they will begin to buy new lows and scale in lower for scalps. The USDJPY has a similar 5 minute chart.

The USDCAD 240 minute chart is deciding whether the swing down has begun or if there will be one more new high before the swing down begins. Once it is clear that the bears have taken control, the 1st target is the bottom of the wedge, which is around 1.2900, 300 pips below. Although there was a strong bear breakout last night, the pullback from the 1st leg down was strong. Traders learning how to trade the markets have to be aware that, like with the EURJPY, a strong pullback is followed 40% of the time by the final bear leg before the market creates a swing up.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

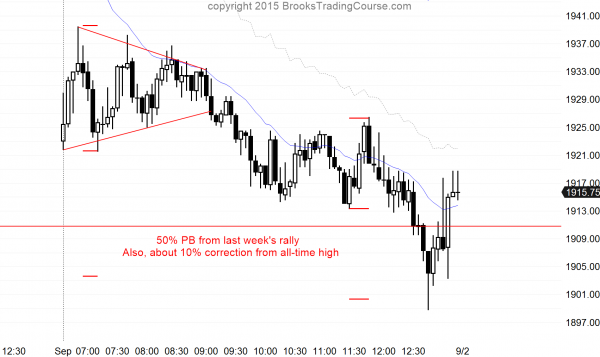

After a big gap down, the Emini had a trending trading range day that tested to just below a 50% pullback from last week’s rally and a 10% correction from the all-time high. It found buyers at the end of the day.

The bulls had a 3 day island bottom on the daily chart last week, and today’s gap down created a 3 day island top. The odds are that the daily chart will go sideways for a month or two. The bottom targets are the support at last week’s lowest close and last week’s low, and the upside targets are the resistance at the bottom of the trading range, which is around 2,000 to 2,050.

Since today reversed up from below a 50% pullback from last week’s strong rally, the odds are that the Emini will try to rally again tomorrow. However, since it found support at the 50% pullback and at the 10% correction level, it might instead go sideways for a day or two. Although it might continue down to last week’s low close, the odds are that there will be buyers there. Even though the daily chart is in a bear trend, a trading range is likely for at least a month. August was such a big bar that September will probably not get above its high or below its low.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.