Day trading tight trading ranges: Updated around 6:55 a.m.

The Emini sold off early on most days over the past couple of weeks. Yet, bulls came in and created Opening Reversals. This sometimes resulted in a low of the day, and other times it simply halted the selling for an hour or so. The bulls are trying to do this again today.

The early selloff was strong enough so that a trading range is more likely than the start of a bull trend day. However, if the bulls are able to create a series of strong bull trend bars and get to a new high, today could still be a bull trend day. If it is a bull trend day, it will probably be a weak one.

More likely, this early selling will probably limit today’s upside. The Big Up Big Down from the end of yesterday will probably be followed by a trading range for an hour or so. It is possible that today could be a big bear trend day, but this too is unlikely. This is a trading range open in a 5 day trading range. The Emini is Always In Short and today could be a bear trend day. Yet, the odds at the moment are against a strong trend day up or down.

A confusing open is a sign that trading range price action is in control. It increases the chances that today will have a lot of trading range price action, especially over the 1st hour.

The Emini remains in a tight trading range: Pre-Open Market Analysis

The Emini yesterday triggered a sell by trading below Monday’s low. Monday was an ioi breakout mode signal bar. Because the momentum has been strong for 2 weeks, the odds were that there would be buyers below Monday’s low. Therefore, a bear reversal was a low probability bet.

Emini bull flag on the daily chart

The Emini has now had a 4 bar pullback on the daily chart. Last week, I said that the Emini was likely to have a 2 – 5 day pullback. It has now met what I think is a reasonable minimum. As a result of the extremely strong rally, the stop for the bulls last week was about 100 points (5%) down. That is too much for many institutions to risk. They reduce the risk by taking partial or full profits. When these bulls sell, the Emini stops going up, and it sometimes goes down.

Is the pullback over? It is too early to tell. However, with yesterday’s lack of momentum, the odds are that the complacency will continue today, adding another bar to the bull flag.

I also said that the bull flag might pull back 30 – 40 points. This is still probable, even if the Emini rallies to a new high over the next couple of day. When a pullback in a strong bull trend only lasts 4 – 5 bars, many firms will not tighten their stops unless there is a strong bull breakout. This means that many firms still want to reduce their position size. This is true even if the Emini breaks to a new high today or tomorrow. As a result, the pullback will probably last at least a few more days.

Emini in the Globex session

The Emini is up about 5 points in the Globex session. Today might gap up to a new all-time high. It is possible that this could be the start of a strong bull trend resumption. It is more likely just a bull leg in the growing 4 day trading range. If there is a strong breakout up or down, traders will mostly swing trade. Yet, the trading range price action of the past 4 days will make traders hesitant. They want to see a strong breakout with follow-through before they will change from limit order scalping to swing trading. The odds are against a strong bull trend when the stop on the daily chart is so far below and the past 4 days have been tight trading ranges.

What about another leg up?

The daily chart is in a strong bull trend. Yet, the stop for the bulls is about 100 points below. The 4 day tight trading range is too small for bulls to raise their stop to below its low. However, if there is a strong bull breakout over the next few days, they will trail their stop up to below the low of this week’s bull flag.

Their reasoning is that a strong rally from here will probably be an exhaustive buy climax that will lead to a couple of weeks of sideways to down trading. They will exit before their stop is hit, and there is no reason to risk the full 100 points down to below the July 6 pullback low.

If the current 4 day bull flag grows, traders will wait for a breakout to a new high and trail their stop to below the bottom of the bull flag. I mentioned that the Emini might have a strong breakout to a new high. More likely, if there is a breakout, it will probably not be especially strong and it will likely last for only a few days and then reverse back into the range. This means that the current 4 day bull flag is probably the start of a trading range that will probably last a couple of weeks, and a new high will probably simply by part of that range.

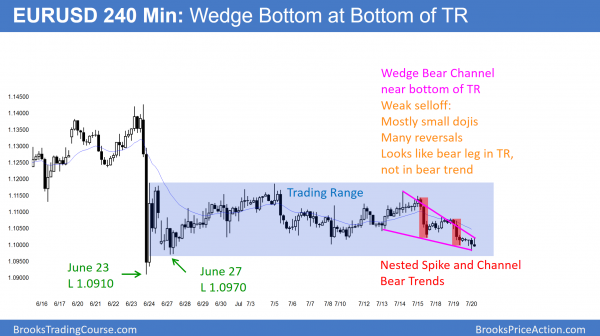

Forex: Best trading strategies

The 240 minute EURUSD chart has been trading down in a Wedge Bear Channel for 4 days. Most of the bars were small dojis and there have been many reversals. This type of trading range price action is usually a bear leg in a trading range and not the start of a bear trend.

I mentioned yesterday that the selloff of the past 24 hours was more likely simply a test of the bottom of the month long-trading range. While that is still true, the test is not complete, and a test can fail. By fail I mean that the EURUSD can fall below support and sell off to some lower support level.

The 60 and 240 minute charts are still in weak bear channels. While the selling has lacked momentum, there is no sign of a bottom yet. This is a good area for the bulls, but they need a strong reversal before traders believe that the bear leg has ended.

Furthermore, the bears need a strong breakout below the range. There is no evidence for this yet. Because most trading range breakout attempts fail, the probability is that the EURUSD Forex chart will reverse back up within a couple of days. The first target is the July 18 lower high of 1.1084.

European EURUSD Forex session

The 5 minute EURUSD Forex chart overnight sold off and reversed back up. It is now in the middle of its 40 pip range. It is probing near the bottom of the month-long trading range. There is no sign of a bottom yet. Day traders are mostly scalping for 10 – 20 pips, which is what they usually do when the sessions have small ranges and lots of reversals.

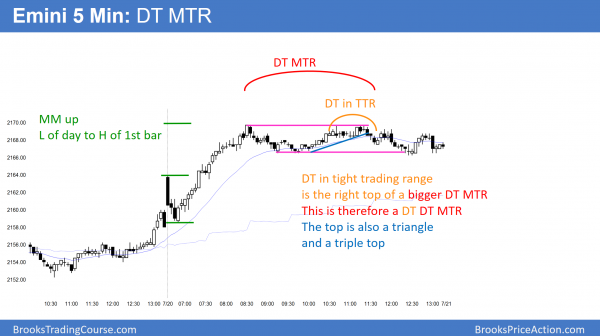

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had an Opening Reversal that led to a strong bull trend. It then entered a tight trading range. There was a double top within the tight trading range. The tight trading range was a Double Top Major Trend reversal. The 1st top was the buy climax high, and the 2nd top was the tight trading range, which subdivided into a smaller double top.

The Emini broke to a new all-time high again today. However, many bulls will use a 1 – 3 day breakout of the ioi to take profits. The odds still favor more bars in the developing trading range. Then , if there is a breakout to a new high, bulls will raise their stops to below the bottom of the range. The stops now are about 100 points below, and bulls need to reduce risk by taking partial profits.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hey Al, I am a 1 contract trader and am having trouble knowing when to swing vs. scalp (hold for a second leg or not). I bought around 7:05am looking for a move to HOD. I pay a lot of attention to actual risk. Often if my actual risk is only 1 point, I am quick to exit with 2 points. This is exactly what happened again today, only to see the market go up for another big leg after a tiny pullback. Which would you rather do; trade 2 contracts so you can scale out with 1? Or focus on finding spots to reenter?

Thanks for your time!

Hi Christos,

Allow me to answer your query, knowing what Al says to similar questions in his room.

>>knowing when to swing vs. scalp<<

An answer Al often quotes is that you should decide this _before_ you place the trade. Make up your mind, place trade, and then manage accordingly. If the trade is only good for a scalp, then scalp. If you believe it can get to a 2nd leg up/down or other support/resistance level, then go for a swing. If swinging, forget about taking 2x actual risk if that means losing a good run. Getting out early when you have already decided on a swing is possibly letting fear take over, right?

And yes, if you do get out early, perhaps due to scalping each time, then just focus on finding next entry.

Using 2 contracts to scale out 1c on a scalp is workable only if your winning percentage is very high. Or if % high and using wider stops. Lots of discussion on these topics in the Ask Al blog.

Hey Al,

I remember in one of your books you mentioned that your goal was to get up to trading institutional volume. Is that still your goal? Do you still have many trading goals at your level of mastery?

Thanks for your time.

Hi Faizal,

Al has quoted 2 trading goals in his trading room recently: 1) To not lose any day for a whole year, and 2) to catch a strong trend and keep increasing size as it goes up.

If you listen to Al talking about his start in trading nearly 30 years ago, he was already trading the equivalent of 60+ ES contracts before he dedicated himself to trading. So I guess Al could trade many more in 2016 but who wants the stress? Therefore, his “I don’t care” size may be much less than a large institution throwing other people’s money at the market. Being happy is more important.

Hello Al.

I hope you doing well. Al do you think the USD/JPY change it trend from down to Up. because the recent rally exceed the 24-6-2016 sell climax bar high . what are indicator we should look it to lead us to said the trend officially change .

I am doing well, thank you.

When a bear trend gets above a Major LH, the bear trend ends. That means either TR or bull trend, and TR is always more likely. So, yes, the daily chart is Always In Long, but the bulls need a strong breakout above that June 24 sell climax high, or else traders will see the rally as a bull leg in a trading range.

Good Morning Al,

If you had to take a ballpark guess, what % of your entry orders do not get filled during a typical trading day? Thanks.

I often take 20 trades in a day. Probably 2 – 3 do not get filled.