Trading Update: Monday July 25, 2022

Emini pre-open market analysis

Emini daily chart

- The bulls broke above the neckline (June 28) of the double bottom (July 14) last week. Bulls want breakout to lead to a measured move up and test of the June 2nd major low or high. The measured move from the July 14 low to the June 28 high projects up to 4176.25, and the June 2nd high is 4178.75, which is the target for the bulls.

- The bears want the opposite and hope that this rally will lead to a failed breakout of the neckline (June 28) of the double bottom, leading to a wedge.

- The bears will likely need at least a micro double top before they can hope for a reversal down.

- The bulls have a 7-bar bull micro channel since the July 14 low, which is a sign of strong bulls.

- The bear close on Friday is not enough for the bulls to give up below the bar. If the market trades below this low, the odds will favor a new high above the bar or at least a test of the high of the bar.

- While the probability of more up favors the bulls right now, it would not take much for the probability to become more neutral. If the market begins to go sideways around last Friday’s close, that will begin to neutralize the probability and bring it back down to 50-50.

- It is still possible the bears get a micro double top which would be a larger double top on June 28, and the neckline would be July 14. If the bears break below the neckline, the market might get a new low below June and form a larger wedge bottom (May, June, new low).

- Overall, the bulls have a chance here, and they need to do something with it. Right now, the market is always in long, so better to be long than short.

Emini 5-minute chart and what to expect today

- Emini is up 12 points in the overnight Globex session.

- The Globex market has been in a bull trend since early this morning.

- Bulls hope today will lead to continued buying and a close above last Friday’s high.

- While the odds favor high prices, the market may have to go sideways for a couple of days, so traders should expect more trading range days for at least a day or two.

- As always, traders should expect a trading range open and be patient. It is important not to be in too much of a rush on the open.

- On the open, the bars can be big and reverse quickly, which means a trader can lose a lot of points on the open and spend the rest of the day trying to get back to breakeven.

- One thing that Al often says: “if today is going to be a strong trend day, there will be plenty of opportunities to enter.” Al’s point is to not be in a rush on the open to enter a breakout and to wait for the breakout to break above/below the opening range clearly.

- Again, most breakout on the open fail, so most traders should be cautious and consider waiting for 6-12 bars before placing a trade.

- Since most trading ranges often form some kind of double top/bottom or wedge top/bottom, one can consider waiting for one of those above patterns to form before buying.

- Lastly, in general, the initial breakout on the open has a 50% chance of completely reversing, which is another reason traders should be cautious.

- Traders should pay attention to the open of the day, especially if it is within the middle of the day’s range late in the day. The open of the day may be a magnet all day as traders decide on today having a bull or bear close.

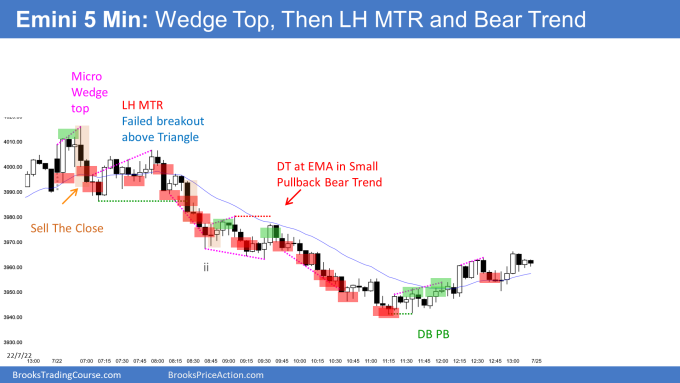

Friday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

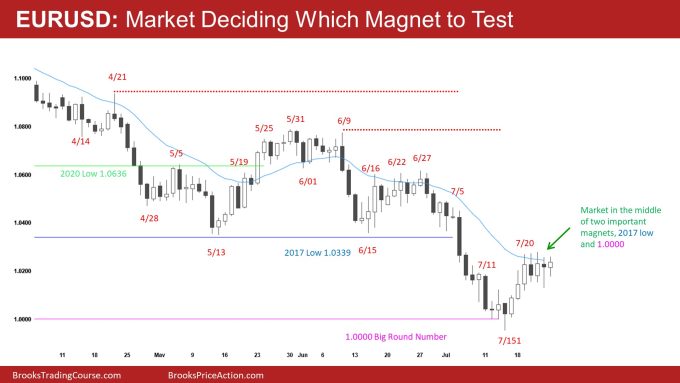

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD continues to go sideways at the moving average (blue line). The market is in the middle of two important targets, the 2017 low and the 1.0000 big round number.

- It is common for the market to begin to go sideways and enter breakout mode right in between two major price levels.

- At the moment, the odds slightly favor the bulls, but not by much. If the probability were high, the market would not be going sideways here, and it would be racing up or down.

- Ultimately, the breakout below the May – June trading range will likely lead to a final flag, and the market will have to reverse back into this trading range.

- The longer the market goes sideways at this price level, the more the probability becomes 50% for the breakout up or down.

- Overall, the odds favor a test of the 2017 low regardless of if the market has to retest the 1.0000 big round number first.

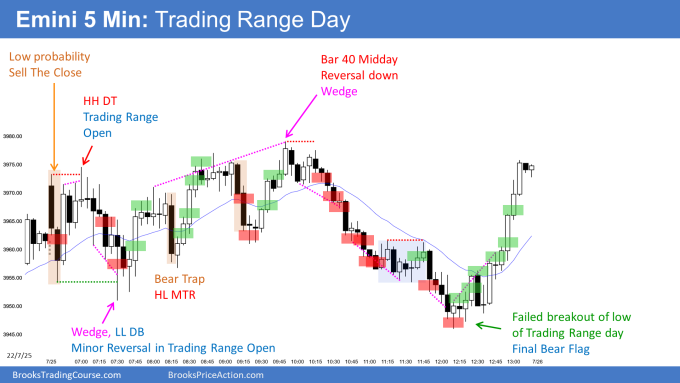

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day summary

- Today was a trading range day with a late rally test of the open of the day.

- The market formed a double top and bottom on the open, which is a breakout mode pattern.

- The bulls tried several times to get the upside breakout. However, the market formed a wedge top around bar 40, a common place for a midday reversal.

- By 10:00, the bears have done a good job increasing the selling pressure, so the odds were that the bull channel would convert into a trading range soon.

- The bears got a strong breakout with follow-through around 10:30, which increased the odds of a couple of legs down.

- The bears ended up forming consecutive wedge bottoms around 12:15, and the market had a strong reversal up into the close.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Hi!

I just want make one observation. The market at the end of the day often tests S/R. So if you have a reversal day – today we had a bull trend for the first half and after we’re have a bear trend – it might be testing some S/R. In this case: low of the day. Therefore, if the market gets near the target is good to be prepared for a reversal.

STC Bear trend starting to early (around bar 64) and so close to suport (low 12), probably not going to make it to the end of the day.

Anyway, we have a double bottom testing low of the day and fail breakout and second entry on bar 70.

Also, how we have a trading range day, probably the market go back to test the open of the day, which the market really did.

Tks for share your study.

Att,

Brad hey, thanks for the report. I do have a question re always in swing entry. Up to bar 40 it was a TR / Broad bull chancel where bulls and bears made money assuming they bet right . Bar 42 was a L1 entry bar and bar 46 L2 entry bar that have lead to a great swing short down to bar 68, it was also the bears MM target from the high of the L2 sell signal (bar 45) to the close of bar 50 that become a measuring gap i think. At which stage can you assume this is swing entry sell with an hope for at least 2 legs down? Can I assume bar 54 was a confirmation that we are heading toward MM target based on the L2 sell signal to the low of bar 50?

Hi Eli,

Bar 41 is a L1 and also a wedge top with 6,28, and bar 41. The day looked like a leg up in a trading range, and typically and it is common to see a reversal around the middle of the day (bar 40). Once the market clearly became Always in short and sell the close on bar 48, traders were selling all the way aggressively down.

Since the market was in a trading range and the bears broke below possible lows in the range, traders will look for some measured move from the high of the rally (bar 41) to the low of something like bar 34. Although this target was never hit, one has to think about the overall premise of the sell-off; it is a bear breakout below a double bottom (34 and 51) which is an attempt at a trading range. This means traders will expect some measured move down, which happened to be bar 41 high to the bar 51 low. Also, the bar 51 low was tested twice on bar 57 and bar 63.

Thanks Brad for clearing this up.