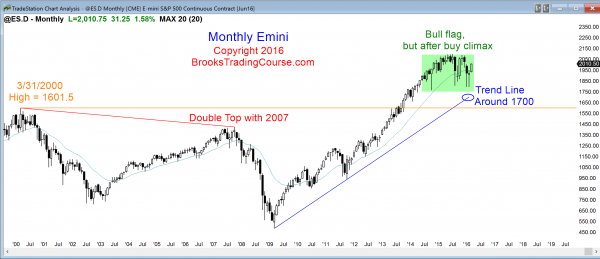

Monthly S&P500 Emini futures candlestick chart: Bull flag after buy climax

The monthly S&P500 Emini futures candlestick chart has a strong entry bar so far for the buy above last month’s buy signal bar, but it is still within a 2 year trading range after a buy climax.

The monthly S&P500 Emini futures candlestick chart continues to grow its bull flag, but it is following an extreme buy climax. The buy climax is still more important than the bull flag, and this means that the odds still are greater for a bear breakout of the 2 year trading range than for a bull breakout. If the trading range continues to grow, the odds will continue to approach 50% for both the bulls and bears.

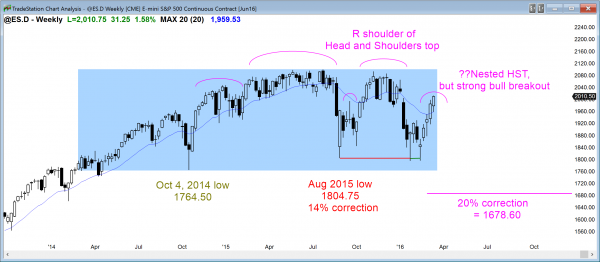

Weekly S&P500 Emini futures candlestick chart: Strong rally in a trading range

The weekly S&P500 Emini futures candlestick chart has had 5 strong weeks up, and is back into the January gap.

The weekly S&P500 Emini futures candlestick chart has had a strong rally up from the bottom of the 2 year trading range. If Monday gaps up, there will be a 2 month island bottom on the weekly chart, which is rare. A gap on the weekly chart requires a gap on a Monday on the daily chart. Only about 20% of gaps on the daily chart come on Mondays, and an island bottom on the weekly chart requires 2 of them. An island bottom in a bear trend often leads to a bull reversal. An island bottom in a trading range is meaningless. It is a sign of strong bulls, but it is in a market that has had alternating signs of strong bulls and bears for 2 years. So what? Eighty percent of these strong legs reverse, so the odds are that this one will as well.

Because the rally has been strong, there is a 70% chance that the 1st reversal down will be minor and it will be bought. This means that the bears will need at least a micro double top before they can take control, which means that the downside risk for the next few weeks is small. As for the upside, 5 strong bull bars in a trading range is unusual and therefore unsustainable and climactic. However, the best the bears can probably hope to see for at least a few weeks is a trading range. Also, the Emini is now in the upper half of its 2 year range. Until there is a breakout, there is no breakout, and this will just be another of many strong legs within the trading range.

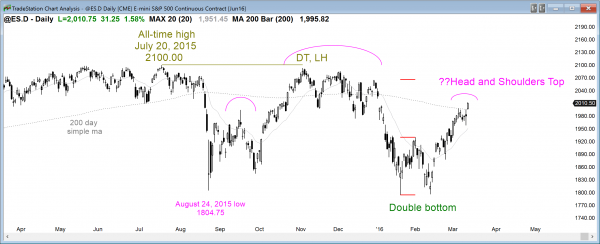

Daily S&P500 Emini futures candlestick chart: Bullish price action but buy climax

The daily S&P500 Emini futures candlestick chart is in its 2nd small leg up after a breakout above a small expanding triangle top. This might create a Low 5 sell signal next week.

The daily S&P500 Emini futures candlestick chart remains the most interesting because of the possible Low 5 sell signal that could come this week. You can read more about this in my post last week. The bears had an expanding triangle top on February 1, which was a Low 3 sell signal. The bulls got a bull breakout above the top on March 1. It was strong enough to make a 2nd leg up likely. Today qualifies as a 2nd leg up. It the Emini forms a bear reversal bar next week and then trades below it, that would be the entry for the Low 5 sell signal. The one in October was followed by 2 month trading range. A reasonable minimum goal after the February buy climax would be a trading range that lasts at least a month. Less likely, the Emini will simply continue to rally to a new all-time high.

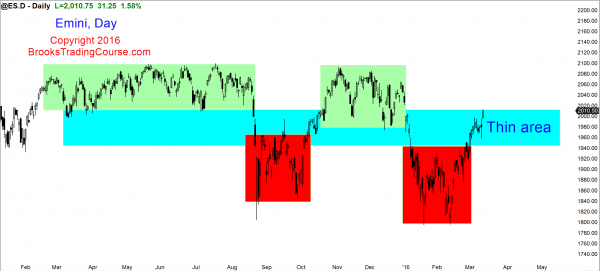

The daily S&P500 Emini futures candlestick chart had a pair of upper trading ranges and a pair of lower trading ranges. There is an area of relatively little trading in between (a thin area).

When there are trading ranges above and below, and a relatively thin area in between, as there is on the daily chart, the Emini usually has to fill in that thin area before it can go much up or down. It raced up to this thin area over the past month, but the rally might simply have been a buy vacuum test of this area.

The odds are that the current buy climax will be replaced by a trading range over the next month or two as the Emini fills in this thin area. It formed trading ranges above, but sold off, showing that traders thought the price was too high. It formed trading ranges below, indicating that the price was too low. It usually has to go too far up and down too far to find where it needs to be, and it probably will decide that the middle is the best choice. A trading range is likely for at least a month.

Best Forex trading strategies

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

Thank you for the commentary. I purchased your course when it first came out, and found it easier, for me, to understand than your books. I have had a hiatus from trading, but now getting back into it. I am enjoying your other course information too, the manual, etc.

Dr. Brooks,

I am a novice at this bar by bar interpretation of the market. I have a vast experience in all the wrong ways of looking at the market. I have just started working with your course and I can already see why I consistently took positions prematurely and bailed out prematurely. I hope to provide some useful comments when I have spent enough time studying your course and feel competent enough to have intelligent questions or comments. Thank you very much.

Shantu Dand, M.D.