Earnings and North Korea’s nuclear program are catalysts for correction

Updated 6:46 a.m.

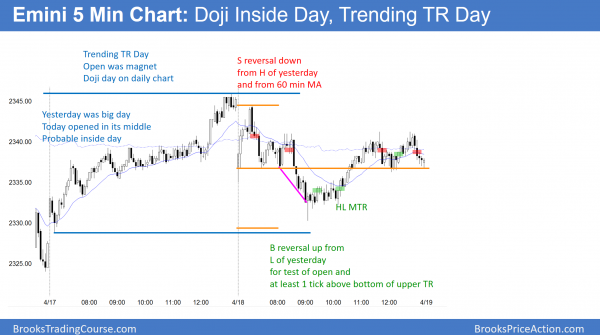

The Emini gapped back below the 60 minute moving average and into yesterday’s 4 hour trading range. In addition, it broke below yesterday’s bull channel. Finally, it pulled back to the middle of yesterday’s range, and yesterday had a big range. These factors therefore increase the odds that today will be mostly a trading range day.

While the Emini rallied on the open, it will probably not break strongly above yesterday’s high. Since a 2nd leg up is likely after the 60 minute wedge bottom, today will probably not break below yesterday’s low.

The Emini is Always In Long, but because a trading range day is likely, this opening rally might become an early high of the day. Traders will therefore look for a reversal down from a test of yesterday’s high or the 60 minute moving average. The bears will need at least a micro double top or a parabolic wedge top. Even if the bulls get a 1 – 2 hour rally, the odds are that it will lead to a swing down after a couple of hours.

Pre-Open market analysis

The Emini reversed up yesterday from a nested wedge bottom on the 60 minute chart. Furthermore, the reversal was from above the March 27 major higher low. Consequently, the bulls are hoping that the bull trend will resume. The minimum goal is a 2 legged rally on the biggest time frame that shows the pattern. That is the 240 minute chart. Hence, the odds are that there will be a pullback within a day or two. Furthermore, the odds favor a higher low and a 2nd leg sideways to up over the next several days.

Yet, the sell climaxes make it likely that the daily chart is in an early bear trend. As a result, the rally over the next week will probably fail to break above the March 15 major lower high. Therefore, the bears will sell the rally, knowing that the Emini will probably break below the March 27 low within a month or two. In addition, they expect a 5% correction down to the close of last year. Hence, they expect the correction to take back all of the 2017 gains.

Overnight Emini Globex trading

The Emini is down 6 points in the Globex market. Since yesterday’s rally was not particularly strong, it will probably be just a leg up in the bear channel on the daily charge. Yet, it follows a wedge bottom on the 240 minute chart. Consequently, if there is a pullback over the next few days, the bulls will probably buy it and create a 2nd leg sideways to up.

Since the daily chart is likely in an early bear trend, the rally will probably be just a bull leg in the bear channel. The odds therefore are that the rally will fail to get above the March 15 major lower high. Unless the bulls break above that high, the odds are that the daily chart is in a bear trend. Furthermore, the rally may even fail to get above the April 5 minor lower high before the bear trend resumes.

EURUSD Forex market trading strategies

The 240 minute EURUSD Forex chart is rallying from a head and shoulders bottom. If the bulls get a breakout, the targets are a measured move up and a 50% correction. Hence, that would also be a test of prior highs and lows.

The EURUSD Forex market turned up from a higher low major trend reversal yesterday. Yet, it has not yet broken strongly above the 3 week trading range. The 2 day rally has been strong. In addition, the EURUSD market is reversing up from the bottom of a 6 month bull channel. Consequently, the odds are that the bulls will get a successful breakout. The rally therefore will probably extend at least another 50 pips over the next week.

The bears hope that the rally is simply a buy vacuum test of the top of the 3 week trading range. They therefore want it to reverse down. That reversal would therefore be a double top with the high of 2 weeks ago.

Overnight EURUSD Forex trading

The EURUSD Forex market rallied over the past 2 hours. It is testing above the top of the 3 week trading range. The minimum goal for the bottom on the 240 minute chart was 10 bars and 2 legs sideways to up. The bulls have achieved that goal, and they therefore might take profits at any time. In addition, the bears might sell aggressively at any time as well.

Yet, because the rally has been strong, the odds favor a successful breakout above the 3 week range. Traders will therefore look at higher resistance levels before selling. Hence, the EURUSD market could rally for several more days before there is a reversal attempt.

Will today be another strong bull trend day? Since the EURUSD market is within nested trading ranges, the odds are that the bulls will be disappointed. Therefore, they will probably get bad follow-through buying today or tomorrow. Consequently, it is more likely that this rally will simply be a bull leg in nested trading ranges, and not the start of a strong bull trend. Hence, the 17 month trading range shows no sign of converting into a trend.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Today reversed down from 6 ticks below yesterday’s high and then from 6 ticks above its low. It was therefore was an inside day. The bulls want today’s low to be a higher low major trend reversal on the 60 minute chart.

After yesterday’s reversal up from a wedge bottom, bulls expect a 2nd leg up. Today reversed up from above yesterday’s low. It therefore became a higher low major trend reversal. Yet, there are not many bars in the legs down or up today. Consequently, the Emini might go sideways again tomorrow. That would therefore increase the number of bars in the higher low on the 60 minute chart. Hence, it would make the pattern more major.

Because the weekly chart has such a strong sell setup, any rally over the next week or so will probably form a lower high on the daily chart. Furthermore, there is a 60% chance that a 5% correction is underway. Yet, the bears need a strong break below the March 27 major higher low before traders believe that a 5% correction is likely. I allready have enough evidence.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.