Market Overview: Nifty 50 Futures

Nifty 50 Wedge Overshoot on the monthly chart. The market on the monthly chart showed a very small bull close in February. Following the wedge overshoot, bulls managed to generate strong and consecutive bull bars, increasing the likelihood of a measured move up based on the bull breakout of the wedge top pattern. Nifty 50 continues to trade in a robust trend, with bulls forming strong and consecutive bull bars. This implies that bears would need a significant reversal attempt to change the trend. It’s important to note that any weak reversal would likely result in a trading range rather than a reversal. On the weekly chart, the market is within a strong bull channel, with another strong bull close above the significant round number 22000.

Nifty 50 futures

The Monthly Nifty 50 chart

- General Discussion

- Nifty 50 is entrenched in a strong bull trend, with bears failing to produce strong consecutive bear bars recently. Given the strength of the bull trend, bears should refrain from selling unless strong reversal attempts are observed.

- The market has shown robust follow-through of the bull breakout of the wedge top, allowing bulls to enter this trend with a target of a measured move up based on the height of the wedge top.

- Bulls who are already in long positions should maintain their positions until the market forms strong consecutive bear bars.

- Deeper into Price Action

- Following the bull breakout of the wedge top, bears have been unable to form a bear bar. Currently, the market is trading within a small bull microchannel, indicating strong bullish sentiment. This is likely to attract more bulls into the market.

- Even if bears manage a strong bear close in March, the likelihood of a reversal would be minimal compared to trend resumption.

- Patterns

- The market has experienced a strong breakout of the wedge top, suggesting traders can anticipate a measured move up equivalent to the height of the wedge pattern.

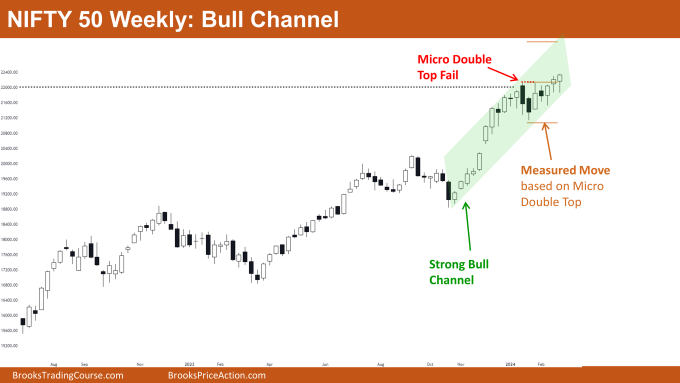

The Weekly Nifty 50 chart

- General Discussion

- On the weekly chart, Nifty 50 maintains a strong bull trend within a robust bull channel. Therefore, bears should refrain from selling.

- Given the current position of the market near the bottom of the bull channel, bulls may consider buying opportunities.

- Bulls who entered positions due to the measured move up caused by the micro double top fail should continue holding their positions.

- Deeper into Price Action

- Over recent bars, bears have failed to achieve a strong bear close.

- With the market showing a strong bull close above 22000, the probability of an upward movement is higher than a bearish one.

- In strong trends like the current one, traders can aim for a 1:1 risk-to-reward ratio, as the probability of a profitable trade exceeds 50%, resulting in a positive trader’s equation.

- Patterns

- In a steep and tight bull channel like the current one, it becomes challenging for bears to profit. However, in broader channels, both bulls and bears can capitalize by buying low and selling high

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.