Market Overview: Nifty 50 Futures

Nifty 50 strong bull close on futures weekly chart, near wedge bottom line, and possible failed bear breakout of a cup & handle pattern. On the daily chart, Nifty 50 forming possible final flag, so the least bulls can expect is a trading range on both weekly and daily charts.

Nifty 50 futures

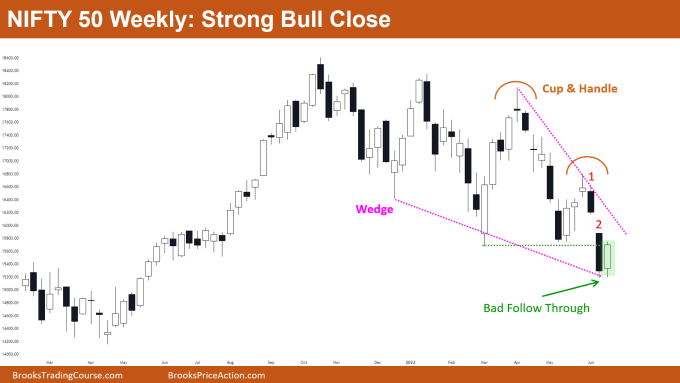

The Weekly Nifty 50 chart

- General Discussion

- Weekly chart gave a strong bull bar closing near high, enough to convince bears to exit out of their shorts, so possible move up expected in the coming week.

- Bulls would prefer to buy on High 2 rather on High 1, as that would increase the probability.

- Deeper into the price action

- If you look carefully, the open of this week was above the close of last week. This means even after 2 consecutive bear bars, the bears bought back their shorts and booked their profits – showing they are less confident.

- To convince many bulls, the market has to form one more bull bar closing near high. But if the next bar is not a strong bull bar, or a bear bar, then you have to expect one more leg down and then enter long on a good High 2 buy signal bar.

- Patterns

- Market forming wedge bottom near start of bull trend (as you can see from the bars on left). This increases the chances of market going higher.

- As bears who shorted cup & handle are also trapped, many bears would be covering their positions. Bulls would be buying, thus increasing the chance that market is going higher.

- Pro Tip

- Whenever you get strong leg down, like bar 1 and 2 marked in chart, then you have to expect one more leg down.

- That is because bears who shorted on close of bar 2 know they are now trapped, so they would be scaling in higher and would try to exit at their average sell price (ie, at breakeven)

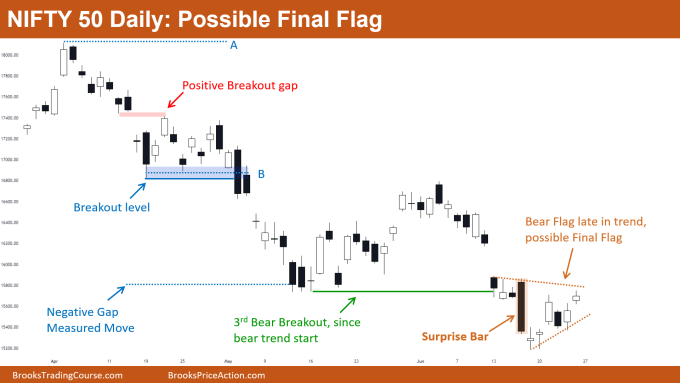

The Daily Nifty 50 chart

- General Discussion

- Market gave another bear breakout (green level) but bad follow-through, also forming a bear flag which can be possible final flag.

- This bear breakout would be the 3rd bear breakout (look at red, blue, green levels) thus possible reversal expected.

- Increasing bull closes and increasing bad follow-through to bear bars suggest that market can soon convert into trading range.

- Deeper into price action

- Whenever you get a surprise bar (marked in chart), then there is a 60% chance you would at least get one more leg down, from where bulls and bears decide where to go further.

- Notice each bear breakout, there is a constant increasing in depth of pullbacks suggesting decreasing bearishness in the market, with probably a trading range soon.

- Market likes to give Measured Moves based upon breakout gaps, like the above highlighted in the chart.

- Every time you see a breakout you can expect a move down equal to the distance between start of the trend and middle of the gap (A ➠ B according to above chart).

- Patterns

- Whenever you get a triangle or trading range with sell climax, bad follow-through bars, with increasing tails late in trend, then this has higher chance of being the final flag rather than a continuation pattern.

- The surprise bar turned out to be a sell climax late in trend. We also got bad follow-through after the bear breakout of 3rd breakout level (green line). This increases the chances of a reversal rather than bear trend.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Really helpful Rishi!

Thank you Mrigank

Learning a lot from your Analysis !

Thanks a LOT !

Thank you very much PERI

Thank you so much for your commentary Rishi. Greatly helping in learning.

Thank you very much Tanmay

Hi, this is my first time to your market comments as I usually only look at the Qs and SPY charts. I just wanted to say I like your format. It flows nicely.

Thank you very much Randall