Market Overview: Nifty 50 Futures

Nifty 50 futures outside bar on the weekly chart and continuing to go up, now the market is near its all-time high (just a few points away from breaking the level). Bulls expect a breakout above the all-time high level and bears would prefer to do nothing until they see a drastic change in price action.

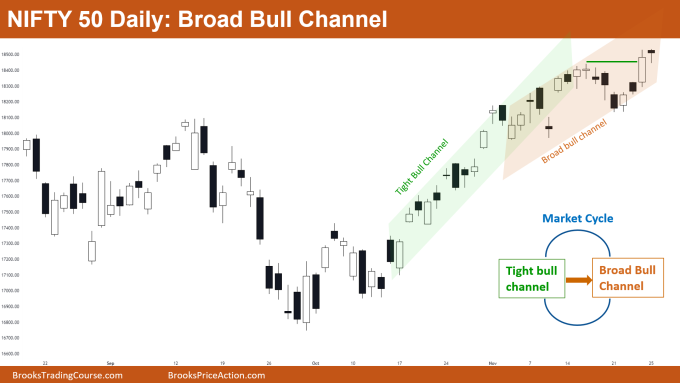

Nifty 50 on the daily chart is transitioning into a broad bull channel from a tight bull channel. Still, bears should not try to sell near the top of the broad bull channel as the Nifty 50 is near an all-time high and therefore can transition into a breakout phase on the daily chart.

Nifty 50 futures

The Weekly Nifty 50 chart

- General Discussion

- Nifty 50 gave a strong bull close this week and even formed an outside up bar which is a sign of strength for the bulls.

- An all-time high is an important level and just like many other important levels (like round number levels), this acts as a magnet.

- The current bull leg is very strong and the least bulls expect would be 2nd leg up before any kind of reversal, and as bears know this they would avoid shorting on the Low 1.

- Deeper into the price action

- The market was in a bull micro channel for many bars, but this week the market broke the low of the prior bar, therefore technically the tight bull channel is over.

- Still, the market is in very strong momentum and now the market formed an outside bar. Many bulls would be placing stop orders to buy at or above the high of the outside bar.

- Aggressive bears would be selling with limit orders at an all-time high (but why?). This is because all-time highs act as an important resistance and many bears believe that the market would at least retrace to the all-time high level before continuing up.

- Patterns

- Nifty 50 forming outside up bar in a strong bull leg which would lead to at least 2nd leg up.

- As the market broke below the bull micro channel there are higher chances that the market would now convert into a tight bull channel.

- Pro Tip on Trading High-1 and High-2

- Conditions, when you can buy on High 1, are:

- On a pullback after a strong bull leg

- Near trading range bottoms

- Near broad bull channel bottom line

- Conditions, when you can buy on High 2, are:

- After a strong bear leg (pullback) in a bull trend

- After a strong bear leg near the trading range bottom

- In general, you should be buying on High 1 only after a weak bear leg and buy on High 2 after a strong bear leg.

- This is because when the market gives a strong bear leg then there is a high probability of another leg down.

- So to avoid getting stopped out on High 1 we enter long on High 2 after 2nd leg down.

- Conditions, when you can buy on High 1, are:

The Daily Nifty 50 chart

- General Discussion

- Nifty 50 transitioning into a broad bull channel from a tight bull channel, and bears are still not able to form strong bear bars.

- Many bulls bought the pullback and now the market has given a breakout above the swing high (green line) which may attract more bulls.

- Deeper into price action

- The last bear leg was the deepest pullback since the bull trend started, this means some limit-order bears made money selling higher.

- As the market is converting into a broad bull channel there may be an increase in limit order bears selling near the top line of the broad bull channel.

- Patterns

- Bears and bulls would be keeping an eye on the next bar, this is because the next bar would decide whether the market would keep within the broad bull channel or start a trading range.

- If the next bar is a strong bear bar then many bears would be shorting for the possible formation of a trading range.

- This is because of the market cycle (quick reminder: Breakout phase → Tight Bull Channel → Broad Bull Channel → Trading Range) as the next possible phase would be a trading range phase.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.