- Market Overview: Weekend Market Analysis

- 30-year Treasury Bond futures

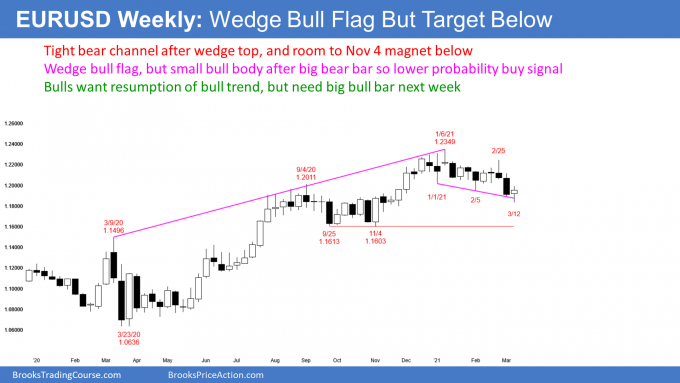

- EURUSD Forex market

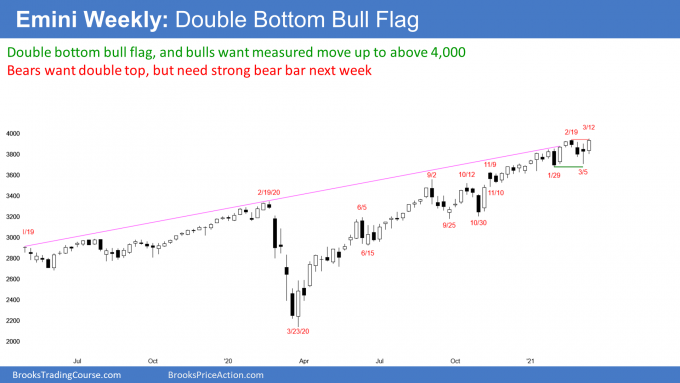

- S&P500 Emini futures

- The Monthly Emini chart is in a strong bull trend

- Small parabolic wedge

- The Weekly S&P500 Emini futures chart breaking above double bottom bull flag

- 4,000 Big Round Number is a magnet just above

- What can the bears expect?

- The Daily S&P500 Emini futures chart breaking above neckline of double bottom

- Can’t this be a double top?

- Probably not strong follow-through next week

Market Overview: Weekend Market Analysis

The SP500 Emini futures market broke to a new all-time high this week, and it should test 4000 Big Round Number next week. Friday is a High 1 bull flag buy signal bar on the daily chart.

The Bond futures market has gone sideways for 3 weeks in a sell climax. While it might fall a little further, traders expect some short covering soon.

The EURUSD Forex market formed a weak buy signal bar for a wedge bull flag on the weekly chart. This should lead to at least slightly higher prices next week.

30-year Treasury Bond futures

The Bond futures weekly chart sell climax is losing some momentum

The weekly bond futures have collapsed into a support zone between the August 2018 high and the January 2020 low. I have been saying for a year that the first reversal down, from an extreme buy climax, typically reverses all the way down to the start of the most recent leg up. On the monthly chart (not shown), that is the January 2020 low. Bonds should get there are some point this year, but there might be short covering first, since the sell climax is so extreme.

The bears only have a 30% chance of the collapse continuing to far below the January 20 low, without a short covering rally first. One of the problems the bears face is the stop for their shorts is far above. The simplest way to reduce risk is to reduce the position size.

That means the bears should begin to take some profits soon. When the bears take profits, they are covering some of their shorts, and this creates a short covering rally. Every bull trend begins with a short covering rally. But the 1st rally in a strong bear trend usually only leads to a bear flag, and not a bull trend.

The past 3 weeks have largely overlapped one another, which means there is some loss of momentum. This is an early sign of minor short covering, and it increases the chance that there will be a short covering rally soon. The bulls need to see some bull bars before they will buy. Once the short covering begins, the minimum traders will expect is a couple legs up for several weeks. Many big bull bars closing on their highs could lead to a big short covering rally, that could last a couple months.

There are now 8 consecutive bear bars, which is unusual and therefore climactic. When there is an extreme sell climax, and the market is just above major support, there is often a short covering reversal up before reaching the support.

If a reversal up and a resumption down are going to be minor, what should traders expect for the next several months? When traders are quick to take profits and look to sell rallies and buy pullbacks, the market usually forms a trading range. Traders expect the sell climax to evolve into a trading range within the next few weeks.

EURUSD Forex market

The EURUSD weekly chart has wedge bull flag

The EURUSD weekly chart has been selling off for 3 months from a wedge top. However, it reversed up this week and closed with a small bull body, just below the 1.20 Big Round Number. It is therefore a weak buy signal bar for next week.

There have been 3 legs down, and the selloff is therefore a wedge bull flag. That will attract buyers next week. At a minimum, traders expect next week to go above this week’s high, which would trigger the buy signal. They want to know if there will be more buyers or sellers above this week’s high.

The bulls hope this will be a resumption of last year’s bull trend. If next week is a big bull bar closing on its high, it will erase last week’s bear bar. That would make the weekly chart neutral again. If there are a couple consecutive big bull bars, the bulls will be back in control.

What if there is no follow-through buying?

But what if next week does not go above this week’s high? Or, if it does, but is a bear bar? Traders will conclude that the 2-week rally is just a minor bounce in the bear channel that began on January 6.

Which is more likely, a resumption of the bull trend or a continuation of the bear channel? The weekly chart has been reversing every couple weeks, since the yearlong wedge top 3 months ago. This week is another reversal. Since there is now a wedge bear channel, which is a bull flag, it creates confusion. Traders need more information before they can form a strong opinion, and that means more bars.

The odds favor at least slightly higher prices next week, and sideways to up trading for at least a couple weeks. At that point, traders will have a better idea of the direction over the next couple months.

S&P500 Emini futures

The Monthly Emini chart is in a strong bull trend

The monthly S&P500 Emini futures chart has a bull bar closing near its high so far in March. The yearlong bull trend has been very strong and there is no top yet. Even once the bears get a reversal down, it will probably be minor. That means a 1- or 2-bar (month) pullback.

However, extreme buy climaxes attract profit takers. This current leg up began in September. Theoretically, the bulls have stops below the September low. That is 20% down, which means the risk is big. The easiest way to reduce risk is to reduce the position size.

At some point, there will be enough bulls taking profits to create a pullback. However, when a trend is this strong, there will be many bulls eager to buy below the low of the prior bar. That should limit the pullback to a month or two.

Small parabolic wedge

The rally from the September low is the 3rd push up from the pandemic low. A reversal down would therefore form a parabolic wedge top. That often can lead to a TBTL (Ten Bar, Two Leg) pullback, but not when the rally is only 13 bars. If there is a TBTL pullback, it will be on a smaller time frame, like the weekly or daily charts. It could therefore last a couple months, which means a couple bars on the monthly chart.

Will the bull trend resume after the 1st pullback? While that is likely, it could also evolve into a trading range, and that could last many bars. The bears will probably need at least a micro double top before they can create a significant reversal down. A micro double top requires at least a few sideways bars. Therefore the downside risk is small over the next couple months.

Because this is a monthly chart, a 2-month pullback could even be 20%. However, since the bears will likely need a micro double top before they can get a trend reversal, traders will be eager to buy the pullback.

The Weekly S&P500 Emini futures chart breaking above double bottom bull flag

The weekly S&P500 Emini futures chart formed a big bull bar this week, and broke to a new all-time high. However, it closed just below the February 16 high, and therefore the bulls were not as strong as they could have been. Last week was a High 1 buy signal bar, and this week triggered the weekly buy signal when it went above last week’s high.

Last week also formed a higher low double bottom bull flag with the January 29 low. The February 16 all-time high is the neckline. Now, the bulls want a 250-point measured move up based on the height of the double bottom. Also, the Emini has been in a trading range all year, and that double bottom is near the bottom of the range. A measured move up would be the same 250 points.

4,000 Big Round Number is a magnet just above

Will the bulls get their measured move target? There is another more important target that they have to clear first. That is the 4,000 Big Round Number. The rally stalled at every Big Round Number since 3,500 in September. Even if the Emini ultimately goes far above 4,000 this year, it will probably go sideways for at least a week or two once it gets to 4,000. Trades will then decide if the Emini will continue up or reverse down.

What can the bears expect?

What about the bears? The past 3 weeks had bear bodies. Therefore, the buy signal was weak. When a weak buy signal triggers, there is a higher probability that it will reverse down within a few weeks. The resistance of the 4,000 Big Round Number increases the chance of a reversal. However, this week was a surprisingly good bull bar, and a Bull Surprise normally has at least some follow-through within a couple bars. Therefore, the risk of a major reversal down next week is small.

But can the bears get at least a minor reversal? A minor reversal can come at any time in any trend. The Emini has been reversing every week or two all year. However, if next week is a bear bar, it is more likely to lead to a brief sideways to down move than a major trend reversal.

The Emini will probably test 4,000 next week. If it does, it is more likely to stall for a couple weeks than immediately reverse down.

The Daily S&P500 Emini futures chart breaking above neckline of double bottom

The daily S&P500 Emini futures chart broke to a new all-time high this week, but closed just below the old high. That old high is the neckline of the January 29/March 4 double bottom. As I mentioned above, the bulls want a 250 point measured move up. The bulls need consecutive closes above the February 16 neckline to confirm the breakout. That would increase the chance of another leg up.

This breakout is particularly important, because the bears had 3 consecutive big bear bars last week, which was good for the bears. When they had 2 consecutive big bear bars in September and again in October, the bears got 10% corrections both times. Traders expected that this time would repeat the pattern. But once the Emini broke above the top of the 3 bear bars, the bears gave up.

When one side gives up, the breakout typically will have at least a small 2nd leg. Therefore, the bulls will look to buy the 1st reversal down, which they did on Friday. Friday is now a High 1 bull flag buy signal bar for Monday. That increases the chance of at least slightly higher prices on Monday.

Can’t this be a double top?

Any test of a prior high can reverse down from a double top. The 2nd leg up in a double top is usually weaker than the first. It is often a wedge bull channel.

But about a 3rd of the time, the 2nd leg up is a very strong buy climax. It can be hard to imagine that a strong 2-week rally could reverse down and be the start of a bear trend, but that happens fairly often.

However, the bears typically need at least a micro double top or an ii pattern (consecutive inside bars), before they can get a trend reversal down. If either forms next week, smart traders will be ready for a possible reversal down. More likely, traders will buy a reversal down next week.

Probably not strong follow-through next week

I mentioned above that the Emini is breaking above a 250-point tall trading range and that the bulls want a measured move up to 4,200. But I also said that the Emini will probably not quickly break far above the 4,000 Big Round Number.

With the strong 6-day rally and the breakout above the 3 bear bars, traders are betting against an immediate reversal down. But with the market stalling at every Big Round Number since 3,500, the Emini will probably not race far up next week either. Therefore, the Emini will probably trade sideways to up next week, and not have a dramatic move in either direction.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Thanks Al. From your experience, do you coonsider the past years rally to be suprisingly strong? Or is it still within normal behvavior. Thanks

Every 10 years or so, the stock market will rally 50 – 100% within a couple years after a 30 – 70% selloff. This one came from a 35% crash last year. Most of this rally was simply a return back to last February’s high.

Since it is about every 10 years, it is unusually strong compared to the other 9 years, but it is average compared to other big rallies. Look at the rallies that started in 2003 and in 2009 for comparison.