Market Overview: Weekend Market Analysis

The SP500 Emini futures market is in a trading range with both an Emini double top bear flag and a double bottom bull flag. There is a 50% chance that a 15% correction is underway.

The EURUSD Forex has weak bear follow-through on the weekly chart. It should test the March 2020 high before reversing higher for a few weeks.

EURUSD Forex market

The EURUSD weekly chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear doji bar. That is weak follow-through selling.

- The bears want a resumption of the May to August bear trend and a 700-pip measured move down, based on the height of the yearlong trading range.

- The yearlong trading range is at the top of a 7-year trading range. When a market is in a trading range and it gets near support, it typically falls below support before reversing up.

- Consequently, this selloff should continue down to below 1.15 (March 9, 2020 Breakout Point) and possibly 1.1422 (June 8, 2020 Breakout Point), whether or not there is a bounce for a couple of weeks first.

- Also, the selloff since May is weaker than last year’s rally, and it is still about a 50% retracement. This further reduces the chance of the selloff continuing down to last year’s low.

- Can the EURUSD continue straight down to last year’s low at around 1.06? Probably not, because a selloff from a double top bear flag (July 30/September 3) typically will find profit-takers around the measured move target, which is 1.1420. That is also at the support of the June 8, 2020 Breakout Point.

- The bears need consecutive big bear bars closing near the lows and below the June 8, 2020 high before traders would expect a 700-pip measured move down.

- Traders should expect a several week rally to begin at any time. However, it probably will not come until the selloff falls at least a little below the March 9, 2020 high.

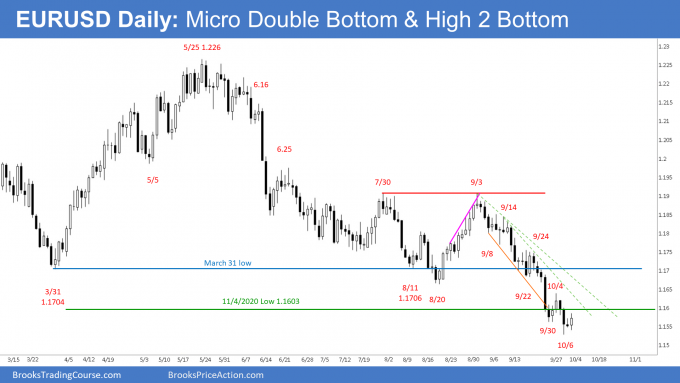

The EURUSD daily chart

- The EURUSD Forex daily candlestick chart triggered consecutive Low 1 sell signals this week, but Friday reversed up and formed a small outside up day. It was also a micro double bottom with Wednesday’s low.

- The bulls hope that this 2nd reversal up from below the yearlong trading range will be successful. There might be one more push down to a wedge bottom (with the September 30 and October 6 lows) to the weekly targets below.

- The EURUSD has been selling off in a tight bear channel since reversing down from a double top bear flag with the July 30 high.

- The 1st pullback (bounce) should be minor. However, there should be a rally lasting several weeks starting within a couple weeks.

- The bears will try to reverse down from a double top bear flag with the October 4th high.

- If the bulls get a reversal up from here, it would be from a micro double bottom and a High 2 bottom with the October 1 high.

- The bulls want a reversal up for at least a couple of weeks from around a measured move down at 1.1420, from the July 30/September 30 double top. The June 10, 2020 high (the breakout Point on the weekly chart) of 1.1422 is almost exactly at the measured move target, so the selloff might dip below that as well.

- However, traders should then expect a rally lasting at least a few weeks and breaking at least a little above 1.1705.

- Why above that price? Because that is the neckline of the double top (the August 20 low) and therefore a breakout point on the way down. Remember, in a trading range, the swings typically go past support and resistance.

S&P500 Emini futures

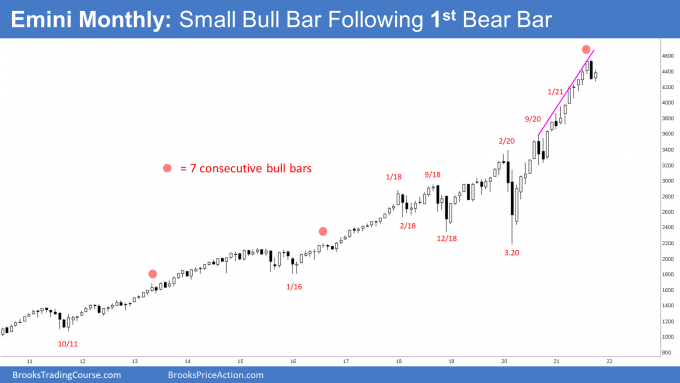

The Monthly Emini chart

- September’s candlestick on the monthly Emini chart was a bear outside down bar closing near its low and below the September low. This is bearish, but the bull trend is strong. Traders will buy the 1st 2- to 3-month pullback

- September ended the 7-month streak of bull bars.

- Al has been saying that there has never been a streak of 8 consecutive bull bars in the 25-year history of the Emini and that either September or October would be a bear bar.

- Furthermore, he has been saying that a bear bar should lead to 2 to 3 months of sideways to down trading. You can see that this is what happened with most other bear bars in prior buy climaxes.

- The bulls will try to create a credible High 1 buy signal bar in October. But even if they do, it will probably lead to a lower high and then a 2nd leg sideways to down.

- If the bulls can get a new high before the end of the year, it will probably be brief. An extreme buy climax like this typically results in at least 2 to 3 months of sideways to down trading.

- The bar after an outside bar often has a lot of overlap with the outside bar.

- The October Emini monthly bar currently is a small bull bar with tails above and below. It is still early in the month and the monthly candlestick will look different by the close of the month.

- At the moment, traders should expect sideways to down trading for a couple more months.

The Weekly S&P500 Emini futures chart

- The weekly Emini candlestick this week was a bull bar with prominent tails above and below.

- It broke below last week’s low but reversed higher to close with a bull body. The bears failed to get follow-through selling from last week’s bear bar.

- There are tails below the last 3 week’s bars therefore it is a micro wedge bottom.

- This week had a bull body so it is a High 1 buy signal bar for next week, but it has a prominent tail above. The bulls are not as strong as they can be.

- Furthermore, there is a 6-bar bear microchannel, which means persistent selling.

- Therefore, any pullback (bounce) from here would likely only be minor and form a lower high.

- The Emini has been in a Small Pullback Bull Trend for more than 60 bars, which is unusual, and therefore unsustainable and climactic.

- Traders will conclude that the Small Pullback Bull Trend has ended once there is a pullback that is at least 50% bigger than the biggest pullback in the bull trend.

- The biggest pullback so far was the 10% selloff in September 2020. A bigger pullback typically means 15 to 20%, and that is why Al has been saying that traders should expect at least 15% correction to begin before the Emini goes above the September high.

- The pullback could also be 50% bigger based on points instead of percent. If so, the target would be 3,850, which is below the 4,000 Big Round Number.

- There is a 50% chance that September 2 will remain the high for the rest of 2021.

- Since there is a 50% chance that the September 2 high will be the high of the year, there is a 50% chance that a 15% correction is underway.

- A 50% chance of September 2 being the high of the year means a 50% chance there will be a new high.

- The bulls know that most reversal attempts in a strong bull trend are minor. That means they become either bull flags or the start of a trading range.

- Since this rally is so extreme, a trading range for 10 or more bars is likely to begin soon. It probably has begun.

- That is true even if there is a new all-time high in the next couple of months. It will probably fail to go much above 4,600. Traders should not expect a resumption of the bull trend until there has been a 15% correction.

The Daily S&P500 Emini futures chart

- Thursday’s big gap up created a 7-day island bottom with the September 20 gap down.

- Emini reversed down on Friday from around the 50-day MA and closed near the low and below Thursday’s low.

- While the Emini reversed up from a lower low double bottom with the September 20 low, it might reverse down from the Emini double top bear flag with the September 23 high. Most trading ranges contain at least one double top and one double bottom.

- Friday triggered the low 2 sell entry from the lower high double top with the September 23 high.

- Monday could gap down, creating a 2-day island top.

- It is important to note that most island tops and bottoms are minor signals.

- Al has been saying that the Emini might form a trading range between the 50- and 100-day moving averages, and that still might be true. Traders are deciding if the 100-day MA support is more important than the 50-day MA resistance.

- It is common for a market to enter a trading range once it has a big reversal down from a buy climax. Big up and big down create big confusion. That typically results in a trading range.

- The Emini is around the middle of a bigger trading range that began in late July.

- Traders are deciding if the September selloff is just a bear leg in the trading range or the start of a bear trend.

- A bear trend has a series of lower highs and lows. The bears need to do more before traders will believe that the Emini is in a bear trend.

- When things are unclear, the probability is usually about 50% for the bulls and bears. That is the case now with the daily chart.

- Traders need to see a strong break below the October 4th low or above the September 23rd lower high before believing that the trading range is converting into a trend.

- The odds are about 50% that the Emini has begun a 15% correction to below 4,000.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.

Thanks for the great report as always! Regarding the daily chart, specifically Thursday October 7th, if you view this bar on ETH thus you get a bull bar with close above midpoint that is a weak L2 vs RTH that results in a bear doji with close around low. What is your view on that in specific how institutes view this? In addition Thursday and Friday closes are above the daily bear trend line thus wondering if it is strengthening the bull case?

There are many correlated markets. If a trader (someone looking for a quick profit) looks at all of them and tries to reconcile the differences, he will never place a trade. A trader has a better chance of consistently making money if he just trades one chart and ignores everything happening on related charts.

Great ! Thank you for sharing !

Welcome Arttur, take care, be safe and happy trading!

Thank you!

Take care and stay safe Simo! Happy trading!