Market Overview: NASDAQ 100 Emini Futures

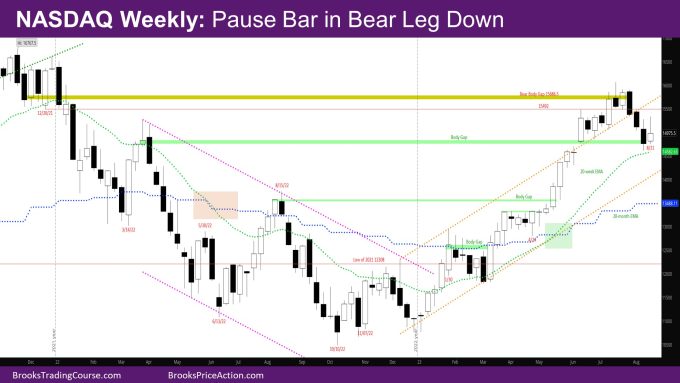

The NASDAQ Emini futures week is a bull doji bar with a long tail above. It is a pause bar in bear leg down since July 31. The market also went above the high of the prior week and then sold off.

The August monthly bar is a bear bar with a tail below. It would be the first bear bar since February. Next week is the last week of the month. Bulls would like to close above the low of the prior month, while bears want the month to close below the low of the prior month. Hence the low of prior month at 15063.25 will be a magnet next week.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- The week is a bull doji bar with a tail above.

- Since the high of this week went above the high of the prior week, this week represents a pullback.

- As was mentioned last week, it was highly unlikely for 4 consecutive bear bars, and that it was more likely for this week to be a doji or bull bar or have a high above the high of prior week.

- This week met that expectation.

- Since the first leg down is strong, there is expected to be a 2nd leg down, and possibly a third leg if the 2nd leg down is strong.

- The market should also test the exponential moving average (EMA) in the next few weeks if not next week.

- Bears wanted to close the body gap with March 2022, which they did last week, although with only a small overlap.

- If bulls can go up from here, the body gap close would be a considered a negative gap – a small overlap, but trend resumption up.

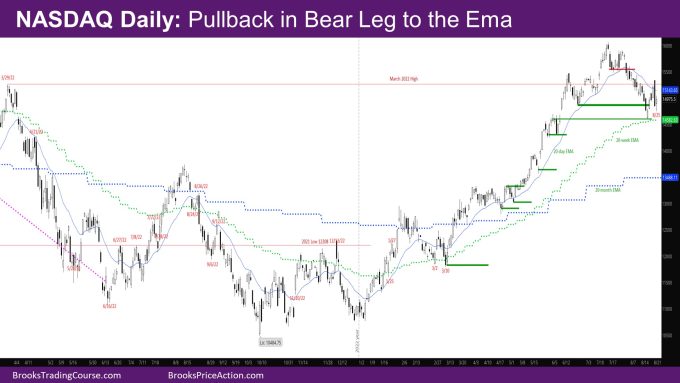

The Daily NASDAQ chart

- Friday is a bull reversal bar with tails above and below.

- The bulls showed strength early in the week, while bears had one big bear day Thursday and the selloff early on Friday.

- Last week’s report said that bulls want to get to the daily EMA, and there would be sellers above – around low of Monday and daily EMA.

- Both these things happened this week.

- Monday was a strong bull bar above the bull reversal bar last Friday.

- Tuesday gapped up but ended as a bear bar near the close of Monday.

- Wednesday was a good bull bar closing just above the daily EMA, but with most of the body below the EMA.

- Thursday gapped up above Wednesday and went above last week’s high, but then sold off. It was a big outside down (OD) day.

- Friday went below the low of Monday and then reversed up to close as a bull bar with a tail above.

- The move up this week was strong enough that there should be a second leg up.

- At the same time, Thursday is a big bear bar, and likely there will be sellers near its high.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

thanks Rajesh!