Market Overview: S&P 500 Emini Futures

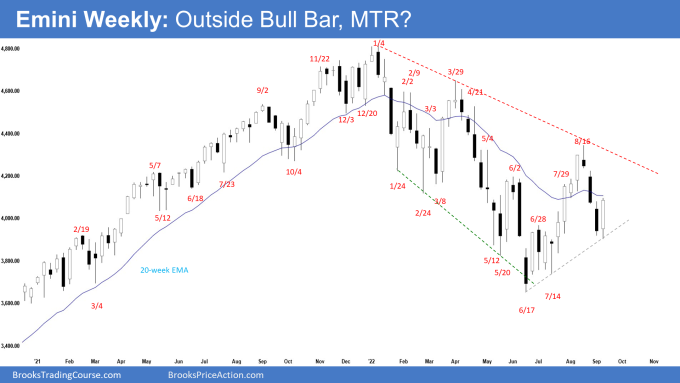

The S&P 500 Emini futures traded below last week’s low but reversed into an Emini outside bull bar closing near the high. Bulls want a reversal higher from a higher low major trend reversal. The bears want at least a small second leg sideways to down following the recent strong sell-off.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an Emini outside bull bar closing near the high.

- Last week, we said that odds are the Emini is still in the sideways to down pullback phase. The bulls still hope for at least a small second leg sideways to up after the pullback. Because of the strong move down, they will need a strong reversal bar, or at least a micro double bottom before traders are willing to buy aggressively.

- This week traded below last week but reversed to close above last week’s high.

- The bears got a reversal lower from around the May 4 high, or the major bear trend line. They want a retest of the June low.

- They want a strong leg down like the one in April. The bears will need to create consecutive bear bars closing near their lows, to increase the odds of a retest of the June low.

- The selloff was strong with consecutive bear bars closing near their lows with an open gap and a micro gap. That means strong bears.

- The bears want at least a small second leg sideways to down to retest Sept 6 low.

- The move up from June 17 low was in a tight channel. The bulls want a second leg sideways to up after a pullback. At the very least, they want a retest of Aug 16 high.

- They want a reversal higher from a higher low major trend reversal.

- The problem with the bull’s case was that the recent selloff was very strong. The second leg sideways to up may only lead to a lower high.

- Since this week was a bull bar closing near the high, it is a good buy signal bar for next week. Next week may gap down at the open, however, small gaps usually close early.

- The next targets for the bulls are the 4100 big round number, the major bear trendline and the Aug 16 high. The 20-week exponential moving average and major bear trendline are resistances above.

- Bulls will need to create a follow-through bull bar closing far above the 20-week exponential moving average to increase the odds of a retest of the Aug 16 high.

- Bears hope next week closes with a bear body even though it may trade higher first.

- The candlestick after an outside bar sometimes is an inside bar, or has a lot of overlapping price action.

- For now, odds slightly favor sideways to up for next week. Traders will be monitoring whether the bulls get a consecutive bull bar or fail to do so.

- If the bulls get a consecutive bull bar, the odds of a test of the bear trend line and Aug 16 high increases. However, if next week closes as a bear bar, we may start to see sellers return for the second leg sideways to down.

The Daily S&P 500 Emini chart

- The Emini traded below last week’s low on Tuesday but reversed higher for the rest of the week with a gap up and closing near the high on Friday.

- Previously, we have said that traders expect at least a small sideways to up retest of the August high after this pullback is over.

- It seems that the second leg sideways to up is currently underway.

- The move up from June 17 low was in a tight channel. That increases the odds that the bulls will get at least a small second leg sideways to up to retest August 16 high.

- The bulls want a continuation higher from a higher low major trend reversal after the current pullback.

- The targets for the bulls are the 4100 big round number, followed by the August 26 high.

- Bears got a strong reversal lower from around the May 4 high, or around the bear trend line. They want a retest of the June low, followed by a breakout, and a measured move down.

- The selloff from Aug 16 was strong enough for traders to expect at least a small second leg sideways to down.

- If the Emini continues higher, the bears want a reversal lower from a double top bear flag with the August 26 high, or a double top major trend reversal with the August 16 high.

- Since Friday was a bull bar closing near the high, Monday may gap up at the open. Small gaps usually close early.

- The bulls will need to create consecutive closes far above the 20-day exponential moving average first to increase the odds of the Emini trading higher.

- For now, odds slightly favor sideways to up for next week.

- However, if the bulls fail to create consecutive bull bars above the 20-day exponential moving average early next week, we may see sellers return for the second leg sideways to down to retest the Sept 6 low.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Thanks Andrew for the great report. Just to add that Tuesday Low was a bear MM target from August 16 high with August 24th PB and a reasonable zone for profit taking alongside the bull trend line from June 17th with July 14th that is strengthening this.

Dear Eli,

Good day to you.

Thanks for your input. Wishing you a great week ahead!

Early holiday for me this week starting tomorrow! 🙂

Best Regards,

AA

Do you think the anticipated Fed interest rate hike of 0.75% later this month is already “baked” into the market?

CME FedWatch Tool is currently pricing in a 91% chance of a 75 basis point hike so yes that is already discounted by the marketplace. A surprise would be something different.

I should also add the Fed comments will be looked at for any changes which could be a surprise as well.

Dear Reinhold and Andrew,

Wishing both of you a great week ahead!

Be well!

Best Regards,

AA

An obvious upside target is the 8/19 to 8/22 gap which is present on the RTH & cash charts but not on the extended hours chart.