Market Overview: Weekend Market Analysis

The SP500 Emini futures is breaking strongly above a 3-month bull channel in an extreme buy climax. The magnets above are the top of the bull channel and measured move targets. Since there have been 11 days without a pullback, there should be a brief pullback next week.

The EURUSD Forex market has been in a trading range for a year with no sign that it is about to end. If July reverses up, there will be a triangle. If July continues down, it will probably not fall far below the bottom of the range.

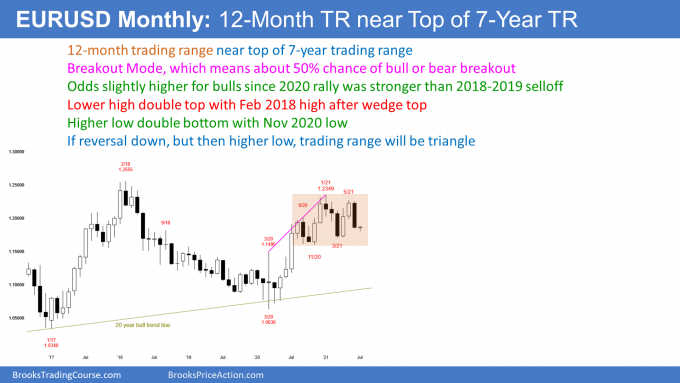

EURUSD Forex market

The EURUSD monthly chart

- June was big bear bar. It closed on its low and far below the May low.

- Reversing down from a lower high after last year’s wedge rally to a double top with the February 2018 high.

- Bears want a trend reversal. They hope for a break below the November low at the bottom of the yearlong trading range and then a measured move down to the 2017 low.

- But markets resist change, and the market is in a trading range. This selloff therefore will probably not break strongly below the November low.

- More likely, the trading range will continue, even if there is a small break below that low.

- Last month was a Bear Surprise Bar. But it is in a trading range, and therefore reversals are more likely than trends.

- There have been many big bull and bear bars over the past year. Every one reversed immediately or after one more bar. That is what is likely this time.

- That means there might be some follow-through selling in July, but July will probably not break strongly below the range.

- So far, July is reversing up from below the June low. If the reversal up continues, but forms a lower high, then there will be a triangle that began in November.

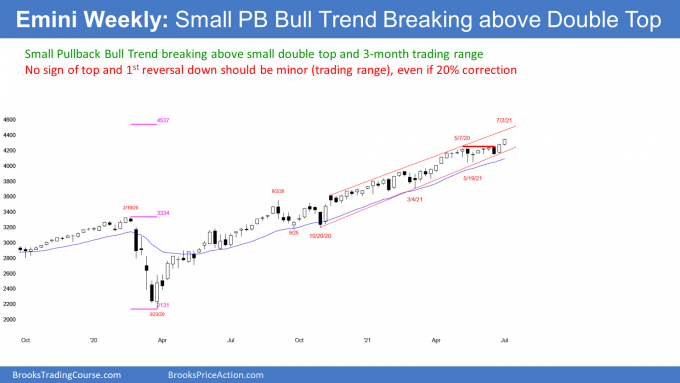

S&P500 Emini futures

The Monthly Emini chart

- July gapped above the June high by 1 tick. Small gaps typically quickly close, and this one closed within the 1st few minutes of the month on Thursday.

- Next monthly target is measured move up at 4,537, based on height of pandemic crash (from February 2020 high to March 2020 low).

- June was the 5th consecutive bull bar. There have not been 6 consecutive bull bars since the pandemic low. That increases the chance that July will close below its open.

- If July has a bear body, July would be the end of a parabolic wedge rally (3 legs up in a tight bull channel) from the March 2020 low. That would probably lead to profit taking and a 2- to 3-month sideways to down pullback.

- Traders will buy that 1st pullback, and therefore it should be only a minor reversal in a strong bull trend.

The Weekly S&P500 Emini futures chart

- Tight bull channel so strong bull trend. Next targets are the top of the bull channel and the measured move based on the height of the pandemic crash.

- Small Pullback Bull Trend for more than 60 bars, which is getting unusual. That increases the chance of the strong bull trend converting into a weaker bull trend.

- A Small Pullback Bull Trend ends with a big pullback. “Big” means bigger than any pullback in the Small Pullback Bull Trend. The biggest pullback was 10% and it lasted 2 months (September and October).

- Therefore, the strong trend will end once there is a 15 – 20% pullback. That pullback will probably last more than 2 months, and it will probably come this year.

- There is no sign that the pullback is about to begin, other than this trend lasting longer than most Small Pullback Bull Trends.

- Traders will buy the selloff, even if it is 20%. A 20% selloff is a bear “market.”

- But it will likely only be a pullback on the weekly and monthly charts, not a bear trend.

- A bear trend is a series of lower highs and lows, and it typically lasts at least 20 bars.

- While that could happen this year on the daily chart, it should not happen on the weekly or monthly charts.

- The best the bears can hope to get this year is a trading range for a few months.

- The low could be as much as 20% down from the high, but traders will buy it, expecting at least a test of the old high, which would be the top of the trading range.

- The bulls hope that the rally from the pullback low will be a resumption of the yearlong bull trend and not simply a test of the old high.

The Daily S&P500 Emini futures chart

- Strong rally from the June 18 low.

- 11-bar bull micro channel. That means every low was at or above the low of the prior bar. It is a sign of strong, relentless buying.

- It is also extreme and it will soon attract profit taking. Should be a 1- to 3-day pullback within next few days.

- Bulls will buy the 1st pullback.

- Bears typically need at least a micro double top before they can get more than a few days down from a micro channel.

Measured move target around 4,400

- Breakout above 3-month trading range.

- Several choices for top and bottom of range. Many computers will use May 7 high and May 12 low. Measured move up is 4,404.

- Top of bull channel is around 4,450, and it is also a magnet above.

- The strength of this breakout is similar to that of the early April breakout. Odds favor higher prices, even if enters a trading range, like after April’s strong breakout.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.

Could the EURUSD monthly chart be in a spike and bull channel?

Yes, it is in a pause after last year’s spike up and it is therefore in a spike and channel bull trend… and there is also a double top, a 7-year trading range, and a 1-year wedge top. There are other things going on as well, and no one knows which pattern will ultimately win out.

Over the next several months, the yearlong trading range will probably dominate. Over the next 10 years, a bull breakout above the 7-year range is slightly more likely than a breakout below.

Has the economy divorced the stock market?

Good question, I’ve been wondering the same thing for a while now.

I know we’re looking strictly at PA, but there is some serious disconnect between markets and the world economy right now…

That is a common perspective, but it can only be right for a short time. I think it is never right.

The stock market is a futures market, and the economy is a current market. The stock market is saying that the economy does not have much near-term risk and it has a good long-term outlook.

Thank you that very concise answer. I like the logic of it