Emini bulls want follow-through buying after breakout and buy climax

Updated 6:53 a.m.

The Emini gapped above Friday’s high and therefore triggered a buy signal on the daily chart. However, the gap was small and the next 3 bars were strong bear bars. The Emini is Always in Short, and there is a 50% chance that it has already formed the high for the day. In addition, Friday was a small day so today has an increased chance of being an outside down day. However, there will probably be buyers below Friday’s low after last week’s strong rally.

At the moment, the Emini is likely to be either a bear trend day or a trading range day. The initial selloff was big enough to make a bull trend day unlikely.

Pre-Open market analysis

Last week had an extremely strong buy climax. However, that means that it was climactic. While it might continue a little further, the odds favor a transition into a tight trading range within a week. Friday was a small day and therefore a pause. It is a buy signal bar for today. However, after Thursday’s extreme buy climax, there might be sellers above. The odds are the the Emini will go at least a little higher, but last week was so climactic that this week might have to go mostly sideways.

When a rally is as strong as last week’s, there is an increased risk of a big bear day. Yet, even if the bears get a reversal for a day or two, the odds still favor higher prices. A strong bull trend usually has to transition into a trading range for 10 or more bars before the bears can take control. This means the risk of a reversal into a bear trend over the next week is small.

Overnight Emini Globex trading

The Emini is up 4 points in the Globex market. The odds are that the day session will trade above Friday’s high and therefore trigger the buy signal on the daily chart. Yet, Thursday was a buy climax late in a bull swing, and Friday was a doji bar on the daily chart. This usually leads to a tight trading range within a few days. Trading ranges on the daily chart usually have bull and bear swings on the 5 minute chart. Because a tight trading range is likely, day traders will start looking for bear swings. Most days over the past week only had bull swings.

Last week was strongly bullish. Therefore there is an increased chance of 1 or 2 more strong bull days before the tight trading range begins. Furthermore, the odds are against a strong bear day today. However, if the Emini is beginning a tight trading range, it will probably have one or more bear trend days within the range.

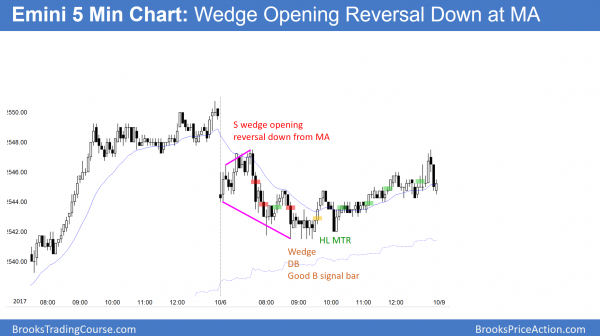

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

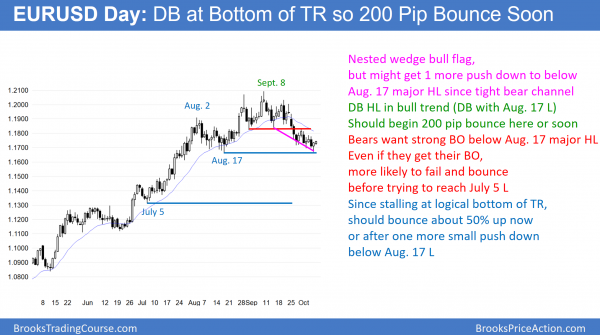

The selloff on the daily EURUSD Forex chart from the small head and shoulders top is stalling just above the August 17 major higher low. This is an attempt to form a double bottom. In addition, it is in a nested wedge bear channel, and now has a good bull reversal bar. The odds favor a 50% pullback over the next few weeks, but there might be a brief breakout below the double bottom first.

The EURUSD daily chart has been in a trading range for 3 months after a strong rally. As long as the selloff holds above the August 17 major higher low, the chart is also in a bull trend. If the selloff falls below, then the chart is in a trading range and a bear trend. The difference is minimal because without a strong bear breakout, it is still more of a trading range than a bear trend. Consequently, the odds are that it will continue in the range for at least a few more weeks.

Since it is in a trading range, bulls and bears will be disappointed. Each wants a trend, and a trading range resists chance. Therefore, unless the bears get a strong breakout below the range, the odds are that a bear breakout will fail. This means that it is more likely that the daily chart will test back up to the middle of the range over the next several weeks than break strongly below.

Nested wedge bottomOvernight EURUSD Forex trading

By trading above Friday’s high, the EURUSD daily chart triggered a buy signal. The bulls have a nested wedge bottom and a double bottom (with the August 17 low). However, if they do not get one or two big bull bars or 3 or 4 small bull bars over the next week, the odds would favor a brief break below the wedge bottom and the August 17 major higher low. Consequently, while the odds favor a swing up on the daily chart, there might be one more brief swing down on the 5 minute chart.

Traders are now deciding whether the bottom is sufficient. They will only become confident once they’ve seen a reversal up. There is therefore an increase chance of a series of bull days over the next couple of weeks. However, since trading ranges disappoint bull and bears and often fall below support before rallying, there might be one or two bear trend days before the 200 pip rally.

The odds of a successful bear breakout and a measured move down without 1st bouncing 200 pips are under 40%.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

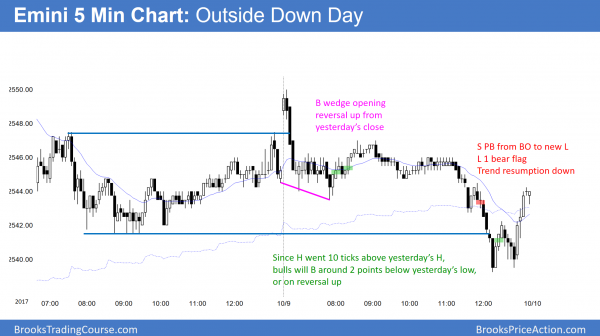

The Emini reversed down from above yesterday’s high and then entered a tight trading range. The bear trend resumed and fell below yesterday’s low. This created an outside down day.

The Emini had an outside down day today. Today’s high therefore formed a micro double top with Thursday’s high. Yet, the bull trend on the daily chart has been strong. Therefore the odds are that the best the bears will get is a 1 – 3 day pullback before the bulls have one more leg up. Since the weekly and monthly charts are so extremely overbought, any new high will probably be small. The odds favor a 100 – 200 point pullback starting within a month or two.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al,

I viewed strong sell off on open as L2/DT on 60 min chart, which gave good context for swing, when 5 min formed wedge and retreated 60 min chart by 50%. i remembered you saying ones, that you often look on 5 min for 50% PB, when good signal bar forms.

Could you please comment?

I also wondered if there is any chance to post some old charts (5 years does not matter), which would show your live trades (preferably good scalping day), so I could study your MM. I think TR with many trades would be great, but of course understand, if you do not wanna do that, but I think it would be great to learn from.

thx

Hi Al,

Why did you say “Bull will B 2pts below LOY since H went 10 ticks above HOY”? How did you calculate it?

Thanks,Jin

I talked about this in the chat room today long before it happened and again just before. When there is an outside day, the size of the 2 breakouts is usually similar. Since the breakout above yesterday’s high was 10 ticks, the breakout below was likely to be very close to that. Therefore, bulls would buy around 8 ticks (2 points) below yesterday’s low. They did!

Thank you so much, Al.