Market Overview: EURUSD Forex

The market traded higher but reversed to close as a bear bar forming a possible EURUSD Failed Breakout. The bears will need to create follow-through selling to increase the odds of a deeper pullback. The bulls hope that the move down is simply a breakout test of the April high (breakout point)

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear bar closing near its low.

- Last week, we said that odds slightly favor the EURUSD to trade at least a little higher and traders will see if the bulls can create follow-through buying or will the market trade slightly higher but close with a long tail above or with a bear body.

- This week traded slightly higher but reversed to close as a bear bar.

- The bulls got the third leg up forming a wedge pattern (Feb 2, Apr 26, and Jul 18).

- Next, they want a strong leg-up lasting many weeks like the one which started in November 2022.

- The targets for the bulls are the Jan/Feb 2022 highs and a measured move up using the height of the prior 6 month’s trading range which will take them to around the October 2021 high.

- However, they were not able to create a follow-through bull bar this week to confirm the breakout above the April high. This is not usually how a strong breakout begins.

- They hope that this week’s pullback was simply a breakout test of the April high (breakout point).

- The bears hope to get a reversal from a failed breakout above April, a wedge top (Feb 2, Apr 26, and Jul 18) and a trend channel line overshoot.

- They need to create follow-through selling next week to increase the odds of a reversal down.

- Since this week’s candlestick was a bear bar closing near its low, it is a sell signal bar.

- Because of the lack of follow-through buying this week, odds slightly favor the market to trade at least a little lower.

- Traders will see if the bears can create follow-through selling or will next week trade slightly lower but close as a doji or with a bull body and a long tail below.

- If the bears get strong follow-through selling, the odds of a deeper pullback will increase.

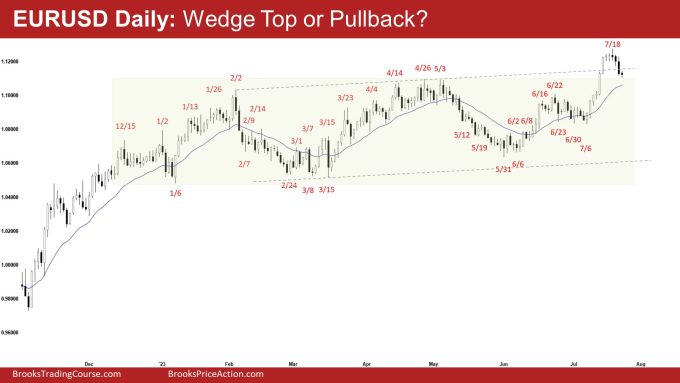

The Daily EURUSD chart

- The EURUSD traded slightly higher earlier in the week but reversed to close near the April high (breakout point).

- Last week, we said that the first pullback would likely be minor, and the odds slightly favor at least a small second leg sideways to up.

- The bulls got a strong breakout from a wedge bull flag (Jun 23, Jun 30, and Jul 6) and a larger second leg sideways to up completing the wedge pattern with the first two legs being February 2 and April 26.

- They want the breakout above April to be the start of a new leg lasting many weeks, like the one which started in November 2022. They want a channel up after a small pullback.

- The next targets for the bulls are the Jan/Feb 2022 highs and a measured move using the height of the January-June trading range which take them to around October 2021 high.

- The move up is strong enough for traders to expect at least a small second leg sideways to up after a slightly larger pullback.

- The bears hope to get a failed breakout above the April high.

- They want a reversal down from a trend channel line overshoot and a wedge top (Feb 2, Apr 26, and Jul 18).

- They will need to continue creating consecutive bear bars closing near their lows to increase the odds of a failed breakout.

- For now, odds slightly favor the market to still be in always in long.

- However, the EURUSD may still trade sideways to down for a while more, probably testing the 20-day exponential moving average to work off the recent overbought conditions.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi Andrew, please do you provide daily analysis? The weekly lookahead is very helpful, but as the new pattern develops during the week. I often get lost. If you can provide daily analysis would be more helpful. Thank you for your constant posts. Much appreciated

Hi Julius, Brad Wolff does a daily EURUSD analysis that is posted about 9:20am ET. Have you not seen that?